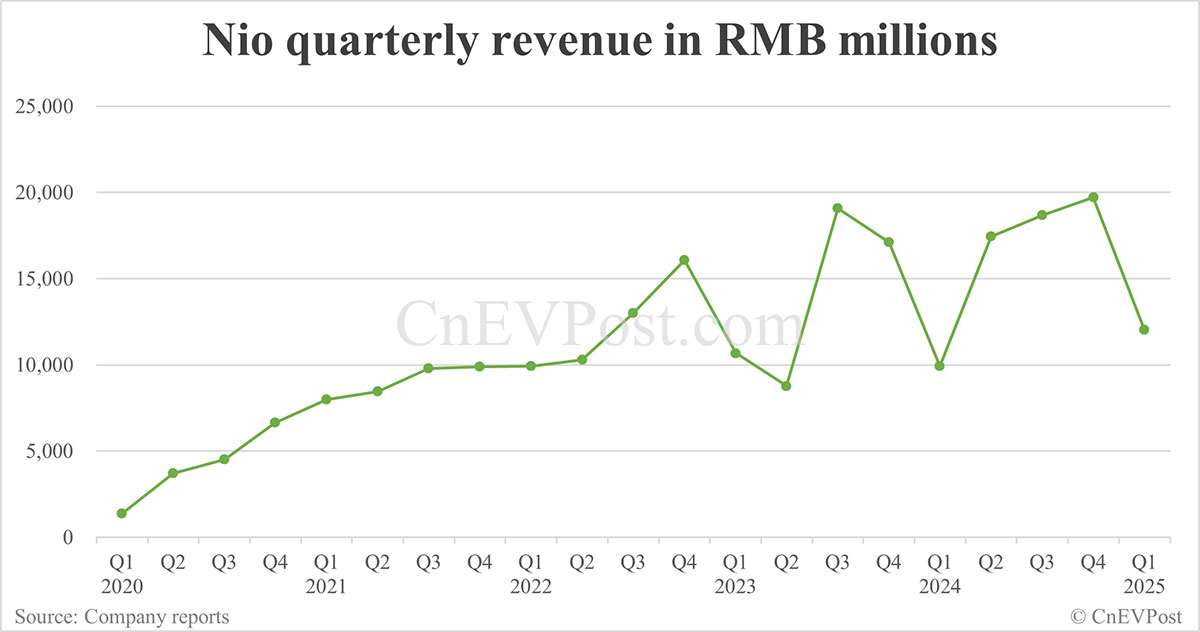

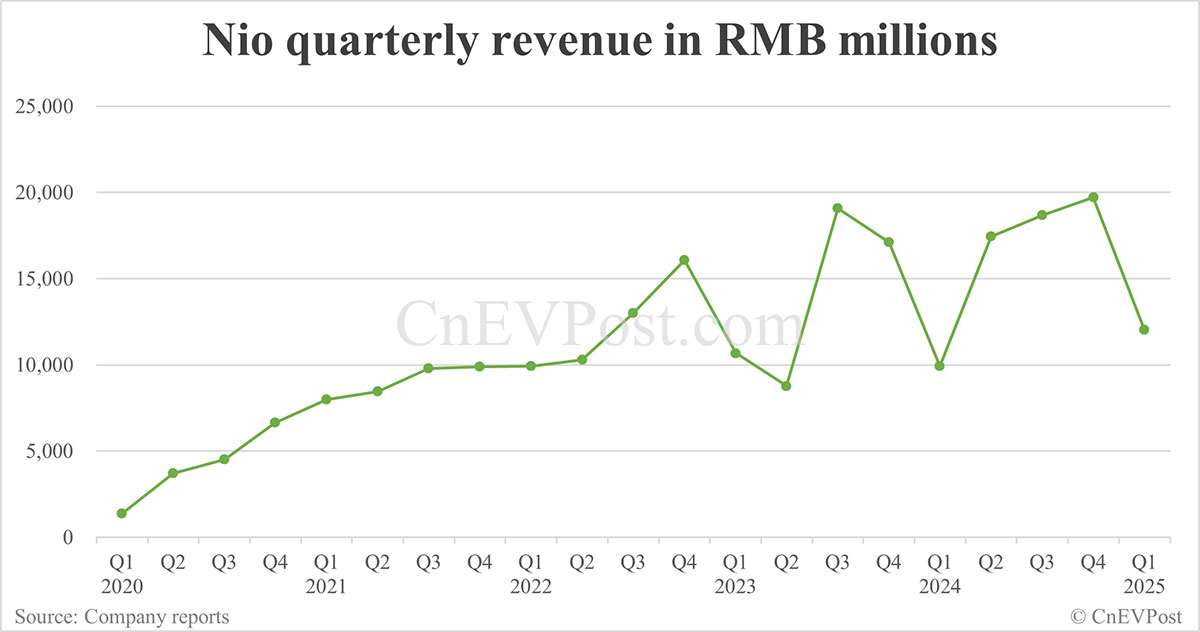

Nio's Q1 2024 Earnings: 21% Revenue Increase Year-Over-Year

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio's Q1 2024 Earnings Surge: 21% Revenue Increase Fuels EV Optimism

Nio, a leading Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 earnings, revealing a significant 21% year-over-year revenue increase. This robust performance has injected fresh optimism into the EV market, particularly amidst global economic uncertainty. The results showcase Nio's resilience and strategic execution, defying some analysts' predictions of a slowdown.

Key Highlights from Nio's Q1 2024 Earnings Report:

-

Revenue Growth: The 21% year-over-year revenue increase signifies strong demand for Nio's vehicles, despite challenges in the broader automotive sector. This growth is attributed to a combination of factors, including successful new model launches and a strengthened sales network.

-

Vehicle Deliveries: While specific delivery figures weren't immediately highlighted in early press releases, the significant revenue increase strongly suggests a substantial rise in vehicle deliveries compared to the same period last year. Further details are expected in the full earnings report.

-

Expansion Strategies: Nio continues to invest heavily in its research and development, aiming to maintain its technological edge in the competitive EV landscape. This commitment to innovation is crucial for sustaining long-term growth. They're also expanding their charging infrastructure and international reach, key components to maintaining market share.

-

Profitability: While specific profit margins weren't detailed in initial reports, the impressive revenue growth suggests progress towards improved profitability, a critical metric for long-term sustainability in the EV industry. Investors will be closely scrutinizing the full financial statement for details on operating profit and net income.

What Drives Nio's Success?

Nio's success isn't solely due to luck; it's a result of a multi-pronged strategy:

-

Innovative Vehicle Designs: Nio consistently delivers stylish and technologically advanced EVs that appeal to a discerning customer base. Their focus on premium features and advanced driver-assistance systems (ADAS) sets them apart.

-

Battery-as-a-Service (BaaS): Nio's innovative BaaS model allows customers to lease batteries separately, reducing the upfront cost of vehicle ownership and enhancing affordability. This model has been instrumental in attracting a broader range of customers.

-

Expanding Charging Network: Nio is rapidly expanding its charging infrastructure, addressing a crucial concern for EV adoption – range anxiety. A robust and convenient charging network is critical for customer satisfaction and market penetration.

-

Strong Brand Recognition: Nio has cultivated a strong brand identity, attracting customers who value innovation, sustainability, and a premium driving experience.

Looking Ahead: Challenges and Opportunities

While the Q1 2024 results are positive, Nio still faces challenges:

-

Global Economic Uncertainty: The ongoing global economic uncertainty poses a potential risk to consumer spending and demand for luxury goods, including premium EVs.

-

Intense Competition: The EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share. Maintaining a competitive edge requires continuous innovation and strategic execution.

-

Supply Chain Disruptions: Potential supply chain disruptions remain a concern for the automotive industry as a whole. Nio's ability to manage these challenges will be critical to sustaining growth.

Despite these challenges, Nio's strong Q1 2024 performance and strategic initiatives position it for continued growth in the dynamic and rapidly evolving EV market. The full earnings report, containing more granular details, will provide a clearer picture of the company's financial health and future prospects. Investors and EV enthusiasts alike will be watching closely.

Keywords: Nio, Q1 2024 earnings, electric vehicle, EV, revenue increase, China, automotive industry, battery-as-a-service, BaaS, EV market, stock market, investment, technology, innovation, charging infrastructure, competition, economic uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio's Q1 2024 Earnings: 21% Revenue Increase Year-Over-Year. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Walz On Trump A Cruel Man Provoking A Stronger Democratic Response

Jun 03, 2025

Walz On Trump A Cruel Man Provoking A Stronger Democratic Response

Jun 03, 2025 -

Underwater Attack On Crimean Bridge Ukraines Alleged New Assault

Jun 03, 2025

Underwater Attack On Crimean Bridge Ukraines Alleged New Assault

Jun 03, 2025 -

Dte Energy Rate Increase Crushing Michigan Families Financially

Jun 03, 2025

Dte Energy Rate Increase Crushing Michigan Families Financially

Jun 03, 2025 -

Key Crimea Russia Link Severed Ukraines Underwater Bridge Assault

Jun 03, 2025

Key Crimea Russia Link Severed Ukraines Underwater Bridge Assault

Jun 03, 2025 -

Urgent Action Needed A Businesss Timeline For Adapting To A 2 C World

Jun 03, 2025

Urgent Action Needed A Businesss Timeline For Adapting To A 2 C World

Jun 03, 2025