NIO Stock Plunges Before Q1 Earnings: Time To Buy The Dip?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock Plunges Before Q1 Earnings: Time to Buy the Dip?

NIO, the Chinese electric vehicle (EV) maker, experienced a significant stock price drop in the days leading up to its Q1 2024 earnings announcement. This dramatic plunge has left many investors wondering: is this a buying opportunity, or a sign of further trouble ahead for the company? Let's delve into the details and explore the potential implications.

The Pre-Earnings Dip: What Happened?

NIO's stock price saw a considerable decline before the release of its first-quarter 2024 financial results. Several factors likely contributed to this downturn. Market anxieties surrounding the overall EV sector, growing competition in the Chinese market, and concerns about NIO's delivery numbers all played a role. The anticipation surrounding earnings often creates volatility, with investors reacting to speculation and rumors before official figures are released. This pre-earnings jitters is a common phenomenon in the stock market, but the magnitude of the drop in NIO's case raised eyebrows.

NIO Q1 2024 Earnings: A Mixed Bag?

While the full details of NIO's Q1 2024 earnings are now public, the results presented a mixed picture. [Insert specific details from the Q1 earnings report here, including delivery numbers, revenue figures, and any significant announcements regarding new models or partnerships. Be sure to cite the source of this information]. Positive aspects should be highlighted alongside any areas of concern, presenting a balanced view for the reader. For example, while delivery numbers might have fallen short of some analysts' expectations, mention any positive trends in specific market segments or advancements in technology.

Analyzing the Dip: Is it a Buying Opportunity?

The question on many investors' minds is whether this pre-earnings dip presents a chance to buy NIO stock at a discounted price. The answer, as always, is complex and depends on individual investment strategies and risk tolerance.

Arguments for Buying the Dip:

- Undervalued Stock: Some analysts argue that the recent price drop has made NIO stock undervalued, presenting a potential entry point for long-term investors. The company's innovative technology and strong brand recognition could drive future growth.

- Growth Potential in the EV Market: The global electric vehicle market is still experiencing significant growth, offering opportunities for companies like NIO to capitalize on increasing demand.

- Technological Advancements: NIO continues to invest heavily in research and development, pushing the boundaries of EV technology. This innovation could solidify its position in the market.

Arguments Against Buying the Dip:

- Intense Competition: The Chinese EV market is fiercely competitive, with established players and numerous startups vying for market share. NIO faces significant challenges in maintaining its competitiveness.

- Economic Uncertainty: Global economic headwinds and potential shifts in government policies could impact the performance of the EV sector and NIO specifically.

- Delivery Challenges: Any ongoing issues with production or delivery could further strain the company's financial performance.

Conclusion: Proceed with Caution

The recent plunge in NIO stock before its Q1 2024 earnings release presents a complex scenario for investors. While the dip might represent an opportunity for some, it's crucial to conduct thorough due diligence before making any investment decisions. Consider the factors discussed above, analyze the full earnings report, and consult with a financial advisor to determine if NIO aligns with your risk tolerance and investment goals. Remember, past performance is not indicative of future results. Investing in the stock market always involves risk.

Further Reading:

- [Link to NIO's Investor Relations page]

- [Link to a reputable financial news source covering NIO]

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock Plunges Before Q1 Earnings: Time To Buy The Dip?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Support For Sheinelle Jones Today Show Family At Uche Ojehs Service

Jun 03, 2025

Support For Sheinelle Jones Today Show Family At Uche Ojehs Service

Jun 03, 2025 -

New Discovery Scientists Investigate Unusual Stellar Pulsations

Jun 03, 2025

New Discovery Scientists Investigate Unusual Stellar Pulsations

Jun 03, 2025 -

Demand And Controversy The Sydney Sweeney Bathwater Story

Jun 03, 2025

Demand And Controversy The Sydney Sweeney Bathwater Story

Jun 03, 2025 -

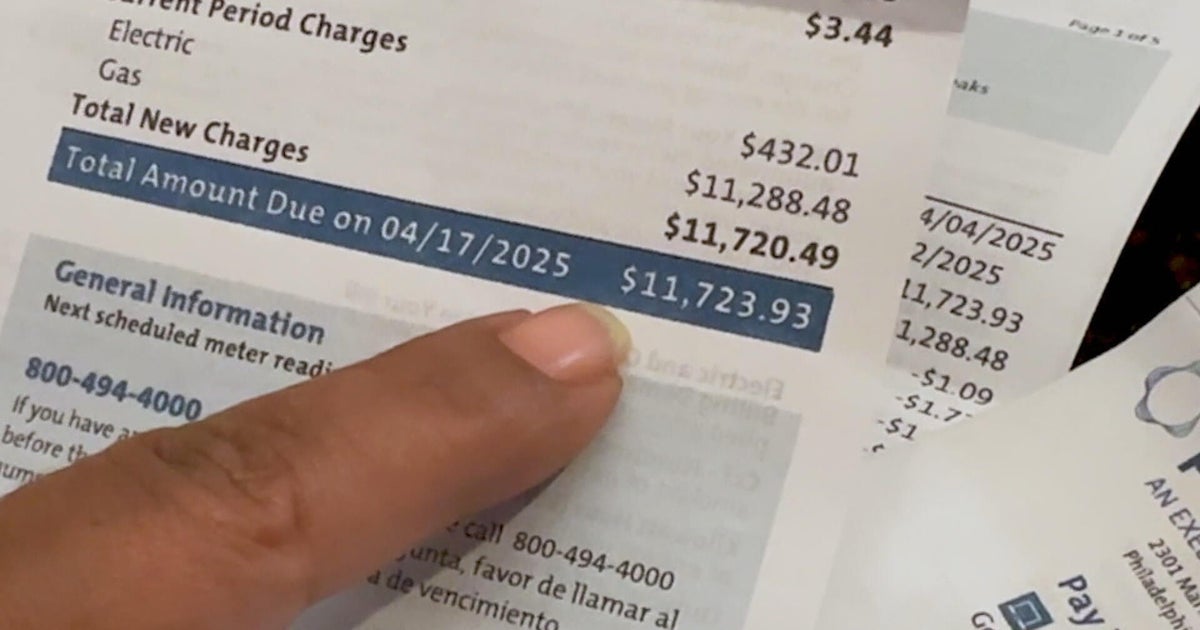

Philadelphia Residents Face Peco Billing Chaos High Bills And Missing Statements

Jun 03, 2025

Philadelphia Residents Face Peco Billing Chaos High Bills And Missing Statements

Jun 03, 2025 -

South Loop Stadium Project Chicago Fire Fc Announces Major Development

Jun 03, 2025

South Loop Stadium Project Chicago Fire Fc Announces Major Development

Jun 03, 2025