Oklo Inc. (OKLO) Stock Price Target Hiked To $55 By Wedbush

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oklo Inc. (OKLO) Stock Price Target Soars to $55: Wedbush Sees Bright Future for Advanced Nuclear Technology

Oklo Inc. (OKLO), a pioneering company in the advanced nuclear technology sector, is experiencing a surge in investor confidence. Wedbush Securities recently raised its price target for OKLO stock to $55, a significant boost that reflects the growing optimism surrounding the company's innovative approach to nuclear energy. This bullish prediction signals a potential windfall for existing investors and positions Oklo as a key player in the burgeoning clean energy market.

What's Driving the Increased Price Target?

Wedbush's increased price target isn't based on mere speculation. The firm cites several key factors contributing to its bullish outlook on OKLO:

-

Technological Innovation: Oklo is developing advanced, small modular reactors (SMRs) that promise to revolutionize nuclear energy production. These reactors offer enhanced safety features, reduced waste, and greater efficiency compared to traditional nuclear plants. This technological advantage is a major draw for investors seeking environmentally friendly and reliable energy solutions. The potential for licensing and deployment of their technology is a significant driver in Wedbush's assessment.

-

Growing Demand for Clean Energy: The global shift towards renewable and sustainable energy sources is undeniable. Oklo's SMR technology is well-positioned to capitalize on this trend, offering a carbon-free alternative to fossil fuels. The increasing urgency to address climate change further strengthens the case for nuclear energy's role in a cleaner energy future, making OKLO an attractive investment.

-

Favorable Regulatory Environment: While nuclear power regulation is complex, positive developments in regulatory approvals and permitting processes could significantly accelerate Oklo's progress. Any positive news on this front could further propel the stock price. The company's proactive engagement with regulators suggests a smoother path to commercialization.

Oklo's Path to Commercialization:

Oklo is currently working towards securing regulatory approvals and constructing its first demonstration reactor. The successful completion of these milestones will be crucial in validating the technology and attracting further investment. The company's progress in securing funding and partnerships also contributes to Wedbush's positive outlook.

Risks to Consider:

While the outlook is positive, investing in Oklo, like any growth stock, carries inherent risks. These include:

-

Regulatory Uncertainty: The nuclear energy sector is heavily regulated, and delays or setbacks in obtaining necessary permits could impact the company's timeline and financial performance.

-

Technological Challenges: Developing and deploying advanced nuclear technology presents significant technological hurdles. Unforeseen challenges could impact the project's cost and timeline.

-

Competition: The advanced nuclear sector is becoming increasingly competitive, with other companies developing similar technologies. Oklo will need to maintain its technological edge to succeed.

Investing in Oklo: A High-Risk, High-Reward Proposition?

Wedbush's $55 price target suggests a significant upside potential for OKLO stock. However, investors should carefully consider the inherent risks associated with investing in a company operating in a highly regulated and technologically challenging sector. This is not a suitable investment for risk-averse investors. Thorough due diligence and a long-term investment horizon are crucial before considering adding OKLO to your portfolio.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oklo Inc. (OKLO) Stock Price Target Hiked To $55 By Wedbush. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lauren Sanchezs Appearance Evolution Over The Years And Public Reaction

May 28, 2025

Lauren Sanchezs Appearance Evolution Over The Years And Public Reaction

May 28, 2025 -

Widespread Power Failures Reported After Intense Overnight Storm

May 28, 2025

Widespread Power Failures Reported After Intense Overnight Storm

May 28, 2025 -

Should You Sell Your Uber Stock A Realistic Assessment

May 28, 2025

Should You Sell Your Uber Stock A Realistic Assessment

May 28, 2025 -

24 Analyst Forecasts Shape Uber Technologies Future Outlook

May 28, 2025

24 Analyst Forecasts Shape Uber Technologies Future Outlook

May 28, 2025 -

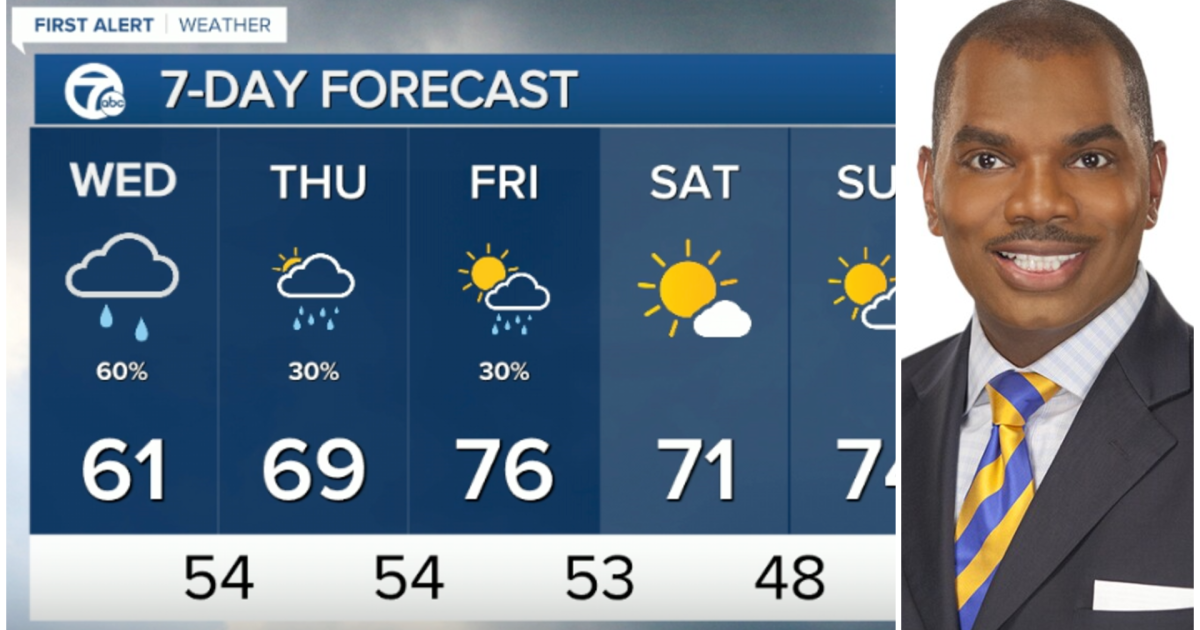

Metro Detroit Weather Update Expect More Rain Wednesday

May 28, 2025

Metro Detroit Weather Update Expect More Rain Wednesday

May 28, 2025