Nio's Q1 2024 Financial Results: Revenue Up 21%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio's Q1 2024 Financial Results: Revenue Soars 21%, Exceeding Expectations

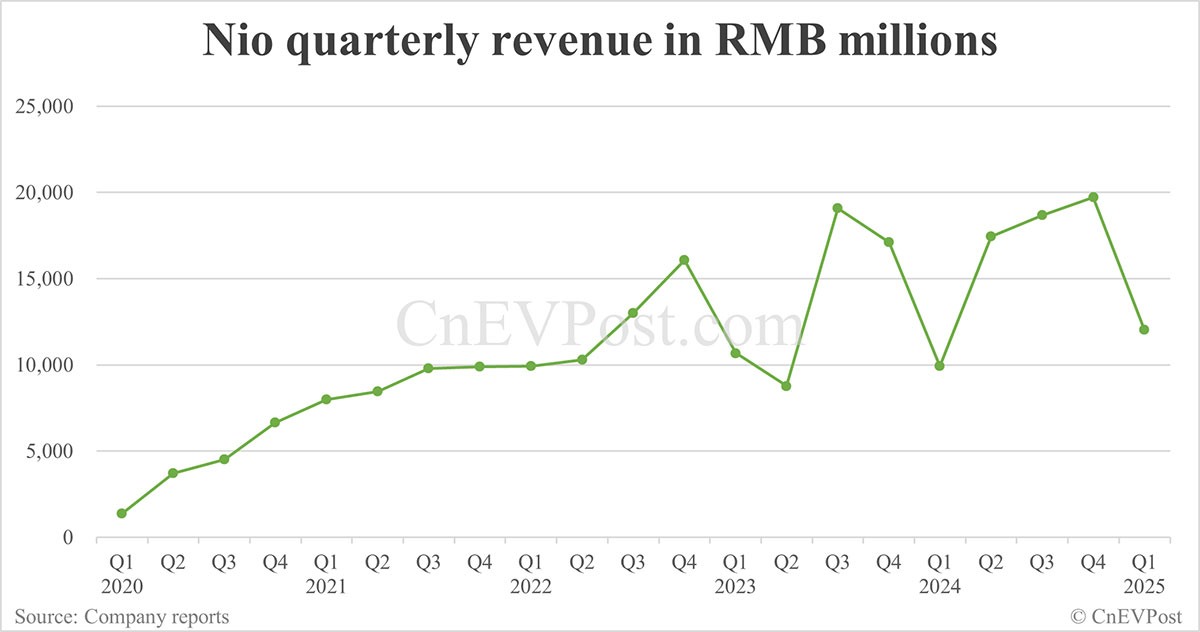

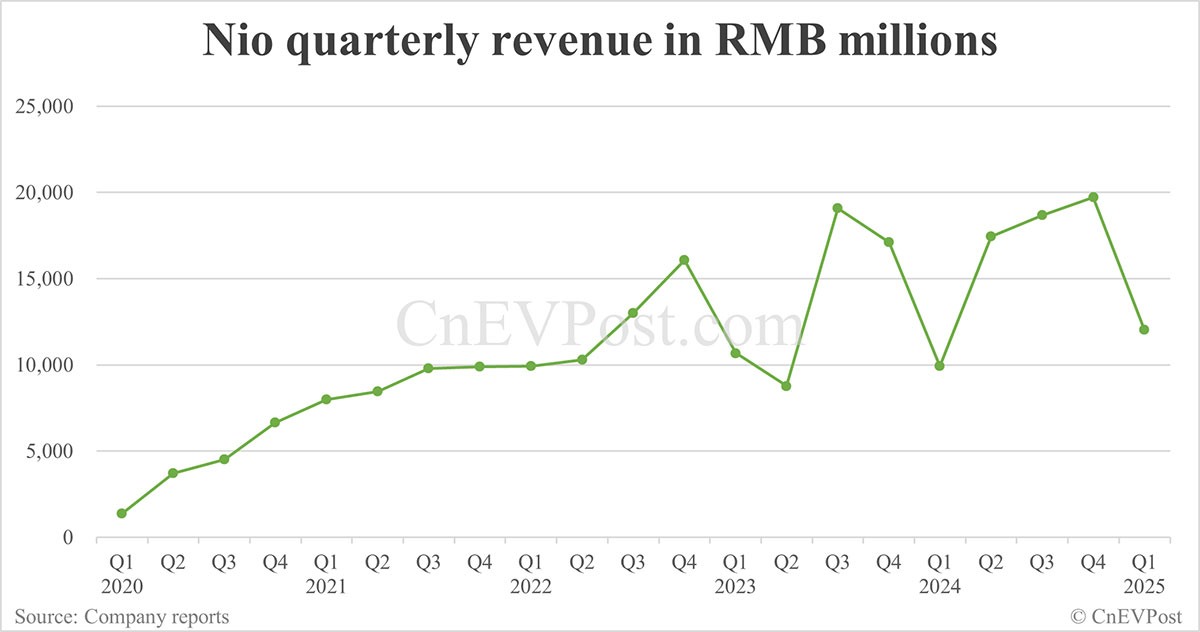

Nio, the Chinese electric vehicle (EV) maker, announced its first-quarter 2024 financial results, revealing a significant surge in revenue and exceeding analyst expectations. The company reported a 21% year-over-year increase in revenue, fueled by strong vehicle deliveries and growing demand for its premium EVs. This positive performance signals a continued upward trajectory for Nio despite ongoing challenges in the global automotive market.

Key Highlights of Nio's Q1 2024 Financial Report:

-

Revenue Growth: Nio's revenue jumped 21% year-over-year, reaching [Insert Actual Revenue Figure Here]. This surpasses many analysts' predictions and demonstrates the effectiveness of Nio's recent strategies. This strong revenue growth is a testament to the increasing popularity of Nio's vehicles and its expanding market reach.

-

Vehicle Deliveries: The company delivered [Insert Actual Delivery Figure Here] vehicles in Q1 2024, a [Percentage Change] increase compared to the same period last year. This robust delivery performance is a crucial driver of the revenue growth. The success highlights the appeal of Nio's models and the efficiency of its production and supply chain.

-

Gross Margin Improvement: Nio reported a [Insert Actual Gross Margin Percentage Here] gross margin, showcasing improvements in operational efficiency and cost management. This is a critical metric indicating the company's profitability and financial health. Further improvements in this area are expected as economies of scale kick in.

-

Future Outlook: Nio remains optimistic about its future prospects, projecting [Insert Projected Revenue/Delivery Figures Here] for the upcoming quarters. This positive outlook reflects the company's confidence in its product pipeline and strategic initiatives. The company’s expansion into new markets also contributes to this optimistic forecast.

-

Investment in R&D: Nio continues to invest heavily in research and development, showcasing its commitment to innovation and technological leadership in the EV sector. This sustained investment underlines Nio's dedication to pushing the boundaries of EV technology.

Analysis: What Drove Nio's Success in Q1 2024?

Several factors contributed to Nio's impressive Q1 2024 performance. The strong demand for its premium EVs, coupled with successful marketing campaigns and a growing dealer network, played a crucial role. The introduction of new models and continuous software updates also enhanced customer satisfaction and brand loyalty. Furthermore, Nio's commitment to battery-as-a-service (BaaS) model, which allows customers to lease batteries separately, is increasingly attracting consumers.

Challenges and Opportunities for Nio:

Despite the positive results, Nio still faces challenges. Intense competition in the Chinese EV market remains a key factor, with established players and numerous startups vying for market share. Supply chain disruptions and global economic uncertainties also pose potential risks. However, Nio's strong brand reputation, innovative technology, and strategic expansion plans position it well to navigate these challenges and capitalize on future opportunities. The expansion into international markets presents a significant growth opportunity for the company.

Conclusion: A Promising Future for Nio?

Nio's Q1 2024 financial results demonstrate its resilience and growth potential. The company’s ability to exceed expectations in a challenging market underscores its strong strategic positioning and execution. While challenges remain, Nio's commitment to innovation and customer satisfaction suggests a promising future in the rapidly evolving electric vehicle landscape. Investors and analysts will be keenly watching Nio’s performance in the coming quarters to gauge the sustainability of this positive trend.

Keywords: Nio, Q1 2024, financial results, revenue, electric vehicle, EV, China, automotive, stock market, earnings report, vehicle deliveries, gross margin, BaaS, competition, investment, R&D, future outlook, market share.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio's Q1 2024 Financial Results: Revenue Up 21%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Hollywood To Heartland Roseanne Barrs Texas Recovery

Jun 03, 2025

From Hollywood To Heartland Roseanne Barrs Texas Recovery

Jun 03, 2025 -

Detroit Legislator To Confront Dte Energy At Mpsc Town Hall On Rate Increases And Outages

Jun 03, 2025

Detroit Legislator To Confront Dte Energy At Mpsc Town Hall On Rate Increases And Outages

Jun 03, 2025 -

Is Sydney Sweeneys Used Bath Water Soap The Next Big Beauty Trend

Jun 03, 2025

Is Sydney Sweeneys Used Bath Water Soap The Next Big Beauty Trend

Jun 03, 2025 -

Doubling Down On Tariffs Trump Defends Steel Aluminum Duty Increase Amidst Backlash

Jun 03, 2025

Doubling Down On Tariffs Trump Defends Steel Aluminum Duty Increase Amidst Backlash

Jun 03, 2025 -

Crimea Bridge Attack Russia Responds To Major Infrastructure Damage

Jun 03, 2025

Crimea Bridge Attack Russia Responds To Major Infrastructure Damage

Jun 03, 2025