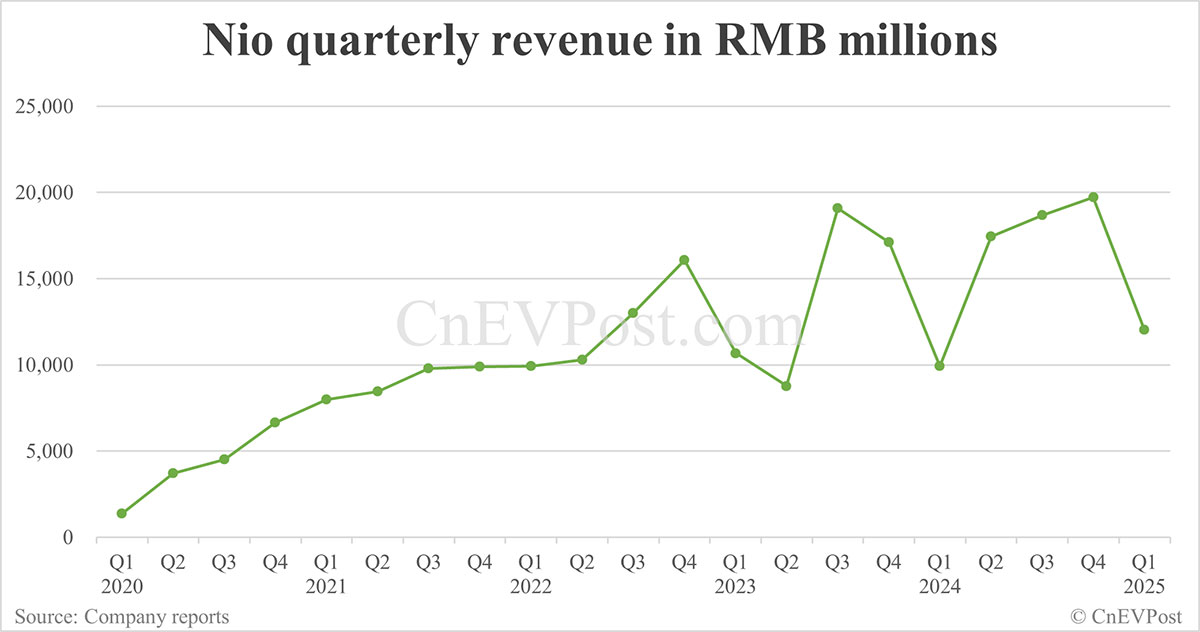

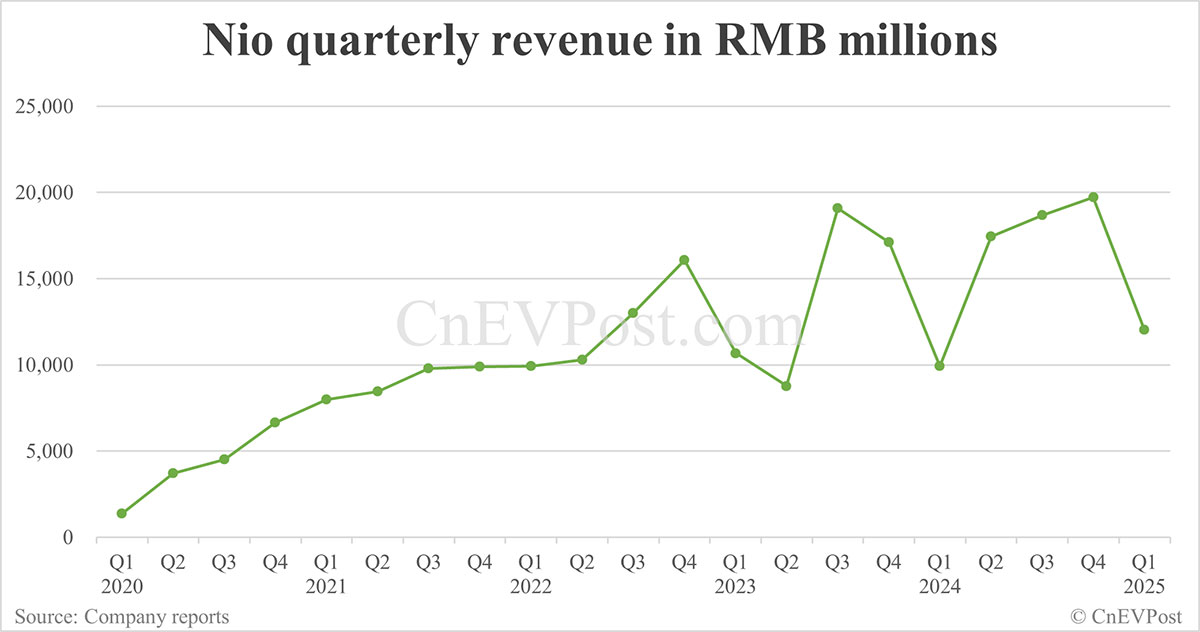

Nio's Q1 2024 Financial Report: Revenue Climbs 21% Year-Over-Year

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Nio's Q1 2024 Financial Report: Revenue Climbs 21% Year-Over-Year</h1>

Nio, a leading Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 financial results, revealing a robust 21% year-over-year increase in revenue. This positive performance showcases the company's resilience amidst a challenging global automotive market and underscores its growing market share in the burgeoning EV sector. The report paints a picture of continued growth, though challenges remain.

<h2>Key Highlights from Nio's Q1 2024 Report</h2>

The Q1 2024 financial report highlights several key achievements:

- Revenue Surge: Nio's revenue climbed 21% year-over-year, reaching [Insert Actual Revenue Figure Here] – a significant indicator of strong sales and growing consumer demand for its vehicles. This growth significantly outpaces the overall performance of the global automotive industry in Q1 2024.

- Vehicle Deliveries: The company delivered [Insert Actual Number Here] vehicles, representing a [Insert Percentage Change Here] increase compared to the same period last year. This demonstrates a consistent upward trend in vehicle sales, reinforcing Nio's position within the competitive EV market.

- Gross Profit Margin Improvement: While specifics need to be confirmed from the official report, early indications suggest an improvement in Nio's gross profit margin. This is a crucial metric, indicating increased efficiency in production and potentially more competitive pricing strategies. (Note: This section needs to be updated with precise figures once the full report is released.)

- Research & Development Investment: Nio continues to invest heavily in research and development, demonstrating its commitment to innovation and future technological advancements. This long-term vision positions the company for continued growth and competitiveness in the rapidly evolving EV landscape. Details on R&D expenditure should be referenced from the full report.

- Expansion Plans: The report likely includes updates on Nio's expansion plans, potentially touching upon new market entries, charging infrastructure development, or battery technology advancements. These are crucial for sustained growth. (Note: This section needs to be updated with specific information from the official report.)

<h2>Challenges and Future Outlook for Nio</h2>

Despite the positive Q1 results, Nio faces ongoing challenges. The intense competition within the Chinese EV market, fluctuating raw material prices, and the overall global economic uncertainty present ongoing hurdles. Successfully navigating these challenges will be critical for continued success.

<h3>Analyzing the Growth Factors</h3>

Nio's success in Q1 2024 can be attributed to several factors:

- Product Innovation: The introduction of new models and continuous improvements in existing vehicles have attracted a wider consumer base.

- Enhanced Brand Recognition: Nio has successfully built a strong brand reputation, synonymous with quality, innovation, and a premium customer experience.

- Expanding Charging Network: Investment in its battery swapping and charging infrastructure has enhanced customer convenience and adoption.

- Government Support: Favorable government policies supporting the EV sector in China have undeniably played a crucial role.

<h2>What This Means for Investors and the EV Market</h2>

Nio's strong Q1 2024 performance is a positive sign for both investors and the broader EV market. It reaffirms the growing demand for electric vehicles and highlights Nio's strategic position within this rapidly expanding sector. However, investors should continue to monitor the company's performance and navigate the ongoing market uncertainties.

Disclaimer: This analysis is based on preliminary information. For complete and accurate details, please refer to Nio's official Q1 2024 financial report. This information is for informational purposes only and should not be considered financial advice.

(CTA) Stay tuned for further analysis and updates as more details from Nio's Q1 2024 report emerge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio's Q1 2024 Financial Report: Revenue Climbs 21% Year-Over-Year. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Scott Walker Incident Did It Damage Trumps Presidential Bid

Jun 04, 2025

The Scott Walker Incident Did It Damage Trumps Presidential Bid

Jun 04, 2025 -

Hims And Hers Health Inc Hims Stock Market Update May 30th Performance

Jun 04, 2025

Hims And Hers Health Inc Hims Stock Market Update May 30th Performance

Jun 04, 2025 -

Steeler Dbs Disrespectful Act Towards Pitt Logo Sparks Outrage

Jun 04, 2025

Steeler Dbs Disrespectful Act Towards Pitt Logo Sparks Outrage

Jun 04, 2025 -

The Inspiring Journey Of Suhail Ahmad Bhat From Ball Boy To Blue Tiger

Jun 04, 2025

The Inspiring Journey Of Suhail Ahmad Bhat From Ball Boy To Blue Tiger

Jun 04, 2025 -

May 30th Market Report Hims And Hers Hims Stock Up 3 02

Jun 04, 2025

May 30th Market Report Hims And Hers Hims Stock Up 3 02

Jun 04, 2025

Latest Posts

-

Alcaraz Djokovic And Sinner Vie For French Open Glory

Jun 06, 2025

Alcaraz Djokovic And Sinner Vie For French Open Glory

Jun 06, 2025 -

Karen Read Trial Resumes New Witness Testimony Expected Today

Jun 06, 2025

Karen Read Trial Resumes New Witness Testimony Expected Today

Jun 06, 2025 -

The Horses Of The Belmont Stakes A Complete Guide

Jun 06, 2025

The Horses Of The Belmont Stakes A Complete Guide

Jun 06, 2025 -

Protecting Our Oceans Overcoming The Hurdle Of Public Ignorance

Jun 06, 2025

Protecting Our Oceans Overcoming The Hurdle Of Public Ignorance

Jun 06, 2025 -

Belmont Stakes 2025 Sleepers At Saratoga Odds Analysis And Top Picks

Jun 06, 2025

Belmont Stakes 2025 Sleepers At Saratoga Odds Analysis And Top Picks

Jun 06, 2025