NIO Stock: Q1 Earnings Impact And Investment Strategy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock: Q1 Earnings Impact and Investment Strategy

NIO, a leading electric vehicle (EV) manufacturer in China, recently released its Q1 2024 earnings report, sending ripples through the investment community. The results, while showing some progress, also highlighted ongoing challenges within the competitive Chinese EV market. This article delves into the impact of the Q1 earnings on NIO stock and explores potential investment strategies moving forward.

Q1 2024 Earnings: A Mixed Bag

NIO's Q1 earnings revealed a complex picture. While the company delivered a higher-than-expected number of vehicles, exceeding analyst predictions, profitability remained elusive. Revenue growth, although positive, fell short of some optimistic forecasts. The report also highlighted the intense price competition in the Chinese EV market, forcing NIO to adjust its pricing strategy, impacting profit margins. This price war, fueled by established players and new entrants, continues to pressure the entire sector.

Several factors contributed to this mixed performance:

- Increased Competition: The Chinese EV market is fiercely competitive, with established brands and new startups vying for market share. This intense rivalry has led to aggressive price cuts, squeezing profit margins across the board.

- Supply Chain Issues: Although less impactful than in previous quarters, lingering supply chain disruptions continue to pose challenges for NIO's production and delivery timelines.

- Economic Slowdown: The ongoing economic slowdown in China also casts a shadow over consumer spending, potentially impacting demand for luxury EVs like those offered by NIO.

Impact on NIO Stock Price

The Q1 earnings announcement resulted in a mixed reaction from investors. While some were encouraged by the robust vehicle deliveries, others expressed concern about the persistent profitability challenges. The stock price experienced a temporary dip following the release, reflecting the market's cautious assessment of the results. However, long-term investors remain divided on the stock's future trajectory.

Investment Strategy Considerations:

Investing in NIO stock requires careful consideration of several factors:

- Long-Term Growth Potential: Despite the current headwinds, NIO retains significant long-term growth potential. Its innovative technology, expanding product lineup, and growing presence in international markets offer a compelling long-term investment thesis.

- Market Volatility: The Chinese EV market is notoriously volatile, subject to rapid shifts in government policies, technological advancements, and consumer sentiment. Investors should be prepared for significant price fluctuations.

- Risk Tolerance: Investing in NIO stock carries inherent risks, including the possibility of further price declines and the potential for the company to fail to meet its growth targets. Investors should only allocate capital they are comfortable losing.

- Diversification: As with any investment, diversification is crucial. Don't put all your eggs in one basket. Consider diversifying your portfolio across various asset classes to mitigate risk.

Should You Invest in NIO?

The decision to invest in NIO stock is ultimately a personal one, depending on your individual risk tolerance, investment goals, and market outlook. Thorough research, including a review of financial statements and independent analyst reports, is crucial before making any investment decisions. Consulting with a qualified financial advisor can also provide valuable guidance.

Looking Ahead:

NIO's success hinges on its ability to navigate the challenges of intense competition, supply chain disruptions, and economic uncertainty. Its future performance will depend on its ability to innovate, control costs, and effectively market its vehicles to a growing customer base. The coming quarters will be critical in determining whether NIO can overcome these hurdles and deliver on its long-term growth potential. Keep an eye on upcoming earnings reports and industry news for further insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock: Q1 Earnings Impact And Investment Strategy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump And Walker A Public Rift And Its Political Fallout

Jun 03, 2025

Trump And Walker A Public Rift And Its Political Fallout

Jun 03, 2025 -

Ukraines Underwater Attack Cripples Russia Crimea Link

Jun 03, 2025

Ukraines Underwater Attack Cripples Russia Crimea Link

Jun 03, 2025 -

Abas Role Curtailed In Trump Judicial Nominee Vetting Process Under Bondi

Jun 03, 2025

Abas Role Curtailed In Trump Judicial Nominee Vetting Process Under Bondi

Jun 03, 2025 -

Key Russia Crimea Link Severed Ukraine Confirms Bridge Strike Using Underwater Explosives

Jun 03, 2025

Key Russia Crimea Link Severed Ukraine Confirms Bridge Strike Using Underwater Explosives

Jun 03, 2025 -

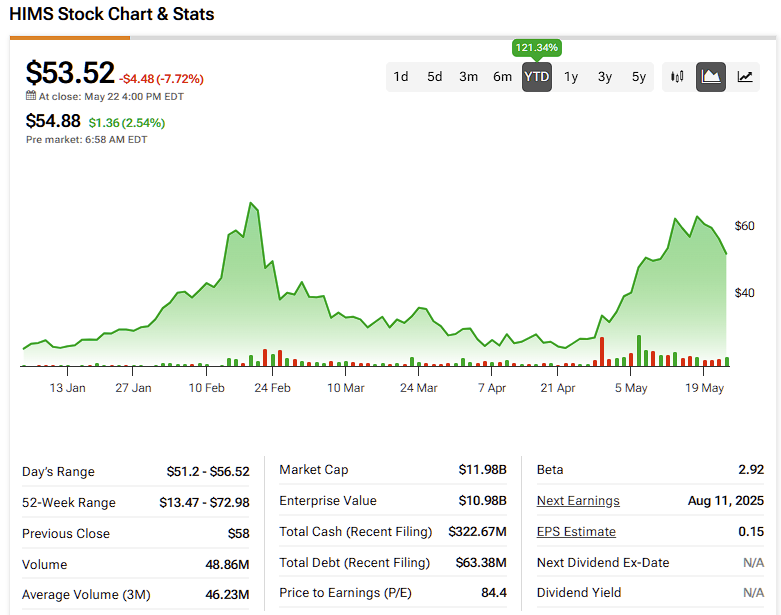

Hims And Hers Hims Stock Understanding The Volatility And Future Potential

Jun 03, 2025

Hims And Hers Hims Stock Understanding The Volatility And Future Potential

Jun 03, 2025