No Change To Australian Interest Rates: RBA Governor Bullock's Assessment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Change to Australian Interest Rates: RBA Governor Bullock's Assessment

The Reserve Bank of Australia (RBA) has held the official cash rate steady at 4.1 percent, marking a pause in the aggressive tightening cycle that began in May 2022. Governor Philip Lowe's assessment, delivered today, emphasizes a need for careful consideration of the current economic landscape before making further adjustments. This decision comes as a relief to some, but leaves others wondering what the future holds for Australian borrowers.

This decision follows months of speculation regarding the RBA's next move. Economists and analysts were divided, with some predicting a further rate hike to combat persistent inflation, while others anticipated a pause to assess the impact of previous increases. Governor Bullock's statement provides key insights into the RBA's reasoning.

Key Takeaways from Governor Bullock's Statement

-

Inflation Remains a Concern: While acknowledging a slight easing in inflation, Governor Bullock stressed that it remains significantly above the RBA's target range of 2-3 percent. The bank remains vigilant in monitoring inflation trends and anticipates further moderation in the coming months. This persistent inflation remains a crucial factor in the RBA's decision-making process.

-

Labour Market Strength: The Australian labor market continues to demonstrate strength, with unemployment remaining low. This positive indicator, however, also contributes to upward pressure on wages, potentially fueling further inflationary pressures. The RBA is closely monitoring wage growth to gauge its impact on inflation.

-

Global Economic Uncertainty: The RBA acknowledges the significant uncertainty in the global economic outlook. Geopolitical risks and ongoing supply chain disruptions pose potential challenges to the Australian economy, requiring a cautious approach to monetary policy. Global economic headwinds are a significant consideration influencing the RBA’s strategy.

-

Data Dependence: The RBA’s future decisions will be heavily data-dependent. The bank will closely monitor incoming economic data, including inflation figures, wage growth, and employment statistics, before making any further adjustments to the cash rate. This data-driven approach underscores the RBA's commitment to a measured and considered response to economic developments.

What This Means for Australian Homeowners and Borrowers

The decision to hold interest rates steady provides some temporary respite for homeowners and borrowers. However, it's crucial to remember that the RBA's assessment points to ongoing inflation concerns and a cautious outlook. Borrowers should continue to carefully manage their finances and prepare for potential future rate adjustments. [Link to a helpful resource on managing mortgage repayments].

Looking Ahead: Future Interest Rate Predictions

Predicting future interest rate movements remains challenging. While this pause offers temporary relief, the RBA's continued focus on inflation suggests that further rate hikes remain a possibility, depending on future economic data. Several economic analysts predict [insert a range of predictions from reputable sources with links to their reports]. The RBA’s commitment to data dependence means that staying informed about upcoming economic releases is crucial.

The RBA’s decision highlights the complexities of managing monetary policy in a dynamic global environment. The pause represents a strategic move, allowing the RBA to assess the effectiveness of previous rate hikes and gather more data before making further adjustments. While offering temporary relief, the uncertainty surrounding future interest rates underscores the need for prudent financial management for Australian households and businesses.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Change To Australian Interest Rates: RBA Governor Bullock's Assessment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

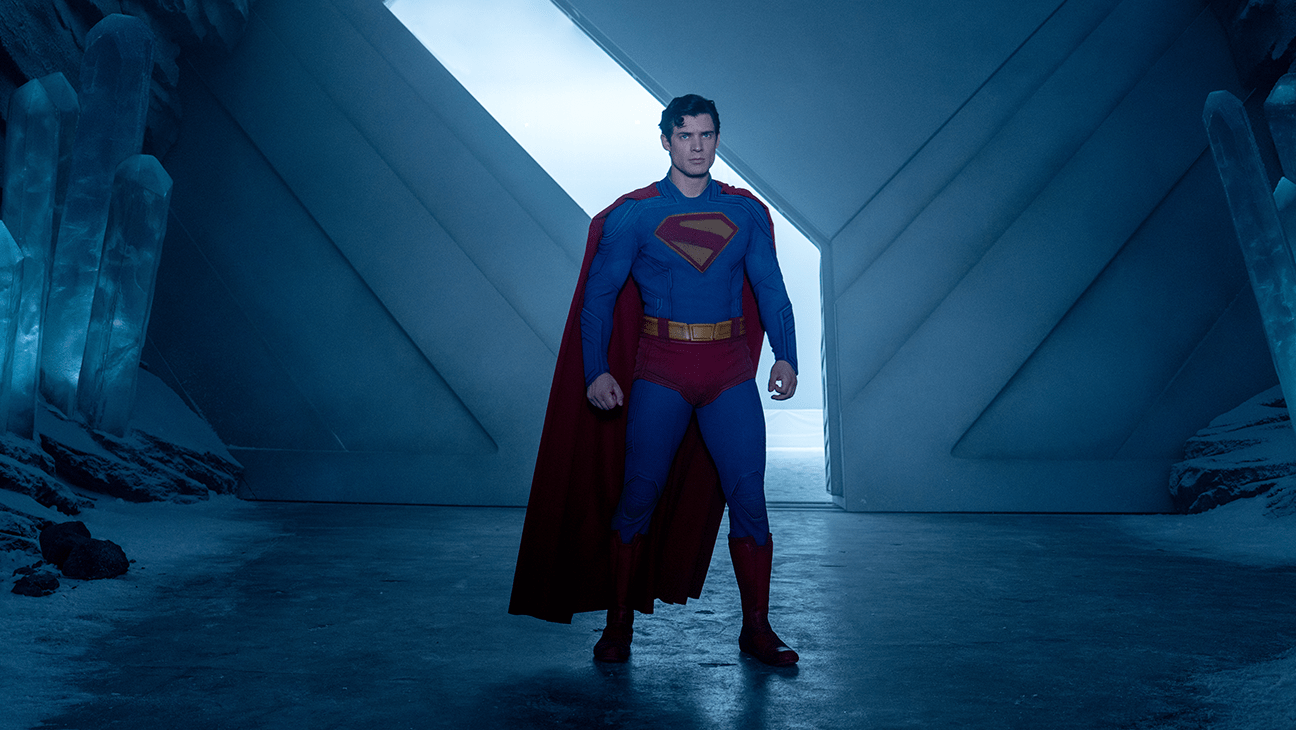

Critics React James Gunns Superman Reboot Shows Strong Potential

Jul 09, 2025

Critics React James Gunns Superman Reboot Shows Strong Potential

Jul 09, 2025 -

No Change To Interest Rates Reserve Bank Keeps Rate At 3 85

Jul 09, 2025

No Change To Interest Rates Reserve Bank Keeps Rate At 3 85

Jul 09, 2025 -

Climate Experts Under Siege Whats At Risk During Trumps Summer Offensive

Jul 09, 2025

Climate Experts Under Siege Whats At Risk During Trumps Summer Offensive

Jul 09, 2025 -

Quentin Tarantinos Inglourious Basterds A Critical Analysis

Jul 09, 2025

Quentin Tarantinos Inglourious Basterds A Critical Analysis

Jul 09, 2025 -

Twice The Luck Two Winning Mass Cash Lottery Tickets Sold At Same Gas Station In Ma

Jul 09, 2025

Twice The Luck Two Winning Mass Cash Lottery Tickets Sold At Same Gas Station In Ma

Jul 09, 2025

Latest Posts

-

End Of The Line Philadelphia Union Strike Resolved Live Updates

Jul 09, 2025

End Of The Line Philadelphia Union Strike Resolved Live Updates

Jul 09, 2025 -

Examining Us Complicity The Iran Israel Conflict And American Involvement

Jul 09, 2025

Examining Us Complicity The Iran Israel Conflict And American Involvement

Jul 09, 2025 -

Former Nhl Player Nick Tarnasky Caught In Heated Golf Course Altercation

Jul 09, 2025

Former Nhl Player Nick Tarnasky Caught In Heated Golf Course Altercation

Jul 09, 2025 -

Home Run Derby Yankees Rout Mariners Following Rain Delay

Jul 09, 2025

Home Run Derby Yankees Rout Mariners Following Rain Delay

Jul 09, 2025 -

Red Bull Announces Horners Exit Mekies Takes The Helm

Jul 09, 2025

Red Bull Announces Horners Exit Mekies Takes The Helm

Jul 09, 2025