NIO Stock: Analyzing The Pre-Earnings Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Stock: Analyzing the Pre-Earnings Dip

NIO, the Chinese electric vehicle (EV) maker, has seen its stock price experience a pre-earnings dip, a common phenomenon for companies facing market scrutiny before releasing their financial results. This dip, while potentially concerning for some investors, presents an opportunity for a closer look at the company's performance and future prospects. Understanding the reasons behind this fluctuation is crucial for navigating the complexities of the EV market and making informed investment decisions.

The Pre-Earnings Jitters: Why the Dip?

Pre-earnings dips are often attributed to a mixture of factors, and NIO is no exception. Investors tend to adopt a wait-and-see approach before a company reveals its financial health. This cautious stance can lead to selling pressure, pushing the stock price down. Several specific factors might be contributing to NIO's current dip:

-

Market Volatility: The broader market's volatility, particularly within the tech and EV sectors, plays a significant role. Concerns about global economic growth, rising interest rates, and geopolitical uncertainties can impact investor sentiment across the board, affecting even strong performers like NIO.

-

Competition: The EV market is fiercely competitive, with established players and new entrants constantly vying for market share. NIO faces competition from domestic rivals like BYD and international giants like Tesla. Any perceived weakening in NIO's competitive position could trigger selling pressure.

-

Delivery Numbers Expectations: Analysts and investors closely scrutinize NIO's vehicle deliveries. Any deviation from projected delivery numbers, whether positive or negative, can significantly impact the stock price. Pre-earnings speculation about potential shortfalls can contribute to the dip.

-

Supply Chain Challenges: The global supply chain continues to present challenges for many industries, including the automotive sector. Any concerns about potential disruptions to NIO's supply chain could add to investor anxiety.

Analyzing NIO's Fundamentals:

Despite the pre-earnings dip, it's crucial to analyze NIO's underlying fundamentals. The company has demonstrated strong growth potential in the past, with innovative vehicle designs and a growing charging infrastructure. Key factors to consider include:

-

Innovation and Technology: NIO consistently invests in research and development, pushing the boundaries of EV technology. Their battery-as-a-service (BaaS) model is a unique differentiator, addressing range anxiety and battery cost concerns.

-

Expanding Market Presence: NIO's expansion into new markets both within China and internationally is crucial for long-term growth. Success in these endeavors will be a key factor in future performance.

-

Financial Performance (Post-Earnings): The upcoming earnings report will provide crucial insights into NIO's financial health, including revenue growth, profitability, and future guidance. This will be a critical moment to reassess the investment thesis.

What to Expect Post-Earnings:

The upcoming earnings report will be a pivotal moment for NIO investors. A strong performance could reverse the pre-earnings dip and propel the stock price upward. Conversely, a disappointing report could exacerbate the decline. Investors should carefully analyze the company's financial statements and management commentary to gauge the company's future trajectory.

Conclusion:

The pre-earnings dip in NIO stock is a complex phenomenon influenced by various market and company-specific factors. While caution is warranted, this dip could present a buying opportunity for long-term investors who believe in NIO's growth potential. Thorough due diligence, analysis of the upcoming earnings report, and a long-term investment perspective are crucial for navigating this volatility. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Stock: Analyzing The Pre-Earnings Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The 2 C Threshold A Time Critical Guide For Corporate Climate Adaptation

Jun 04, 2025

The 2 C Threshold A Time Critical Guide For Corporate Climate Adaptation

Jun 04, 2025 -

Roots Century Propels England To Thrilling Win Over West Indies

Jun 04, 2025

Roots Century Propels England To Thrilling Win Over West Indies

Jun 04, 2025 -

Real Life Tech Execs Models For Successions Powerful Mountainhead Characters

Jun 04, 2025

Real Life Tech Execs Models For Successions Powerful Mountainhead Characters

Jun 04, 2025 -

Former Wvu Player Faces Twitter Criticism Over Pitt Logo Incident

Jun 04, 2025

Former Wvu Player Faces Twitter Criticism Over Pitt Logo Incident

Jun 04, 2025 -

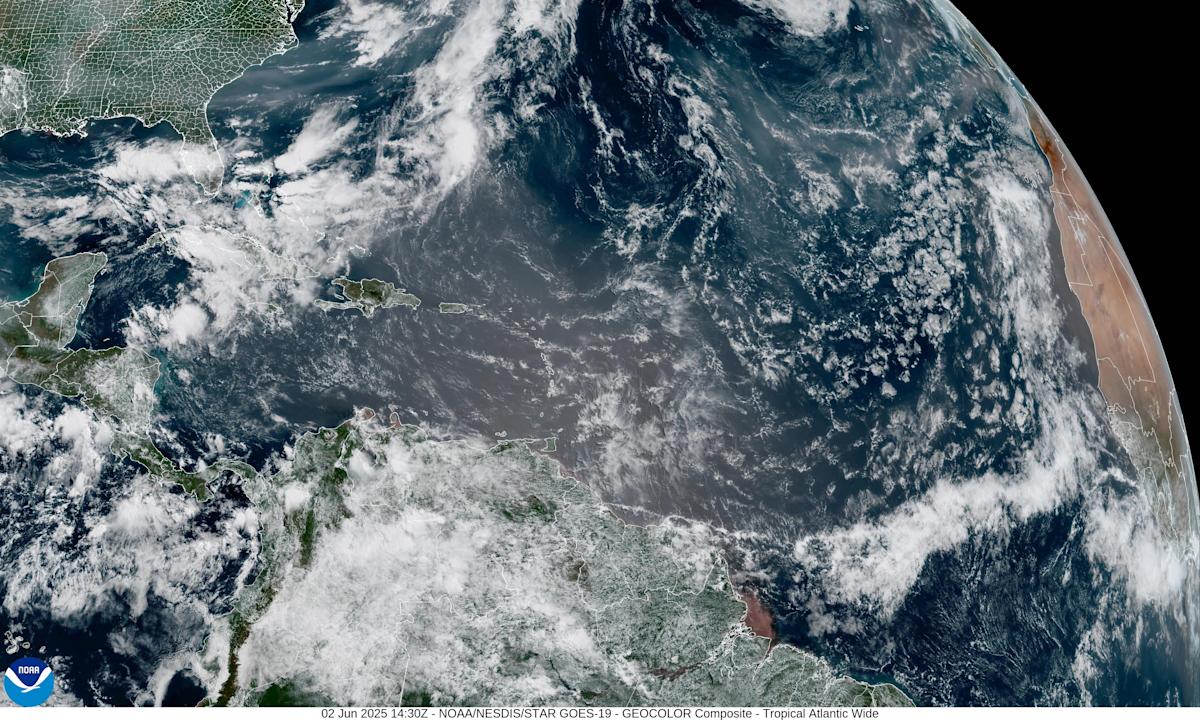

Wall Of Dust Exploring The Effects Of Saharan Dust And Canadian Wildfire Smoke On Florida

Jun 04, 2025

Wall Of Dust Exploring The Effects Of Saharan Dust And Canadian Wildfire Smoke On Florida

Jun 04, 2025