NIO Stock Price Falls Ahead Of Q1 Earnings Report: What To Expect

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock Price Falls Ahead of Q1 Earnings Report: What to Expect

NIO, the Chinese electric vehicle (EV) maker, saw its stock price dip ahead of its highly anticipated Q1 2024 earnings report. This decline reflects investor anxiety surrounding several key factors impacting the company's performance and the broader EV market in China. Understanding these factors is crucial for investors trying to gauge the potential impact on NIO's future trajectory.

The Pre-Earnings Dip: A Sign of Nervousness?

NIO's stock price experienced a noticeable downturn in the days leading up to the release of its Q1 earnings. This isn't entirely unusual; pre-earnings volatility is common for publicly traded companies, especially in a sector as dynamic as the EV industry. However, the magnitude of the drop suggests heightened investor concern. Several market analysts attribute this to a confluence of factors, including intensifying competition, macroeconomic headwinds in China, and uncertainties surrounding NIO's future growth prospects.

Key Factors Influencing Investor Sentiment:

Several key factors are likely contributing to the pre-earnings jitters:

-

Intense Competition: The Chinese EV market is incredibly competitive, with established players like BYD and new entrants constantly vying for market share. NIO faces pressure to maintain its innovation and competitiveness amidst this fierce landscape. [Link to article about competition in the Chinese EV market]

-

Macroeconomic Headwinds in China: China's economic recovery has been slower than anticipated, impacting consumer spending and potentially affecting demand for luxury EVs like those offered by NIO. This economic uncertainty introduces risk for investors. [Link to article about China's economic outlook]

-

Supply Chain Disruptions: While less prominent recently, ongoing global supply chain challenges could still impact NIO's production and delivery timelines, potentially affecting its financial results. [Link to article about global supply chain issues]

-

Battery Prices and Raw Material Costs: Fluctuations in battery raw material prices, such as lithium and cobalt, directly impact EV manufacturing costs and profitability. These price increases could squeeze NIO's margins. [Link to article about battery material costs]

What to Expect from the Q1 Earnings Report:

Investors will be closely scrutinizing several key metrics in NIO's Q1 earnings report:

-

Vehicle Deliveries: The number of vehicles delivered will be a critical indicator of NIO's sales performance and market demand. Any significant deviation from expectations could trigger further stock price movement.

-

Revenue Growth: Analysts will be looking for signs of revenue growth, indicating the company's ability to generate sales and maintain profitability.

-

Gross Margins: Monitoring gross margins will help assess NIO's pricing power and cost management efficiency. Pressure on margins could be a concern for investors.

-

Guidance for Future Quarters: NIO's guidance on future vehicle deliveries and financial performance will provide insight into its outlook and future growth potential. This is often a major driver of post-earnings stock price movements.

Potential Scenarios and Investor Strategies:

Depending on the Q1 results, several scenarios are possible:

-

Positive Surprise: If NIO surpasses expectations, the stock price could rebound significantly, rewarding investors who remained optimistic.

-

Meeting Expectations: Meeting analysts' forecasts might lead to a slight price increase or stabilization, offering a sense of relief to investors.

-

Disappointing Results: Underwhelming performance could trigger further stock price declines, prompting investors to reassess their positions.

Investors should carefully consider their risk tolerance and investment strategy before making any decisions based on the Q1 earnings report. Conducting thorough research and consulting with a financial advisor are highly recommended.

Conclusion:

The pre-earnings decline in NIO's stock price highlights the uncertainties and challenges facing the company and the broader Chinese EV market. The upcoming Q1 earnings report will be crucial in determining the future direction of NIO's stock price. Investors should approach the results with caution and a clear understanding of the various factors at play. Stay tuned for updates following the release of the report.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock Price Falls Ahead Of Q1 Earnings Report: What To Expect. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New South Loop Soccer Stadium Chicago Fires Ambitious Project

Jun 03, 2025

New South Loop Soccer Stadium Chicago Fires Ambitious Project

Jun 03, 2025 -

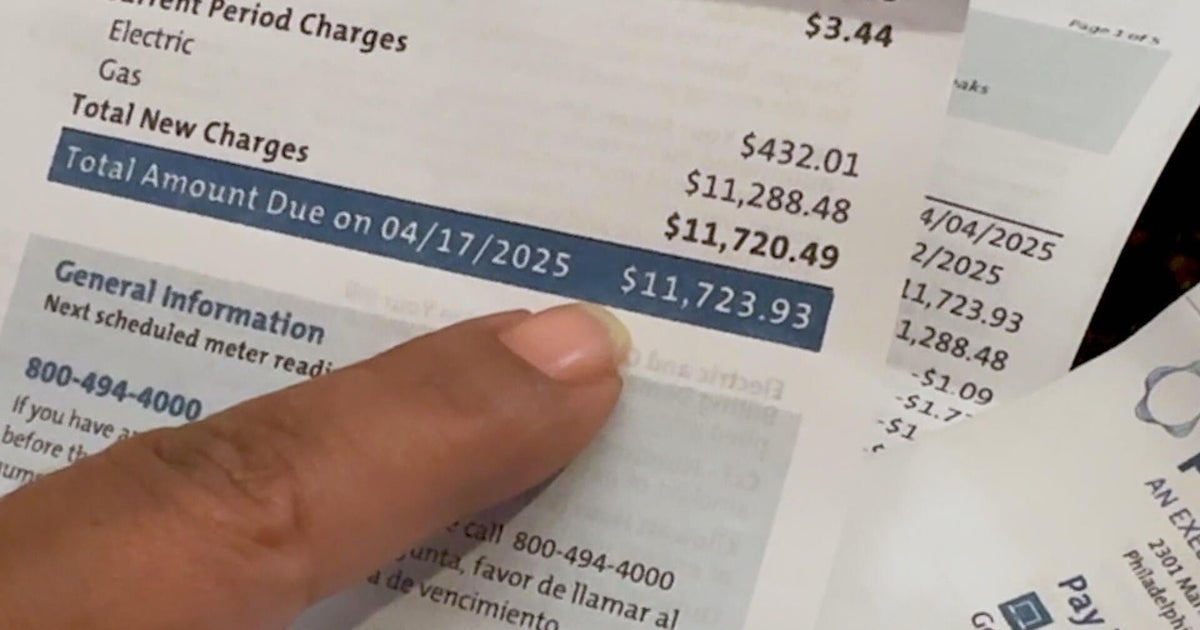

Peco Billing Chaos 12 K Bill Highlights System Failures And Months Long Delays

Jun 03, 2025

Peco Billing Chaos 12 K Bill Highlights System Failures And Months Long Delays

Jun 03, 2025 -

Murder Suspect Arrested Cross State Investigation Concludes

Jun 03, 2025

Murder Suspect Arrested Cross State Investigation Concludes

Jun 03, 2025 -

Local Unions Join Rep Ro Khanna In Protest Against Federal Job Cuts

Jun 03, 2025

Local Unions Join Rep Ro Khanna In Protest Against Federal Job Cuts

Jun 03, 2025 -

Jamie Dimon Identifies Trumps Most Important Focus In A Changing World

Jun 03, 2025

Jamie Dimon Identifies Trumps Most Important Focus In A Changing World

Jun 03, 2025