NIO Q1 Earnings Looms: Stock Price Drop—Smart Investment Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looms: Stock Price Drop—Smart Investment Now?

NIO, a leading Chinese electric vehicle (EV) manufacturer, is gearing up to release its Q1 2024 earnings report, a moment that has investors on edge. Recent stock price drops have sparked a crucial question: is this a buying opportunity, or a sign of deeper trouble? Let's delve into the factors influencing NIO's current market position and explore whether now is the right time to invest.

NIO's Recent Challenges:

The recent decline in NIO's stock price isn't entirely surprising. The Chinese EV market is fiercely competitive, with established players like BYD and newer entrants constantly vying for market share. Furthermore, macroeconomic headwinds in China, including a slower-than-expected economic recovery, have impacted consumer spending, affecting demand for luxury EVs like those offered by NIO.

NIO has also faced challenges related to:

- Increased Competition: The burgeoning EV market in China sees relentless competition, squeezing profit margins.

- Supply Chain Disruptions: Global supply chain issues continue to pose a risk to production and delivery timelines.

- Economic Slowdown: A cooling Chinese economy has dampened consumer confidence and overall vehicle sales.

Analyzing the Q1 Earnings Report:

The upcoming Q1 earnings report will be crucial in assessing NIO's performance and future prospects. Investors will be keenly focused on several key metrics:

- Delivery Numbers: The number of vehicles delivered will be a critical indicator of market demand and NIO's ability to compete.

- Revenue Growth: Sustained revenue growth is essential for demonstrating the company's financial health and long-term viability.

- Profitability: While NIO is still in a growth phase, any signs of improved profitability will be viewed positively by investors.

- Guidance for Future Quarters: Management's outlook for the remainder of the year will offer valuable insights into NIO's expectations and strategic plans.

Is it a Smart Investment Now?

The question of whether to invest in NIO after its recent stock price drop is complex and depends on individual risk tolerance and investment strategies. While the challenges are undeniable, there are also compelling reasons for optimism:

- Technological Innovation: NIO continues to invest heavily in research and development, pushing the boundaries of EV technology. Their battery swap technology remains a unique selling point.

- Expanding Market Reach: NIO is gradually expanding its presence in international markets, diversifying its revenue streams.

- Government Support: The Chinese government continues to support the development of the domestic EV industry, offering potential benefits to NIO.

Before Investing:

Before making any investment decisions, it's crucial to conduct thorough due diligence. This includes:

- Reading the Q1 earnings report carefully: Understand the details of NIO's performance and management's commentary.

- Analyzing financial statements: Assess NIO's financial health and identify potential risks.

- Considering your own investment goals: Ensure the investment aligns with your risk tolerance and long-term financial plans.

- Consulting with a financial advisor: Seek professional advice tailored to your individual circumstances.

Conclusion:

The current dip in NIO's stock price presents both risks and opportunities. While the competitive landscape and macroeconomic factors present challenges, NIO's technological innovation and potential for future growth warrant careful consideration. The upcoming Q1 earnings report will be pivotal in determining the stock's future trajectory. Investors should approach this situation cautiously, performing comprehensive research and potentially seeking professional financial advice before making any investment decisions. The potential for significant returns exists, but so does the risk of further losses. Therefore, thorough due diligence is paramount.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looms: Stock Price Drop—Smart Investment Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hims And Hers Hims Should You Buy Sell Or Hold

Jun 03, 2025

Hims And Hers Hims Should You Buy Sell Or Hold

Jun 03, 2025 -

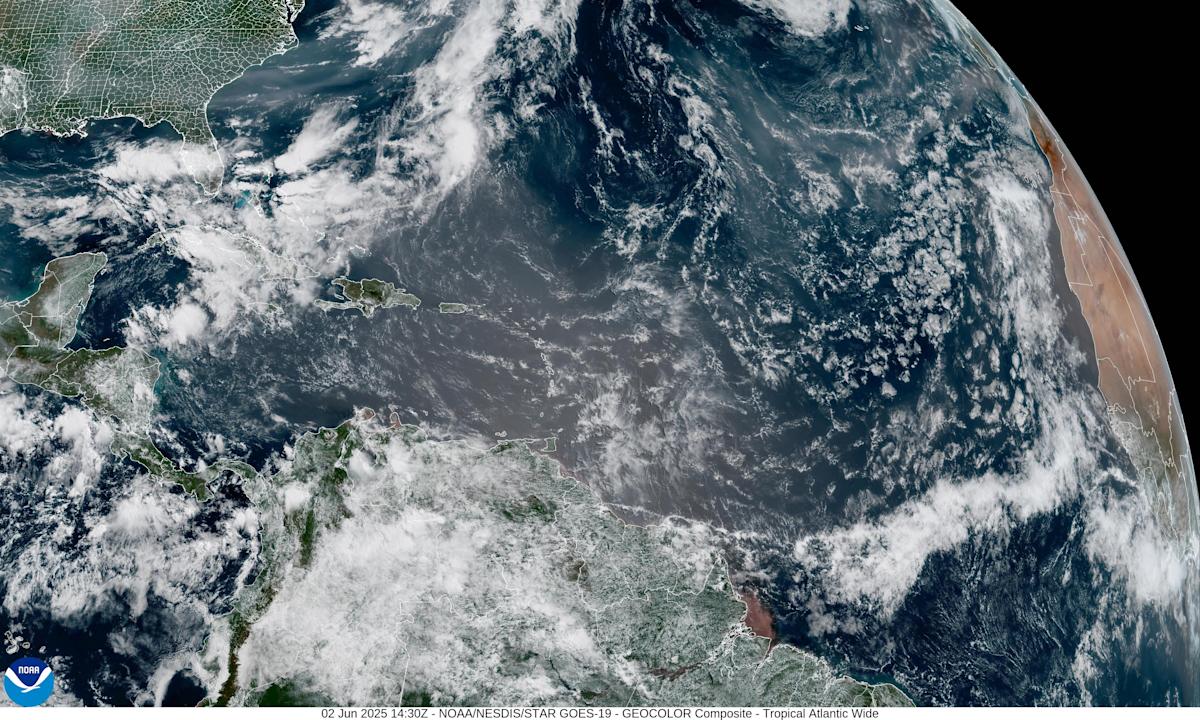

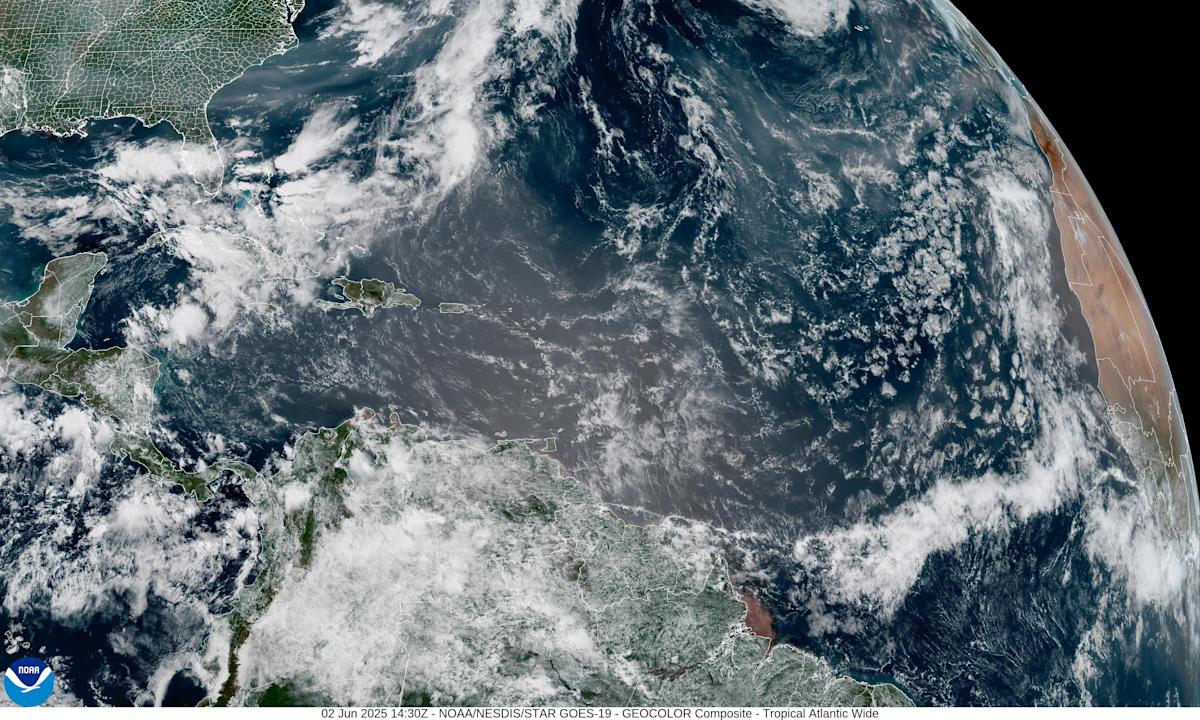

Saharan Dust Storm And Canadian Wildfire Smoke Combine To Affect Florida

Jun 03, 2025

Saharan Dust Storm And Canadian Wildfire Smoke Combine To Affect Florida

Jun 03, 2025 -

Saharan Dust Storm And Canadian Wildfire Smoke Converge Over Florida Assessing The Effects

Jun 03, 2025

Saharan Dust Storm And Canadian Wildfire Smoke Converge Over Florida Assessing The Effects

Jun 03, 2025 -

Sheinelle Jones Finds Solace In Colleagues Amidst Husbands Funeral

Jun 03, 2025

Sheinelle Jones Finds Solace In Colleagues Amidst Husbands Funeral

Jun 03, 2025 -

Roseanne Barr Rebounds From Tractor Accident Thriving In Texas

Jun 03, 2025

Roseanne Barr Rebounds From Tractor Accident Thriving In Texas

Jun 03, 2025