NIO Stock: Q1 Results And Investment Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock: Q1 Results Signal a Rocky Road Ahead, But Long-Term Potential Remains

NIO, a leading electric vehicle (EV) manufacturer in China, recently released its Q1 2024 results, sending ripples through the investment community. While the numbers weren't disastrous, they certainly weren't the stellar performance many analysts had predicted, raising questions about the company's investment outlook. This article delves into the key takeaways from the report and analyzes the implications for NIO stock.

Q1 2024 Results: A Mixed Bag

NIO reported a significant increase in vehicle deliveries compared to Q1 2023, showcasing continued growth in the EV market. However, this growth was slightly below analyst expectations, leading to a dip in the stock price. The company cited several factors contributing to this shortfall, including intensified competition in the Chinese EV market and ongoing supply chain challenges.

Specifically, the report highlighted:

- Increased Deliveries, but Below Expectations: While NIO delivered a substantial number of vehicles, the figures fell short of the consensus forecast, impacting investor sentiment.

- Pricing Pressure: Competition is fierce, leading to price wars and impacting profit margins. NIO, like other EV manufacturers, is feeling the pressure to maintain competitiveness.

- Supply Chain Resilience: While supply chain issues are easing, they remain a factor, potentially affecting production and delivery timelines.

- Focus on New Models and Technologies: NIO is investing heavily in research and development, particularly in battery technology and autonomous driving capabilities. This long-term strategy requires significant upfront investment, impacting short-term profitability.

Analyzing the Investment Outlook: Cautious Optimism

The Q1 results paint a picture of a company navigating a challenging market landscape. The short-term outlook for NIO stock appears somewhat uncertain, with potential for further volatility. However, several factors suggest long-term potential:

- Strong Brand Recognition and Growing Market Share: NIO has established a strong brand presence in China, appealing to a technologically savvy and affluent customer base. Continued growth in market share is a key indicator of long-term success.

- Innovation and Technological Advancements: NIO's commitment to innovation, particularly in battery swapping technology and autonomous driving, positions it favorably for future growth. This technological edge is a key differentiator in a crowded market.

- Government Support for the EV Industry: The Chinese government continues to strongly support the development and adoption of electric vehicles, providing a favorable regulatory environment for NIO and its competitors. This ongoing support could be a significant catalyst for future growth.

What to Watch For:

Investors should closely monitor the following in the coming quarters:

- Delivery numbers: Consistent growth in vehicle deliveries is crucial for validating NIO's growth trajectory.

- Profit margins: Managing pricing pressure and improving operational efficiency are key to improving profitability.

- New product launches: The success of new models will be pivotal in driving future growth.

- Technological advancements: Demonstrating progress in battery technology and autonomous driving will be vital in maintaining a competitive edge.

Conclusion:

NIO's Q1 results present a complex picture for investors. While the short-term outlook may be uncertain, the company's long-term potential remains significant. Investors considering investing in NIO stock should carefully weigh the risks and rewards, considering the competitive landscape and the company's ongoing investments in future technologies. Conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions. Remember, past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock: Q1 Results And Investment Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crimea Bridge Explosion Damage Assessment And Impact Analysis

Jun 03, 2025

Crimea Bridge Explosion Damage Assessment And Impact Analysis

Jun 03, 2025 -

England Captain Lauds Joe Roots Maturing Skills

Jun 03, 2025

England Captain Lauds Joe Roots Maturing Skills

Jun 03, 2025 -

Improved Relationship Inside Miley And Billy Cyrus Family Dynamic

Jun 03, 2025

Improved Relationship Inside Miley And Billy Cyrus Family Dynamic

Jun 03, 2025 -

Russia Crimea Link Severed Ukraine Confirms Underwater Explosive Strike On Bridge

Jun 03, 2025

Russia Crimea Link Severed Ukraine Confirms Underwater Explosive Strike On Bridge

Jun 03, 2025 -

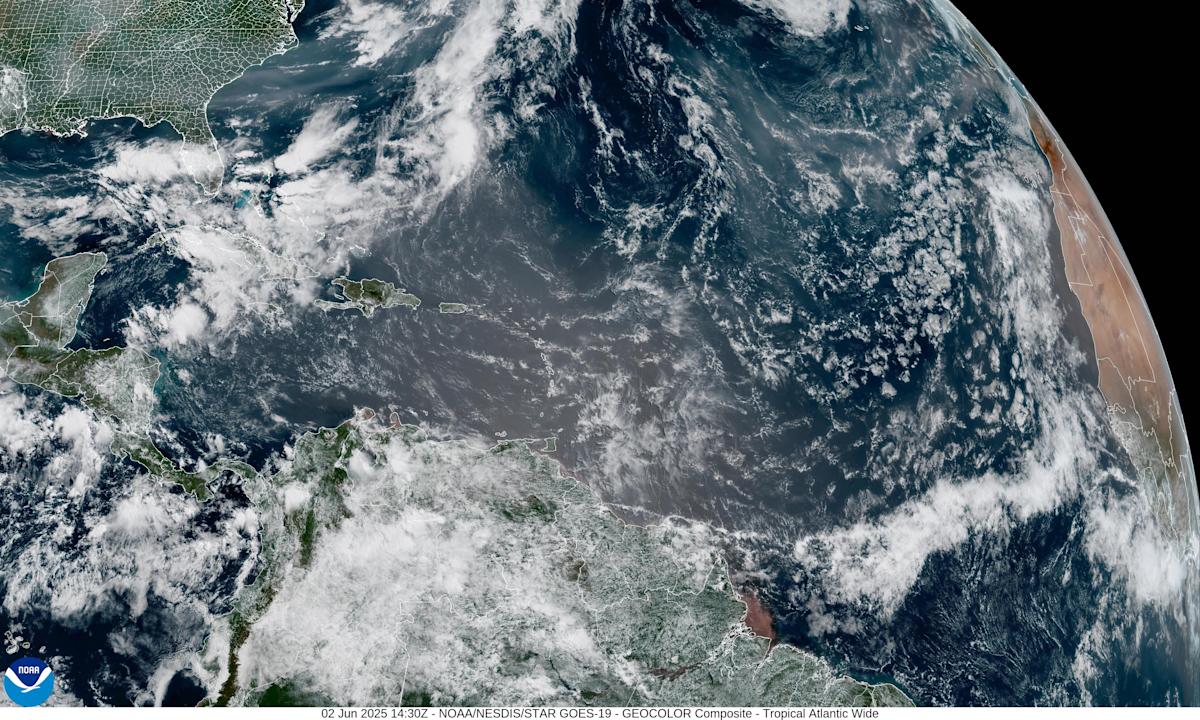

Canadian Wildfire Smoke And Saharan Dust Cloud Impact Floridas Environment

Jun 03, 2025

Canadian Wildfire Smoke And Saharan Dust Cloud Impact Floridas Environment

Jun 03, 2025