Nio's Q1 2024 Earnings: 21% Year-on-Year Revenue Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio's Q1 2024 Earnings: A 21% Year-on-Year Revenue Surge Signals Continued Growth

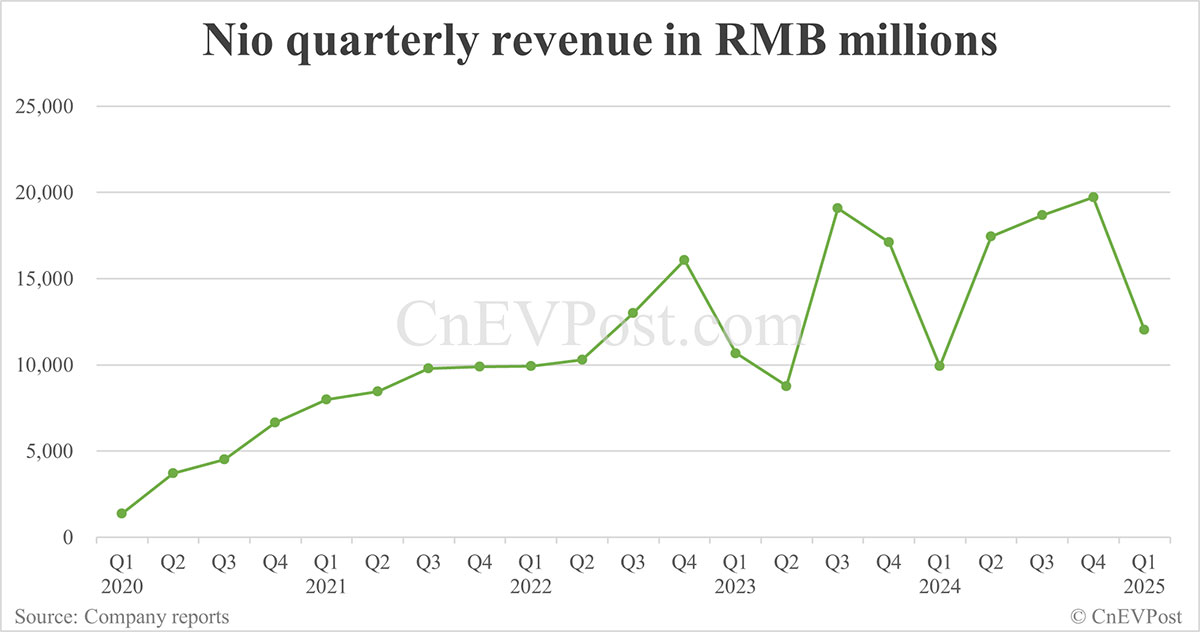

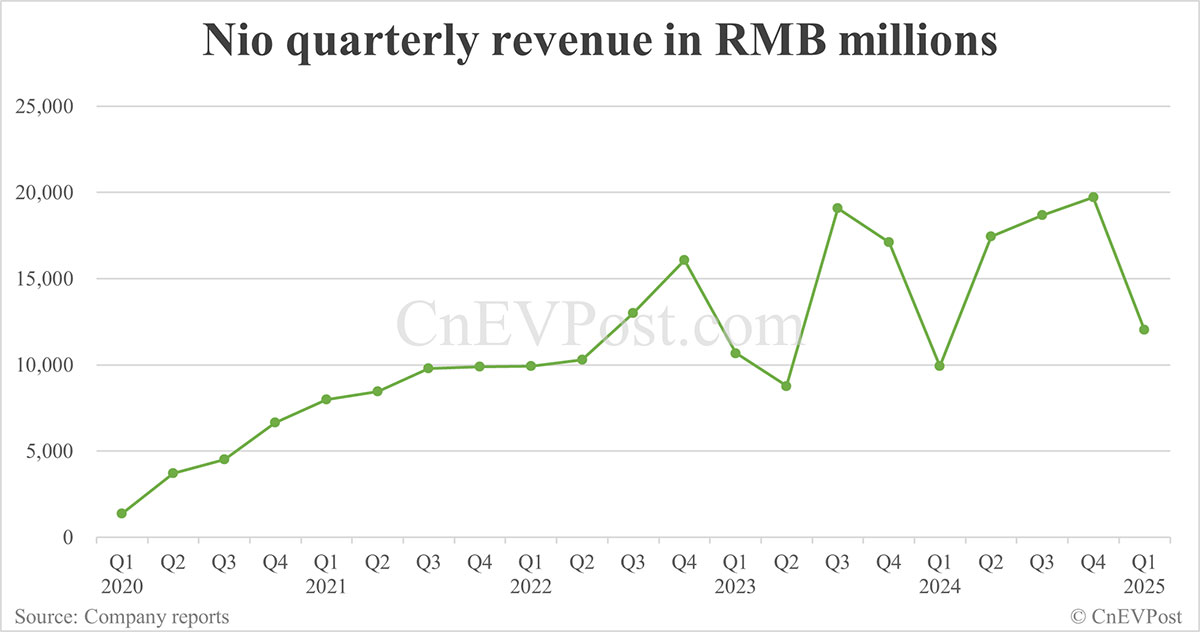

NIO, the leading Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 earnings, revealing a robust 21% year-on-year increase in revenue. This impressive performance underscores Nio's continued growth trajectory despite persistent challenges in the global automotive market. The results exceeded analyst expectations, solidifying Nio's position as a major player in the increasingly competitive EV landscape.

Key Highlights from Nio's Q1 2024 Earnings Report:

-

Revenue Growth: A significant 21% year-on-year increase in revenue, reaching [Insert Actual Revenue Figure Here] – exceeding market predictions. This strong performance can be attributed to several factors, including increased demand for their models and effective marketing strategies.

-

Vehicle Deliveries: Nio delivered [Insert Actual Delivery Figure Here] vehicles in Q1 2024, showcasing consistent growth in consumer adoption of their electric vehicles. This figure represents a [Percentage Change]% increase compared to the same period last year. The success can be attributed to the introduction of new models and improvements in their existing lineup.

-

Gross Profit Margin: The company reported a gross profit margin of [Insert Actual Gross Profit Margin Here]%, indicating improved efficiency in manufacturing and operations. This improvement signals positive cost management and a path to greater profitability.

-

Future Outlook: Nio remains optimistic about its future prospects, citing strong order backlogs and plans for new product launches. The company is focused on expanding its market presence both domestically in China and internationally. They highlight ongoing investments in research and development, particularly in battery technology and autonomous driving capabilities.

What Fueled Nio's Impressive Q1 Performance?

Several factors contributed to Nio's exceptional Q1 2024 performance:

-

New Model Introductions: The launch of new models, including [Mention Specific New Models and their impact], significantly boosted sales and attracted new customers. These vehicles often incorporate cutting-edge technology and appeal to a wider range of consumer preferences.

-

Enhanced Battery Technology: Nio's commitment to battery technology innovation, including their battery-as-a-service (BaaS) program, continues to attract customers seeking convenient and cost-effective EV ownership. This innovative approach addresses range anxiety and lowers the overall cost of EV adoption.

-

Expanding Charging Infrastructure: Nio's strategic investments in expanding its charging network and improving charging infrastructure are vital in supporting the growing number of vehicles on the road. This infrastructure is a key differentiator in the increasingly competitive EV market.

-

Strong Brand Recognition: Nio's brand recognition and reputation for quality and innovation remain strong, contributing to increased customer loyalty and market share.

Challenges and Future Considerations:

Despite the positive Q1 results, Nio faces ongoing challenges including:

-

Intense Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share. Nio must continuously innovate and adapt to maintain its competitive edge.

-

Supply Chain Issues: Global supply chain disruptions continue to pose a risk to production and delivery timelines. Effective supply chain management is critical to meeting growing demand.

-

Global Economic Uncertainty: Economic uncertainties and potential downturns could affect consumer demand for luxury electric vehicles.

Conclusion:

Nio's Q1 2024 earnings report paints a picture of continued growth and success. The 21% year-on-year revenue increase, coupled with strong vehicle deliveries and improved gross profit margins, demonstrates the company's resilience and strategic effectiveness. While challenges remain, Nio's commitment to innovation, expanding infrastructure, and strong brand recognition position it for continued success in the evolving electric vehicle market. Investors and industry analysts will be closely watching Nio's performance in the coming quarters to see if this strong growth trajectory continues.

Keywords: Nio, NIO Stock, Q1 2024 Earnings, Electric Vehicle, EV, Chinese EV, Revenue Growth, Vehicle Deliveries, Battery Technology, BaaS, Charging Infrastructure, Automotive Industry, Stock Market, Investment, Technology, Innovation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio's Q1 2024 Earnings: 21% Year-on-Year Revenue Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Economy Faces Internal Threat According To Jp Morgan Ceo Jamie Dimon

Jun 03, 2025

Us Economy Faces Internal Threat According To Jp Morgan Ceo Jamie Dimon

Jun 03, 2025 -

Major Incident Explosion Rocks Crimea Bridge Disrupting Traffic

Jun 03, 2025

Major Incident Explosion Rocks Crimea Bridge Disrupting Traffic

Jun 03, 2025 -

Hims Stock Price Increase 3 02 Gain On May 30th

Jun 03, 2025

Hims Stock Price Increase 3 02 Gain On May 30th

Jun 03, 2025 -

Underwater Attack On Crimean Bridge Ukraines Alleged Role And Strategic Implications

Jun 03, 2025

Underwater Attack On Crimean Bridge Ukraines Alleged Role And Strategic Implications

Jun 03, 2025 -

The 2 C Threshold Essential Steps For Corporate Climate Resilience

Jun 03, 2025

The 2 C Threshold Essential Steps For Corporate Climate Resilience

Jun 03, 2025