NIO Q1 Earnings Preview: Growth Prospects Amidst Rising Tariff Worries

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Preview: Growth Prospects Amidst Rising Tariff Worries

NIO, the Chinese electric vehicle (EV) maker, is gearing up to release its first-quarter 2024 earnings, and investors are on edge. While the company has shown significant growth potential, rising tariff concerns and a competitive EV market pose significant challenges. This preview analyzes NIO's Q1 prospects, highlighting key factors influencing its performance and the potential impact on its future growth.

The anticipation surrounding NIO's Q1 earnings is palpable. Analysts are keenly watching for signs of continued growth amidst a complex global economic landscape. The company's success hinges on several key performance indicators (KPIs), including vehicle deliveries, revenue growth, and gross margin. Any significant deviation from expectations could trigger substantial market volatility.

Key Factors Influencing NIO's Q1 Performance:

-

Vehicle Deliveries: NIO's Q1 delivery figures will be a crucial indicator of its market share and overall performance. Strong delivery numbers would signal continued consumer demand and successful execution of its product strategy. Any slowdown, however, could raise concerns about market saturation or increased competition. Analysts will be closely scrutinizing the breakdown of deliveries across different models to assess the success of new product launches and the overall market appeal of NIO's offerings.

-

Revenue Growth: Sustained revenue growth is essential for NIO's long-term viability. Investors will be looking for evidence of robust sales and a healthy expansion of its revenue streams, potentially including battery-as-a-service (BaaS) subscriptions. Strong revenue growth would demonstrate NIO's ability to translate vehicle deliveries into increased profitability.

-

Gross Margin: Maintaining or improving gross margin is critical for NIO's profitability. The company's ability to manage costs effectively, particularly in the face of rising raw material prices and potential tariff increases, will be a key focus for investors. A compressed gross margin could indicate pressure on pricing or increased manufacturing costs.

-

Rising Tariff Concerns: The escalating trade tensions between the US and China pose a significant threat to NIO's global ambitions. Increased tariffs on imported goods could inflate production costs and impact the company's competitiveness in international markets. NIO's ability to mitigate these risks through strategic partnerships or alternative supply chains will be under intense scrutiny.

-

Intensifying Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share. NIO's ability to differentiate itself through innovation, superior technology, and a strong brand identity will be vital for its continued success. The competition from companies like Tesla, BYD, and other Chinese EV manufacturers is fierce and unrelenting.

Growth Prospects and Challenges:

NIO's growth prospects remain promising, fueled by the increasing global demand for electric vehicles and the company's innovative product portfolio. However, the challenges posed by rising tariffs, intensifying competition, and economic uncertainty cannot be ignored. The company's ability to navigate these challenges and deliver strong Q1 earnings will be crucial in determining its future trajectory.

What to Watch For: Beyond the core financial metrics, investors should pay close attention to NIO's guidance for the remainder of 2024. This guidance will provide insights into the company's expectations for future growth, potential challenges, and its overall strategic outlook.

Conclusion:

NIO's Q1 earnings report is a pivotal moment for the company. While strong growth potential remains, navigating the complexities of the global EV market and mitigating the impact of rising tariffs will be key to sustaining its momentum. The upcoming earnings call will provide crucial insights into NIO's performance and its prospects for future success. Investors should carefully analyze all aspects of the report before making any investment decisions. Stay tuned for further updates as the Q1 results are released.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Preview: Growth Prospects Amidst Rising Tariff Worries. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

What To Watch Asian Economic Calendar For Monday June 2 2025

Jun 03, 2025

What To Watch Asian Economic Calendar For Monday June 2 2025

Jun 03, 2025 -

From Debut Novel To Bestseller Taylor Jenkins Reids Journey To Publishing Success

Jun 03, 2025

From Debut Novel To Bestseller Taylor Jenkins Reids Journey To Publishing Success

Jun 03, 2025 -

The Wire Actor Speaks Out After Sons 300 Foot Throw During Henry County Tornado

Jun 03, 2025

The Wire Actor Speaks Out After Sons 300 Foot Throw During Henry County Tornado

Jun 03, 2025 -

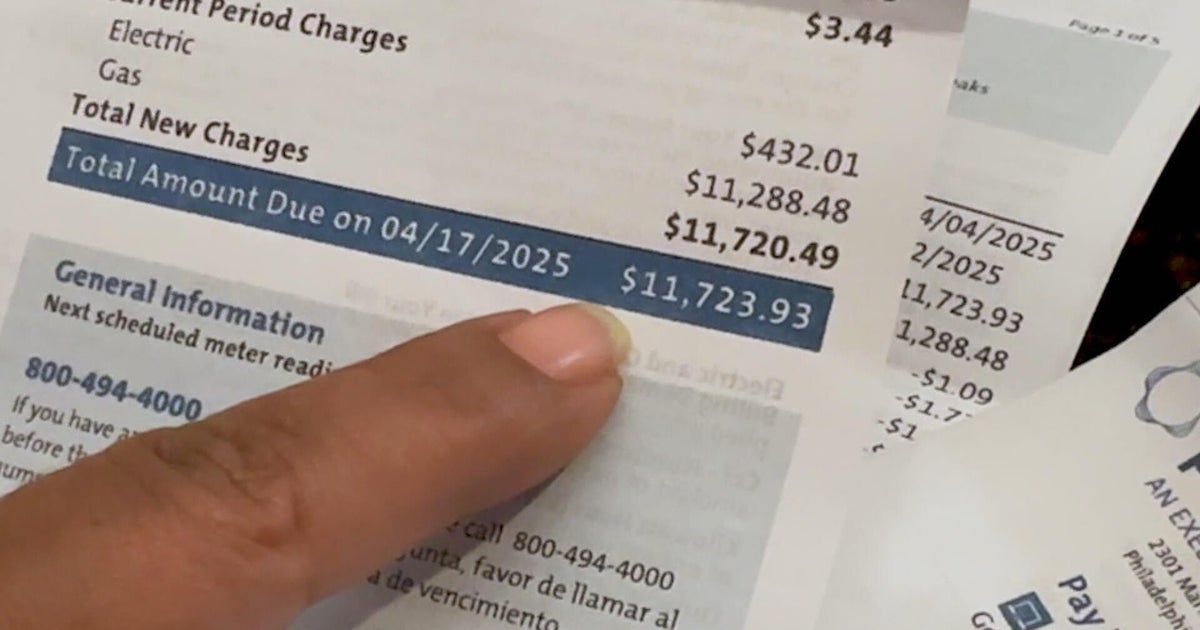

12 000 Peco Bill Stuns Customer Amidst Months Long Billing Delays

Jun 03, 2025

12 000 Peco Bill Stuns Customer Amidst Months Long Billing Delays

Jun 03, 2025 -

Walz Takes Aim At Trump Advocates For A More Assertive Democratic Party

Jun 03, 2025

Walz Takes Aim At Trump Advocates For A More Assertive Democratic Party

Jun 03, 2025