NIO Stock: Q1 Earnings And The Potential For Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock: Q1 Earnings Signal a Promising Future? Is Now the Time to Invest?

NIO, the Chinese electric vehicle (EV) maker, recently released its Q1 2024 earnings report, sending ripples through the investment community. While the results presented a mixed bag for some analysts, others see a strong potential for future growth, making NIO stock a compelling investment opportunity for those with a long-term perspective. This article delves into the key takeaways from the report and explores the potential for future investment in NIO.

Q1 2024 Earnings: A Closer Look

NIO's Q1 2024 earnings revealed a complex picture. While vehicle deliveries exceeded expectations, surpassing analysts' consensus estimates, the company also reported a wider-than-expected net loss. This discrepancy highlights the ongoing challenges faced by NIO, balancing aggressive expansion with profitability. Key highlights included:

- Strong Delivery Numbers: NIO exceeded delivery targets, showcasing continued demand for its electric vehicles, particularly in the premium EV segment. This positive trend indicates strong market traction and brand loyalty.

- Increased Operating Expenses: A significant increase in operating expenses, partly due to investments in research and development (R&D) and expansion into new markets, contributed to the wider net loss. This strategic investment, however, is viewed by many as crucial for long-term success.

- Pricing Strategies and Competition: NIO's pricing strategies, amidst intense competition in the burgeoning Chinese EV market, played a role in the overall financial performance. The company faces stiff competition from established players like Tesla and newer entrants, requiring adaptive strategies to maintain market share.

Analyzing the Potential for Investment

The Q1 earnings report presents a nuanced picture for potential investors. While the net loss might initially deter some, several factors suggest a potentially positive outlook for NIO stock:

- Growth Potential in the EV Market: The global electric vehicle market is poised for explosive growth in the coming years. NIO's strong position in the premium segment of the Chinese EV market positions it well to capitalize on this growth. The ongoing shift towards sustainable transportation presents a significant tailwind for the company.

- Strategic Investments in R&D: NIO's continued investment in R&D underscores its commitment to innovation and technological advancement. This focus on developing cutting-edge technologies, including battery technology and autonomous driving capabilities, is crucial for maintaining a competitive edge.

- Expanding Global Reach: NIO's ambitious plans for international expansion could significantly boost revenue streams in the future. Successfully penetrating new markets will be key to achieving sustainable profitability.

Risks to Consider:

Investing in NIO stock is not without risk. The following factors need careful consideration:

- Intense Competition: The Chinese EV market is highly competitive. Maintaining market share and profitability requires continuous innovation and adaptation.

- Geopolitical Risks: Operating in China exposes NIO to geopolitical risks and potential regulatory challenges.

- Economic Volatility: Global economic uncertainty could impact consumer demand for luxury electric vehicles.

Conclusion: A Long-Term Perspective is Key

The Q1 2024 earnings report provides a mixed but not necessarily negative signal for NIO. While the net loss is a concern, the strong delivery numbers and significant investments in R&D suggest a focus on long-term growth. Investors with a long-term horizon and a tolerance for risk might find NIO stock an attractive proposition. However, thorough due diligence and consideration of the risks outlined above are crucial before making any investment decisions. Consult with a qualified financial advisor before investing in any stock.

Further Research: For more in-depth analysis, you may wish to consult financial news sources like [link to reputable financial news site] and review NIO's official investor relations materials.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock: Q1 Earnings And The Potential For Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The 2 C Threshold A Practical Guide For Corporate Climate Change Adaptation

Jun 03, 2025

The 2 C Threshold A Practical Guide For Corporate Climate Change Adaptation

Jun 03, 2025 -

Uche Ojeh Funeral Sheinelle Jones Finds Comfort In Today Show Colleagues

Jun 03, 2025

Uche Ojeh Funeral Sheinelle Jones Finds Comfort In Today Show Colleagues

Jun 03, 2025 -

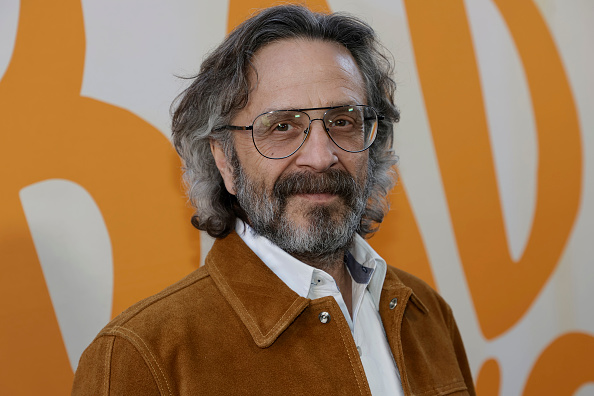

Sixteen Years And Out Marc Marons Wtf Podcast Coming To An End

Jun 03, 2025

Sixteen Years And Out Marc Marons Wtf Podcast Coming To An End

Jun 03, 2025 -

Hims And Hers Hims Stock Performance 3 02 Increase May 30

Jun 03, 2025

Hims And Hers Hims Stock Performance 3 02 Increase May 30

Jun 03, 2025 -

Collective Bargaining In The Federal Sector Risks And Opportunities For Unions

Jun 03, 2025

Collective Bargaining In The Federal Sector Risks And Opportunities For Unions

Jun 03, 2025