Nio Reports 21% Revenue Increase In Q1: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Reports 21% Revenue Increase in Q1: What it Means for Investors

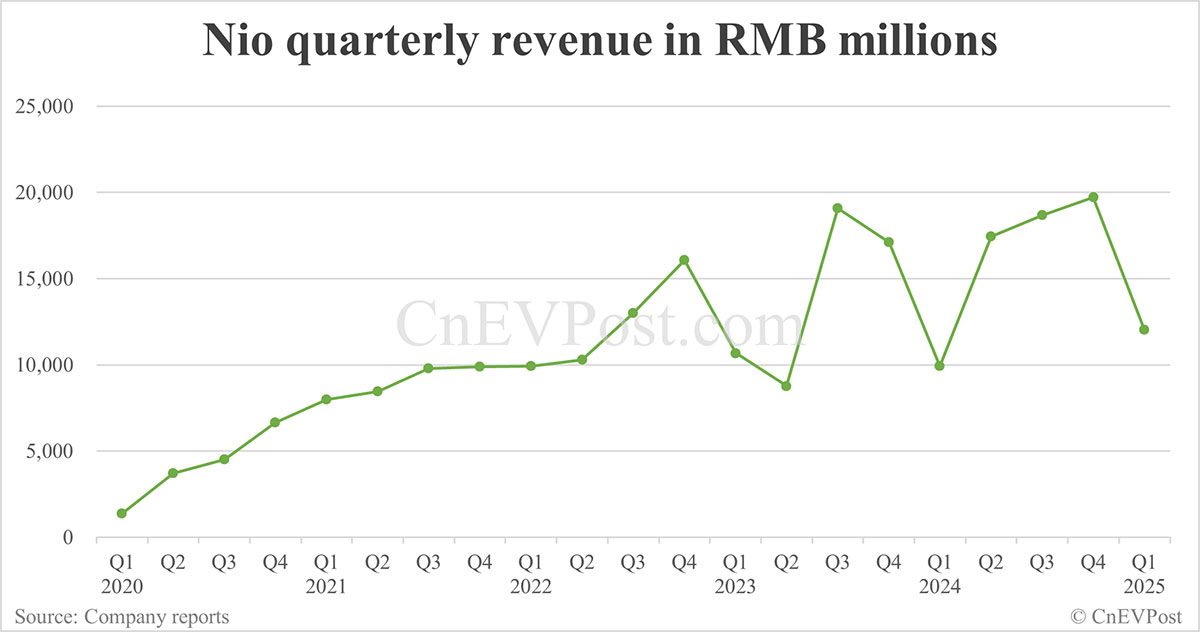

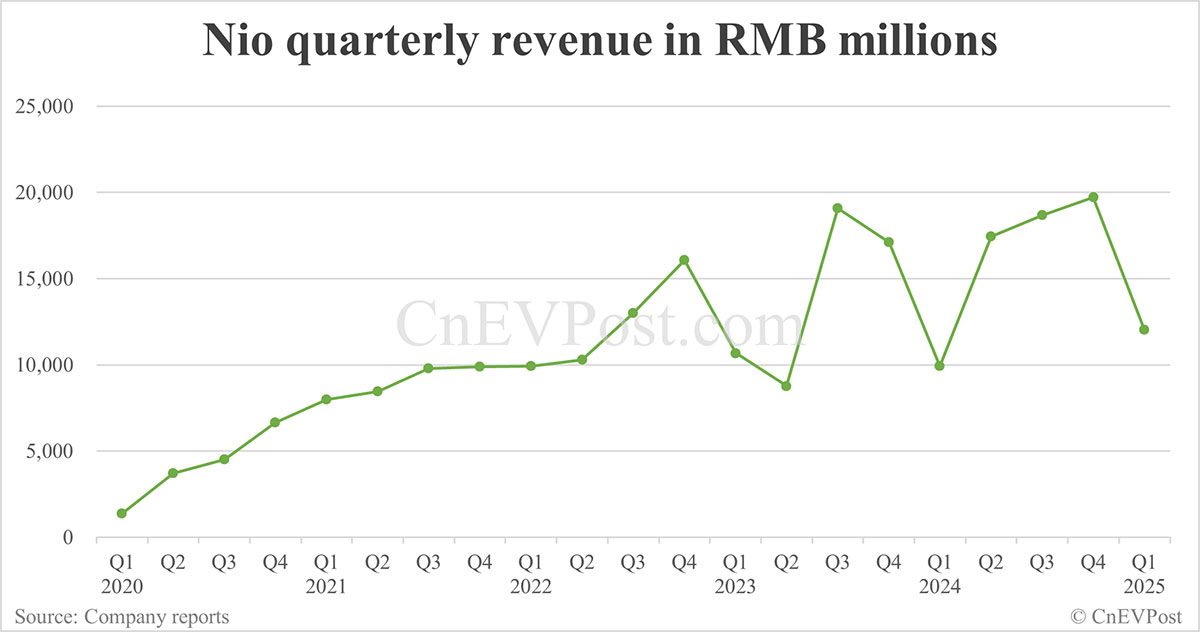

Chinese electric vehicle (EV) maker Nio reported a strong start to 2024, announcing a 21% year-over-year surge in first-quarter revenue. This positive financial performance has sent ripples through the investment community, prompting questions about the future trajectory of the company and the implications for investors. But what does this revenue increase really mean, and should investors be bullish or cautious?

Nio's Q1 2024 Performance: A Closer Look

Nio's Q1 2024 revenue reached [Insert Actual Revenue Figure Here], exceeding analyst expectations of [Insert Analyst Expectation Figure Here]. This significant jump is largely attributed to [Insert Key Reasons for Revenue Increase, e.g., increased vehicle deliveries, strong demand for new models, successful expansion into new markets]. The company delivered [Insert Number] vehicles during the quarter, a [Percentage]% increase compared to the same period last year. This robust delivery performance underscores the growing popularity of Nio's EVs and its ability to compete effectively in the increasingly crowded electric vehicle market.

Key Factors Driving Nio's Growth:

- New Model Launches: The successful launch of new models, such as the [Mention Specific New Models], has significantly boosted sales and contributed to the overall revenue increase. These new models often incorporate innovative features and technologies, attracting a wider range of customers.

- Expanding Market Reach: Nio's strategic expansion into new markets both domestically in China and internationally is playing a crucial role in driving revenue growth. This expansion diversifies its customer base and reduces reliance on a single market.

- Battery-as-a-Service (BaaS): Nio's innovative Battery-as-a-Service model continues to attract customers, offering a flexible and cost-effective way to own an electric vehicle. This subscription-based model is a key differentiator in the market.

- Improved Supply Chain Management: The company has seemingly addressed previous supply chain challenges, leading to improved production efficiency and increased vehicle deliveries.

What This Means for Investors:

While the 21% revenue increase is undoubtedly positive news, investors should consider several factors before making investment decisions. The EV market remains highly competitive, with established players and numerous startups vying for market share. Geopolitical uncertainties and potential economic downturns could also impact future performance.

Potential Risks and Challenges:

- Intense Competition: The Chinese EV market, and the global EV market as a whole, is fiercely competitive. Nio faces stiff competition from established automakers like Tesla and BYD, as well as a host of other emerging EV companies.

- Economic Uncertainty: Global economic conditions can significantly impact consumer spending, potentially affecting demand for luxury electric vehicles.

- Supply Chain Disruptions: While Nio has seemingly improved its supply chain management, future disruptions remain a potential risk.

Looking Ahead:

Nio's Q1 results suggest a positive trajectory, but sustained growth will depend on continued innovation, effective market expansion, and the ability to navigate the challenges inherent in the competitive EV landscape. Investors should monitor the company's progress in these areas, along with broader macroeconomic trends, to make informed investment decisions. For a deeper dive into Nio's financial performance, you can visit their investor relations website: [Insert Link to Nio Investor Relations Website].

Call to Action: Stay informed about the latest developments in the EV industry and Nio's performance by following reputable financial news sources and conducting your own thorough research before making any investment decisions. Remember, past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Reports 21% Revenue Increase In Q1: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chicago Fire Stadium 650 Million Investment In The 78 Development

Jun 04, 2025

Chicago Fire Stadium 650 Million Investment In The 78 Development

Jun 04, 2025 -

We Re All Going To Die The Gops Desperate Defense Of Trumps Controversial Legislation

Jun 04, 2025

We Re All Going To Die The Gops Desperate Defense Of Trumps Controversial Legislation

Jun 04, 2025 -

Chinese Ev Maker Nios Q1 Earnings Preview Growth And Challenges

Jun 04, 2025

Chinese Ev Maker Nios Q1 Earnings Preview Growth And Challenges

Jun 04, 2025 -

New Claims Of Sabotage Ukraines Underwater Attack On Crimean Bridge

Jun 04, 2025

New Claims Of Sabotage Ukraines Underwater Attack On Crimean Bridge

Jun 04, 2025 -

India Vs Thailand International Friendly Result Commentary And Highlights

Jun 04, 2025

India Vs Thailand International Friendly Result Commentary And Highlights

Jun 04, 2025