NIO's Q1 2024 Results: A Deep Dive Into Deliveries And Tariff Challenges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO's Q1 2024 Results: A Deep Dive into Deliveries and Tariff Challenges

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 financial results, revealing a mixed bag of successes and challenges. While vehicle deliveries exceeded expectations for some, the company grappled with increased tariff hurdles impacting profitability. This deep dive analyzes NIO's performance, examining key delivery figures and the significant impact of tariffs on the company's overall financial health.

Record Deliveries, but at What Cost?

NIO reported a significant increase in vehicle deliveries during Q1 2024, surpassing analyst predictions and setting a new record for the company. This positive trend is fueled by the growing demand for EVs in China and the increasing popularity of NIO's innovative models, such as the ET7 and ES7. The strong sales figures are undeniably a testament to NIO's strong brand recognition and product appeal. However, celebrating solely the delivery numbers overlooks a crucial factor impacting the bottom line.

- Key Delivery Figures: [Insert specific delivery numbers from the Q1 2024 report here. Include a year-over-year comparison for context]. This represents a [percentage]% increase compared to Q1 2023. Specific model breakdowns should be included here if available in the report.

Tariff Troubles: A Major Headwind

The positive news on deliveries is unfortunately counterbalanced by the significant impact of increased tariffs. These tariffs, primarily impacting imported components and materials, have substantially increased NIO's production costs, squeezing profit margins. This is a pressing issue for many EV manufacturers, highlighting the complexities of global supply chains and international trade policies.

- Impact on Profitability: The increased tariff burden directly translated to a lower-than-expected profit margin for Q1 2024. [Insert specific data on profit margins from the report, comparing to previous quarters and providing context]. This underlines the crucial need for NIO to explore strategies to mitigate these cost increases.

NIO's Strategies for Navigating the Challenges

Facing these challenges, NIO isn't standing still. The company is actively pursuing various strategies to address both the immediate impact of tariffs and long-term competitiveness. These strategies likely include:

- Supply Chain Diversification: Moving away from reliance on specific import sources to reduce vulnerability to tariff fluctuations is a critical long-term strategy.

- Cost Optimization: Implementing cost-cutting measures across the production process to offset the impact of tariffs is essential for maintaining profitability.

- Innovation and New Product Launches: Continuing to innovate and launch new, competitive EV models will help NIO maintain its market share and appeal to customers. This could also include focusing on domestically sourced components.

Looking Ahead: Challenges and Opportunities

The Q1 2024 results present a complex picture for NIO. While record deliveries demonstrate strong consumer demand, the substantial impact of tariffs presents a considerable challenge. NIO's ability to successfully navigate these headwinds through strategic diversification, cost optimization, and continued innovation will ultimately determine its long-term success. The coming quarters will be crucial in assessing the effectiveness of these strategies.

Keywords: NIO, Q1 2024, electric vehicles, EV, China, deliveries, tariffs, profit margins, supply chain, financial results, stock, investment, automotive industry, competition, Tesla, Xpeng, Li Auto.

Call to Action: Stay tuned for further updates on NIO's performance and the evolving landscape of the Chinese EV market. Follow us for in-depth analysis and insights. (This CTA is subtle and encourages further engagement).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO's Q1 2024 Results: A Deep Dive Into Deliveries And Tariff Challenges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Key Crimea Bridge Hit Ukraine Claims Responsibility For Strike

Jun 03, 2025

Key Crimea Bridge Hit Ukraine Claims Responsibility For Strike

Jun 03, 2025 -

Protecting Federal Employee Rights The Challenges Facing Unions And Collective Bargaining

Jun 03, 2025

Protecting Federal Employee Rights The Challenges Facing Unions And Collective Bargaining

Jun 03, 2025 -

Ukraine Confirms Crimea Bridge Strike Details Of Underwater Operation Emerge

Jun 03, 2025

Ukraine Confirms Crimea Bridge Strike Details Of Underwater Operation Emerge

Jun 03, 2025 -

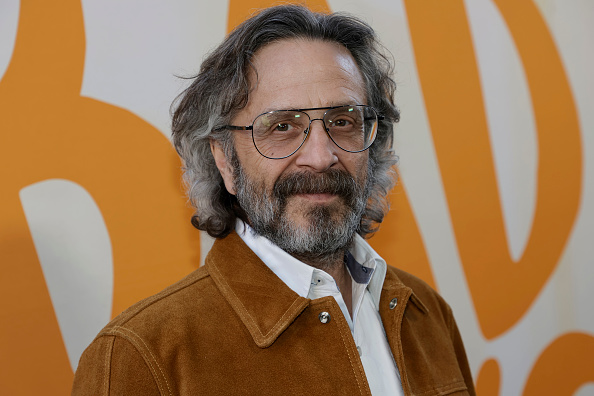

Marc Marons Long Running Wtf Podcast Concludes

Jun 03, 2025

Marc Marons Long Running Wtf Podcast Concludes

Jun 03, 2025 -

Veteran Joe Root Shows Improvement Says Englands Brook

Jun 03, 2025

Veteran Joe Root Shows Improvement Says Englands Brook

Jun 03, 2025