NIO Q1 Earnings Preview: Examining Delivery Numbers And Tariff Effects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Preview: Examining Delivery Numbers and Tariff Effects

NIO's upcoming Q1 2024 earnings report is generating significant buzz among investors. The electric vehicle (EV) maker faces a critical period, navigating evolving market dynamics, including fluctuating delivery numbers and the impact of potential tariff adjustments. This preview delves into the key factors investors should watch closely as NIO prepares to unveil its financial performance.

NIO's Delivery Figures: A Key Performance Indicator (KPI)

NIO's Q1 2024 vehicle deliveries will be a major focus. Analysts and investors will scrutinize the numbers for signs of sustained growth or potential slowdown. Several factors could influence these figures, including:

- Supply chain disruptions: The ongoing global chip shortage and other supply chain bottlenecks could continue to impact production and deliveries.

- Competition: Intense competition in the burgeoning EV market from established automakers and new entrants puts pressure on NIO's market share.

- New model introductions: The success of new NIO models, if any were launched during the quarter, will play a crucial role in overall delivery numbers. The market eagerly anticipates data on the performance of any recent releases.

Analyzing the year-over-year and quarter-over-quarter growth in deliveries will offer valuable insights into NIO's market traction and operational efficiency. A significant drop in deliveries could raise concerns about the company's future prospects.

Tariff Implications: A Looming Shadow

Geopolitical factors and potential tariff adjustments represent a significant wildcard for NIO's Q1 results. Any changes in import/export tariffs, especially between China and key markets, could directly impact NIO's profitability and pricing strategy. Investors will be keen to understand the company's mitigation strategies and the potential financial impact of these tariffs on its bottom line. The company's guidance on future tariff expectations will be closely examined.

Beyond Deliveries and Tariffs: What Else to Watch

While delivery numbers and tariff impacts are paramount, investors should also pay attention to:

- Gross margin: Monitoring NIO's gross margin provides insight into its pricing power and operational efficiency. Any significant decline could indicate pressure on profitability.

- Research and development (R&D) spending: NIO's investment in R&D reflects its commitment to innovation and future growth. Increased R&D spending might signal ambitious plans for new technologies and models.

- Guidance for Q2 2024 and beyond: The company's outlook for the coming quarters will offer valuable insights into its projected growth trajectory and overall financial health. This forward-looking guidance is crucial for long-term investment decisions.

Conclusion: A Crucial Quarter for NIO

NIO's Q1 2024 earnings report is a pivotal moment for the company. The interplay of delivery numbers, tariff effects, and other financial metrics will provide a comprehensive picture of NIO's performance and future prospects. Investors should carefully analyze these factors to make informed decisions about their investments in this dynamic sector of the automotive industry. Stay tuned for our post-earnings analysis following the release of the official report!

Keywords: NIO, NIO Q1 Earnings, Electric Vehicle, EV, China EV market, NIO stock, EV delivery numbers, tariffs, supply chain, competition, gross margin, R&D, Q2 2024 guidance, NIO financial results, automotive industry.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Preview: Examining Delivery Numbers And Tariff Effects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Massive Saharan Dust Cloud Blankets Caribbean Impacts Us Forecast

Jun 04, 2025

Massive Saharan Dust Cloud Blankets Caribbean Impacts Us Forecast

Jun 04, 2025 -

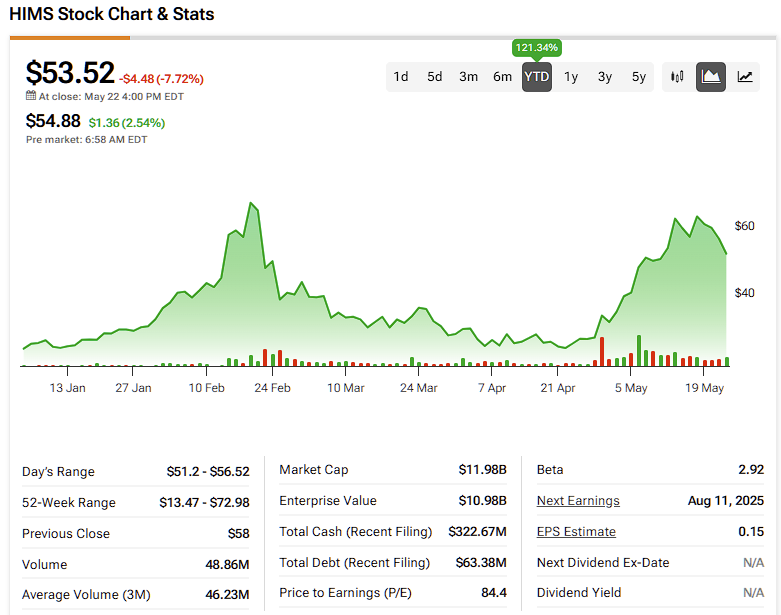

Hims And Hers Health Hims Understanding The Risks And Rewards

Jun 04, 2025

Hims And Hers Health Hims Understanding The Risks And Rewards

Jun 04, 2025 -

Lu Pones Actions Spark Controversy Massive Broadway Protest Over Treatment Of Mc Donald And Lewis

Jun 04, 2025

Lu Pones Actions Spark Controversy Massive Broadway Protest Over Treatment Of Mc Donald And Lewis

Jun 04, 2025 -

Federal Employee Unions Protecting Collective Bargaining Rights

Jun 04, 2025

Federal Employee Unions Protecting Collective Bargaining Rights

Jun 04, 2025 -

Time Management Strategies Of A 30 Year Old Tech Billionaire

Jun 04, 2025

Time Management Strategies Of A 30 Year Old Tech Billionaire

Jun 04, 2025