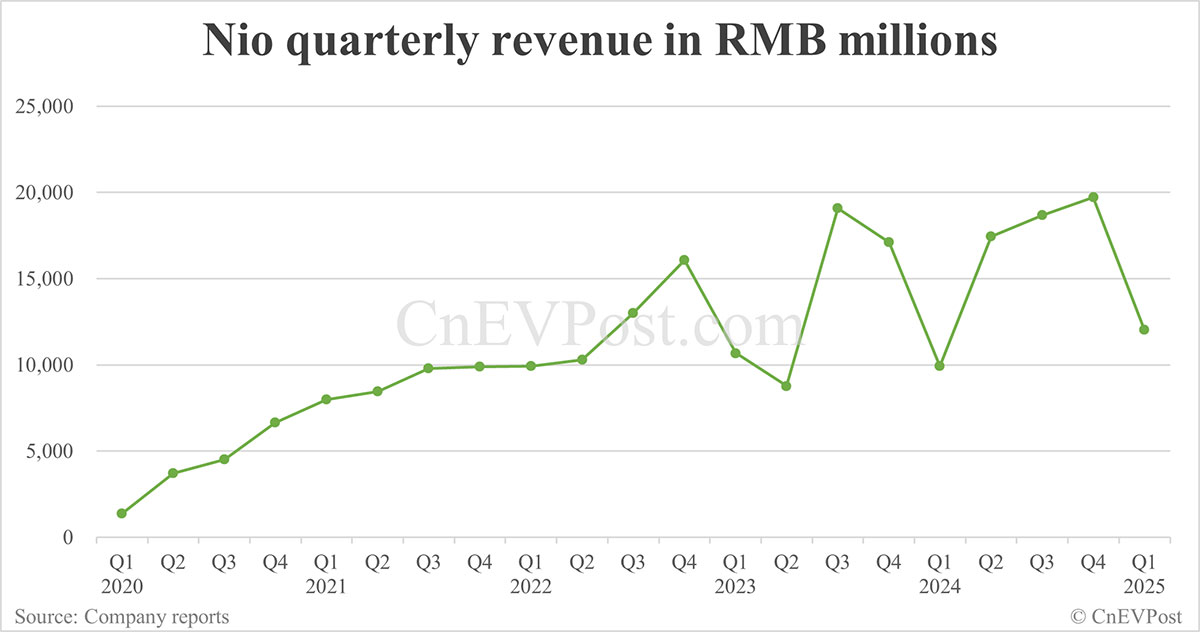

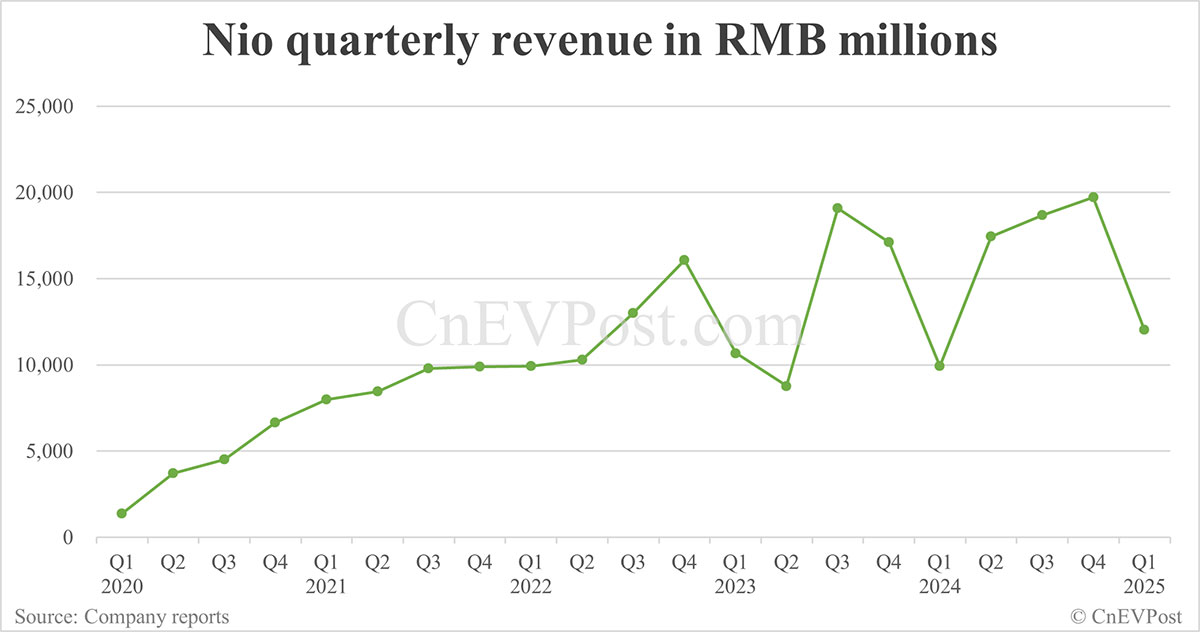

Nio's Q1 2024 Earnings Report Shows 21% Revenue Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio's Q1 2024 Earnings Report Shows 21% Revenue Increase: Electric Vehicle Maker Exceeds Expectations

NIO Inc. (NYSE: NIO), a leading Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 earnings report, revealing a robust 21% year-over-year increase in revenue. This positive performance surpasses analysts' expectations and signals continued growth in the competitive EV market. The report highlights the company's strategic initiatives and underscores its commitment to innovation and expansion.

The impressive revenue surge reflects a combination of factors, including increased vehicle deliveries, a strengthened brand presence, and the successful launch of new models. Let's delve deeper into the key highlights of NIO's Q1 2024 earnings report.

Key Highlights of NIO's Q1 2024 Earnings:

- Revenue Growth: A significant 21% year-over-year increase in revenue, exceeding market projections and demonstrating strong market demand for NIO vehicles.

- Vehicle Deliveries: A substantial increase in vehicle deliveries compared to Q1 2023, solidifying NIO's position in the premium EV segment. Specific delivery figures were [insert exact figures from the report here, linking to the official source].

- New Model Launches: The successful introduction of new EV models contributed significantly to the revenue growth, showcasing NIO's commitment to product innovation and diversification. [Mention specific models launched and their impact].

- Expanding Infrastructure: NIO's continued investment in its battery swapping infrastructure, a key differentiator in the EV market, further enhanced its appeal to consumers. [Mention details about expansion plans and impact].

- International Expansion: [Discuss any progress made on international expansion plans, if mentioned in the report. This is a crucial keyword for SEO].

- Profitability: While not necessarily profitable yet, the report likely included insights into NIO's progress towards profitability, a key concern for investors. [Insert details from the report, including metrics like gross margin, operating expenses etc.]

NIO's Strategic Initiatives Fueling Growth:

NIO's success can be attributed to several strategic initiatives:

- Focus on Premium EVs: NIO’s strategy of focusing on the premium segment of the EV market has proven effective, allowing them to command higher prices and margins.

- Battery-as-a-Service (BaaS): NIO's innovative BaaS model offers a flexible and cost-effective option for EV ownership, attracting a broader range of customers.

- Technology Leadership: Continuous investment in research and development ensures NIO remains at the forefront of EV technology, enhancing its competitive edge.

- Enhanced Customer Experience: NIO prioritizes customer satisfaction through a seamless ownership experience, from purchase to after-sales service.

What the Future Holds for NIO:

The strong Q1 2024 results suggest a positive outlook for NIO. However, the EV market remains highly competitive, with established players and new entrants vying for market share. NIO's continued success will depend on its ability to maintain its innovation momentum, expand its market reach, and effectively manage its operational costs. [Mention any future plans or guidance provided in the earnings report].

Investors will be closely watching NIO's performance in the coming quarters to see if this strong growth can be sustained. The company’s ability to navigate challenges and capitalize on opportunities in the dynamic EV landscape will be crucial for its long-term success.

Call to Action: Stay tuned for further updates on NIO's progress by following their official website and investor relations section. [Link to NIO's Investor Relations page]. What are your thoughts on NIO's Q1 performance? Share your insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio's Q1 2024 Earnings Report Shows 21% Revenue Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine Drone Strikes A New Global Warfare Standard

Jun 04, 2025

Ukraine Drone Strikes A New Global Warfare Standard

Jun 04, 2025 -

Sheinelle Joness Family Focus Coping With Husbands Death

Jun 04, 2025

Sheinelle Joness Family Focus Coping With Husbands Death

Jun 04, 2025 -

The 78 Development To Include Chicago Fires 650 Million Soccer Stadium

Jun 04, 2025

The 78 Development To Include Chicago Fires 650 Million Soccer Stadium

Jun 04, 2025 -

Hims And Hers Hims Stock Performance 3 02 Rise Reported May 30

Jun 04, 2025

Hims And Hers Hims Stock Performance 3 02 Rise Reported May 30

Jun 04, 2025 -

Lucy Guo How The Youngest Self Made Billionaire Overtook Taylor Swift

Jun 04, 2025

Lucy Guo How The Youngest Self Made Billionaire Overtook Taylor Swift

Jun 04, 2025