NIO Q1 Earnings Report: Analyzing Delivery Numbers And Tariff Effects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Report: Analyzing Delivery Numbers and Tariff Effects

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 earnings report, revealing a mixed bag of results. While delivery numbers showed promising growth, the impact of recent tariff adjustments cast a shadow on the overall financial performance. This article delves into the key takeaways from the report, analyzing both the positive delivery figures and the negative effects of tariffs on NIO's bottom line.

Record Deliveries Despite Global Headwinds:

NIO reported a record number of vehicle deliveries in Q1 2024, exceeding analyst expectations. This surge in deliveries can be attributed to several factors, including the launch of new models like the ET7 and ET5, increased consumer demand for EVs in China, and successful expansion into new markets. The company's robust sales network and improved production efficiency also played a significant role in achieving these impressive figures. However, it's crucial to consider the broader economic context and potential future challenges.

- Key Highlights:

- [Insert Specific Delivery Numbers Here - e.g., "NIO delivered X,XXX vehicles in Q1 2024, a YY% increase compared to Q1 2023."]

- [Mention specific model sales figures if available]

- [Mention any geographical areas showing significant growth]

Tariff Impacts and Margin Pressure:

Despite the strong delivery numbers, NIO's earnings were affected by increased tariffs on imported components. These tariffs, implemented [mention the reason for tariffs and when they were implemented], significantly impacted the company's production costs and reduced profit margins. This highlights the vulnerability of EV manufacturers to global trade policies and the importance of diversifying supply chains. The company acknowledged these challenges in its earnings call, stating that they are actively working on mitigating these effects through [mention strategies like localization of production or alternative sourcing].

Looking Ahead: Challenges and Opportunities:

NIO faces several challenges in the coming quarters. Increased competition in the EV market, particularly from established automakers and other Chinese EV startups, poses a significant threat. Maintaining its growth trajectory while managing rising costs and navigating fluctuating trade policies will require strategic planning and execution.

However, NIO also has significant opportunities for growth. The expanding EV market in China and globally presents a large addressable market. Continued innovation in vehicle technology, expansion into new markets, and potential partnerships could significantly boost NIO's long-term prospects.

NIO's Q1 2024 Earnings: A Balanced Perspective:

NIO's Q1 2024 earnings report presents a complex picture. While record delivery numbers showcase the company's market strength and product appeal, the impact of tariffs underscores the challenges of operating in a volatile global environment. Investors and analysts will be closely monitoring NIO's strategies for addressing these challenges and capitalizing on future opportunities. The company's ability to navigate these complexities will be crucial to its long-term success.

Keywords: NIO, NIO Q1 earnings, electric vehicle, EV, China, delivery numbers, tariffs, profit margins, supply chain, competition, investment, stock market, EV market growth, NIO stock

Call to Action: Stay tuned for our next analysis on NIO's performance and the evolving landscape of the electric vehicle industry. [Link to your website or relevant articles].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Report: Analyzing Delivery Numbers And Tariff Effects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Attack On Crimean Bridge Ukraine Claims Underwater Explosion

Jun 03, 2025

New Attack On Crimean Bridge Ukraine Claims Underwater Explosion

Jun 03, 2025 -

Source Claims Miley And Billy Cyrus Are Closer Than Ever

Jun 03, 2025

Source Claims Miley And Billy Cyrus Are Closer Than Ever

Jun 03, 2025 -

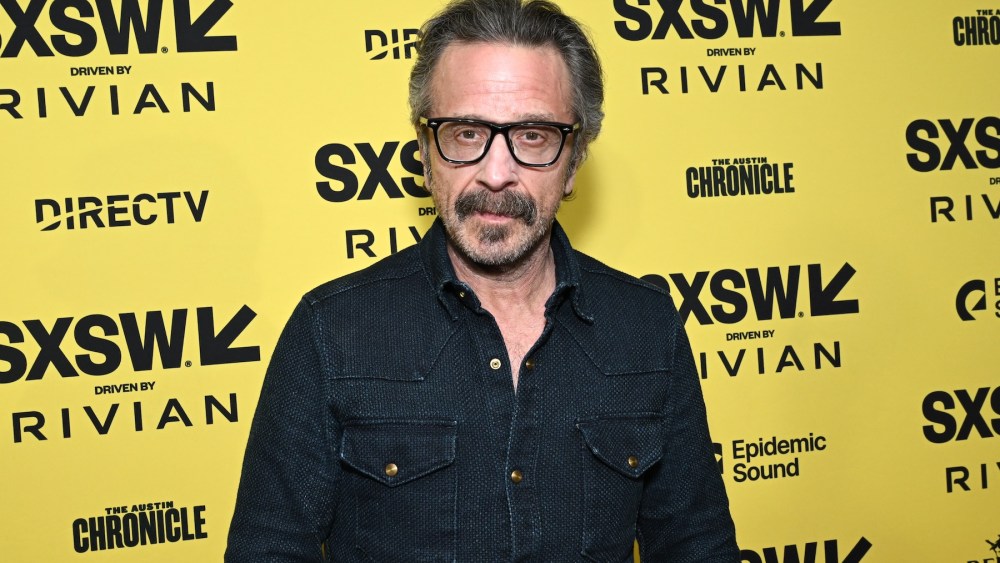

Wtf Podcasts Final Episode Marc Maron Announces End

Jun 03, 2025

Wtf Podcasts Final Episode Marc Maron Announces End

Jun 03, 2025 -

Sheinelle Jones Receives Outpouring Of Support Following Husbands Passing

Jun 03, 2025

Sheinelle Jones Receives Outpouring Of Support Following Husbands Passing

Jun 03, 2025 -

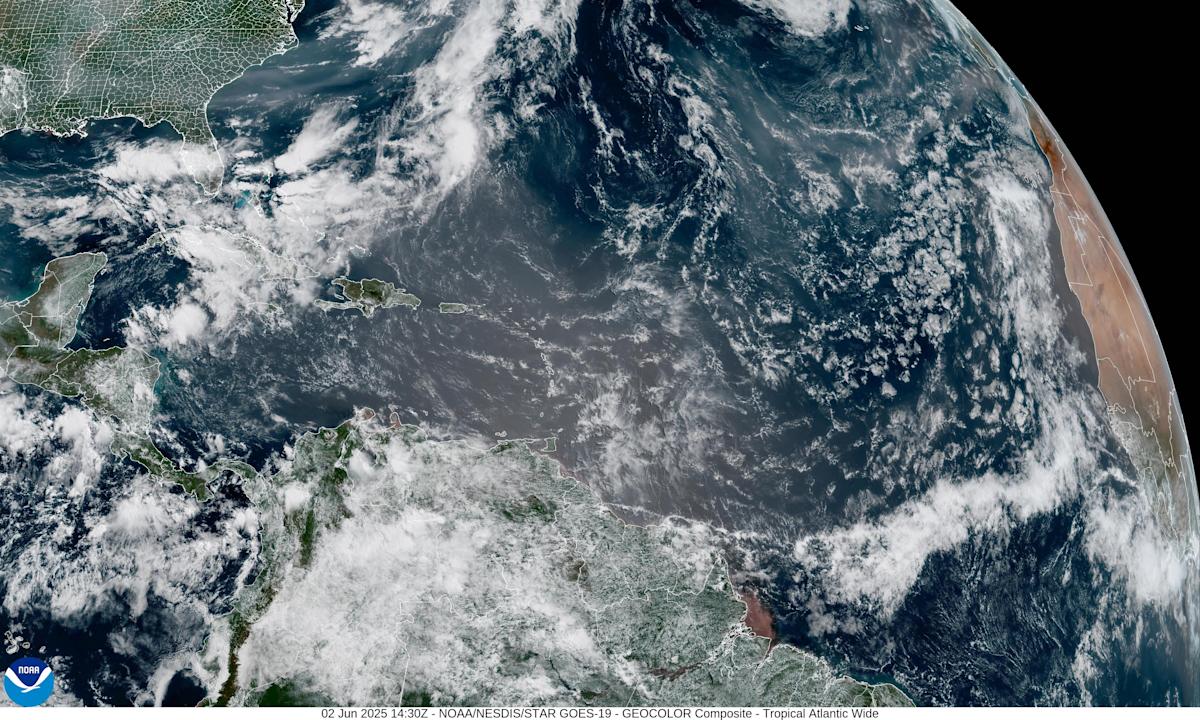

Saharan Dust And Canadian Wildfires A Double Whammy For Floridas Air Quality

Jun 03, 2025

Saharan Dust And Canadian Wildfires A Double Whammy For Floridas Air Quality

Jun 03, 2025