NIO Stock Dips Ahead Of Q1 Results: Should You Invest?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock Dips Ahead of Q1 Results: Should You Invest?

NIO, the Chinese electric vehicle (EV) maker, has seen its stock price dip in anticipation of its first-quarter 2024 earnings report. This fluctuation leaves many investors wondering: is now the time to buy, sell, or hold NIO stock? Let's delve into the factors driving this uncertainty and explore whether investing in NIO remains a worthwhile venture.

The Pre-Earnings Dip: A Common Phenomenon

Stock prices often experience volatility leading up to the release of quarterly earnings reports. This is especially true for companies like NIO, which operate in a rapidly evolving and highly competitive sector. The pre-earnings dip reflects the inherent uncertainty surrounding the company's performance. Investors are hesitant to commit further capital until they have a clearer picture of NIO's financial health and future outlook. This cautious approach is a normal part of the market's response to earnings announcements.

Factors Influencing NIO's Q1 Performance:

Several key factors could significantly impact NIO's Q1 2024 results and subsequent stock price movements:

- Increased Competition: The EV market in China is fiercely competitive, with established players like BYD and new entrants constantly vying for market share. NIO's ability to maintain its competitive edge will be crucial.

- Supply Chain Challenges: Global supply chain disruptions continue to pose a threat to automakers worldwide. NIO's resilience in navigating these challenges will directly impact its production and delivery numbers.

- Demand for Electric Vehicles in China: The overall demand for EVs in China, a crucial market for NIO, will play a key role in determining the company's sales performance. Economic factors and government policies can influence this demand.

- New Product Launches and Innovation: NIO's success hinges on its ability to consistently innovate and introduce compelling new models. The market's reception to any new product launches will be a critical factor.

- Battery Swapping Technology: NIO's unique battery swapping technology is a differentiator in the market. Its adoption rate and operational efficiency will be closely watched.

Should You Invest? A Cautious Approach

The decision of whether to invest in NIO stock before or after the Q1 earnings release requires careful consideration. While NIO has shown potential in the past, the EV market is highly unpredictable. Investors should:

- Thoroughly Research: Conduct thorough due diligence before making any investment decisions. Analyze NIO's financial statements, competitor landscape, and future growth prospects.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification is crucial for mitigating risk in any investment strategy.

- Consider Your Risk Tolerance: NIO stock is considered a relatively high-risk investment. Only invest what you can afford to lose.

- Monitor Market Trends: Keep a close eye on the overall market conditions and industry trends affecting the EV sector.

Looking Ahead:

NIO's Q1 2024 earnings report will provide crucial insights into the company's performance and future trajectory. While the pre-earnings dip presents a potential buying opportunity for some investors, it’s essential to approach the investment with a thorough understanding of the associated risks. Remember to consult with a qualified financial advisor before making any investment decisions. Stay tuned for our post-earnings analysis!

Keywords: NIO, NIO Stock, Electric Vehicle, EV, Chinese Electric Vehicle, Q1 Earnings, Stock Market, Investment, Stock Price, NIO Stock Price, EV Market, China EV Market, Battery Swapping, NIO Battery Swapping, Invest in NIO.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock Dips Ahead Of Q1 Results: Should You Invest?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Another Dte Rate Hike Could Cripple Michigan Households Legislator Claims

Jun 03, 2025

Another Dte Rate Hike Could Cripple Michigan Households Legislator Claims

Jun 03, 2025 -

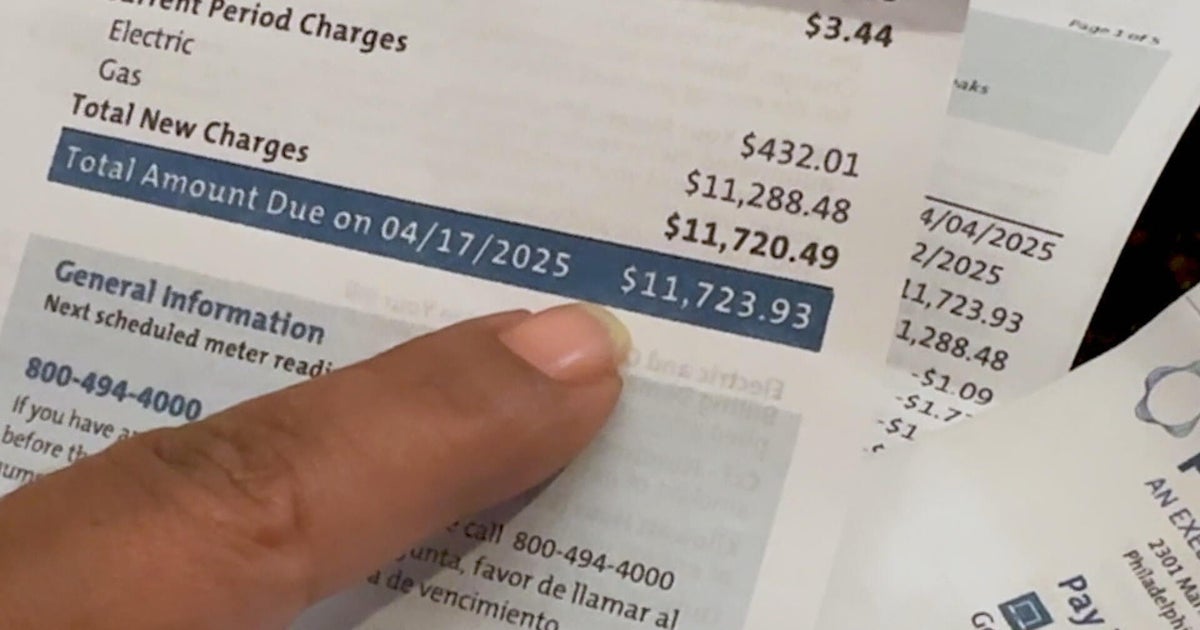

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025 -

South Loop Transformation Chicago Fires New 650 Million Stadium

Jun 03, 2025

South Loop Transformation Chicago Fires New 650 Million Stadium

Jun 03, 2025 -

Local Unions And Rep Ro Khanna Fight Against Federal Job Cuts

Jun 03, 2025

Local Unions And Rep Ro Khanna Fight Against Federal Job Cuts

Jun 03, 2025 -

Trump Judicial Nominee Vetting Bondi Curbs Aba Influence

Jun 03, 2025

Trump Judicial Nominee Vetting Bondi Curbs Aba Influence

Jun 03, 2025