NIO Stock: Pre-Earnings Dip – Investment Opportunity Or Warning Sign?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock: Pre-Earnings Dip – Investment Opportunity or Warning Sign?

NIO, the Chinese electric vehicle (EV) maker, has seen its stock price experience a pre-earnings dip, leaving investors questioning whether this represents a compelling buying opportunity or a harbinger of worse news to come. The recent decline has sparked considerable debate, with analysts offering varying perspectives on the company's future prospects. This article delves into the factors contributing to the dip and analyzes whether now is the right time to invest in NIO stock.

Understanding the Pre-Earnings Dip

Pre-earnings dips are a common phenomenon in the stock market. Investors often sell shares before a company releases its earnings report, seeking to lock in profits or avoid potential losses if the results disappoint. This selling pressure can lead to a temporary decline in the stock price. In NIO's case, several factors likely contributed to the pre-earnings dip:

-

Market Volatility: The broader EV market, and the global stock market as a whole, has experienced considerable volatility recently. Geopolitical uncertainties, rising interest rates, and concerns about inflation have all played a role. NIO, as a growth stock, is particularly susceptible to these broader market trends.

-

Competition: The Chinese EV market is incredibly competitive, with established players like BYD and newer entrants constantly vying for market share. Concerns about NIO's ability to maintain its competitive edge could be contributing to investor apprehension.

-

Supply Chain Challenges: The global supply chain continues to face disruptions, impacting the production and delivery of vehicles. Any perceived weakness in NIO's ability to navigate these challenges could negatively influence investor sentiment.

-

Economic Slowdown in China: China's economic growth has slowed in recent quarters, raising concerns about consumer spending and the demand for luxury goods, including EVs. This impacts sales forecasts for companies like NIO.

Is it a Buying Opportunity?

Despite the pre-earnings dip, some analysts believe NIO stock presents a compelling investment opportunity. Their arguments often center on:

-

Long-Term Growth Potential: The long-term outlook for the EV market remains positive, with significant growth expected in both China and globally. NIO is well-positioned to capitalize on this growth, given its innovative technology and expanding product lineup.

-

Valuation: After the recent dip, NIO's valuation may be considered more attractive compared to its historical levels or relative to its competitors. However, it's crucial to conduct thorough due diligence and consider your own risk tolerance.

-

Technological Innovation: NIO continues to invest heavily in research and development, pushing the boundaries of EV technology. Its battery swapping technology, for instance, is a key differentiator in the market and offers potential for future growth.

-

Expanding Infrastructure: NIO's charging and battery swapping infrastructure is constantly expanding, addressing a critical concern for EV adoption.

Warning Signs to Consider

Conversely, the pre-earnings dip could also signal potential problems. Investors should carefully consider:

-

Profitability: NIO has yet to achieve consistent profitability. Sustained losses could lead to further stock price declines.

-

Debt Levels: High levels of debt could constrain NIO's growth and increase its vulnerability to economic downturns.

-

Geopolitical Risks: Operating in China exposes NIO to geopolitical risks, including potential regulatory changes and trade tensions.

Conclusion: Due Diligence is Key

Whether the pre-earnings dip in NIO stock represents a buying opportunity or a warning sign depends heavily on individual investment strategies and risk tolerance. Thorough research, including a careful review of the company's financial statements and future projections, is crucial before making any investment decisions. Consulting with a qualified financial advisor is always recommended. The information provided here is for educational purposes only and not financial advice. Stay informed about market trends and company announcements before making any investment choices. Remember to diversify your portfolio to mitigate risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock: Pre-Earnings Dip – Investment Opportunity Or Warning Sign?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The 78 Development To Include 650 Million Chicago Fire Soccer Stadium

Jun 04, 2025

The 78 Development To Include 650 Million Chicago Fire Soccer Stadium

Jun 04, 2025 -

Pitt Logo Controversy Twitter Reacts To Former Wvu Players Actions

Jun 04, 2025

Pitt Logo Controversy Twitter Reacts To Former Wvu Players Actions

Jun 04, 2025 -

Major Broadway Controversy Lu Pones Conduct Sparks Outrage Among 500 Fellow Artists

Jun 04, 2025

Major Broadway Controversy Lu Pones Conduct Sparks Outrage Among 500 Fellow Artists

Jun 04, 2025 -

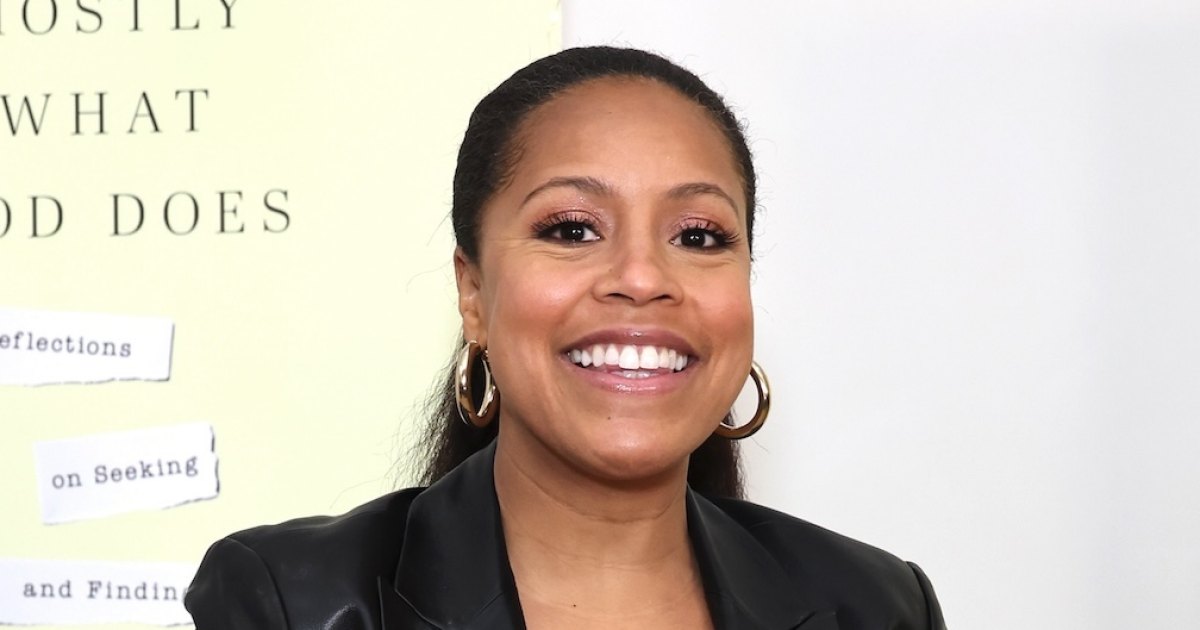

Sheinelle Joness Family Her Focus After Husbands Death

Jun 04, 2025

Sheinelle Joness Family Her Focus After Husbands Death

Jun 04, 2025 -

Collective Bargaining Rights For Federal Employees What The Future Holds

Jun 04, 2025

Collective Bargaining Rights For Federal Employees What The Future Holds

Jun 04, 2025