NIO Q1 Earnings Looming: Stock Dip – Buy Or Sell?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Looming: Stock Dip – Buy or Sell?

NIO, the Chinese electric vehicle (EV) maker, is on the cusp of releasing its Q1 2024 earnings report, and investors are on edge. The stock has experienced a recent dip, leaving many wondering: is this a buying opportunity, or a sign of further trouble ahead? This article delves into the factors influencing NIO's current market position and offers insights to help you make an informed decision.

NIO's Recent Challenges:

The recent stock price decline for NIO isn't entirely unexpected. The Chinese EV market is fiercely competitive, with established players like BYD and newer entrants vying for market share. Several factors have contributed to the current uncertainty surrounding NIO's performance:

-

Intense Competition: The Chinese EV market is a battleground. Competition from both domestic and international brands is pushing down profit margins and increasing the pressure on NIO to innovate and maintain its market position. [Link to article on Chinese EV market competition]

-

Supply Chain Issues: Global supply chain disruptions continue to impact the automotive industry, potentially affecting NIO's production and delivery timelines. These disruptions can lead to increased costs and decreased profitability. [Link to article on global supply chain issues impacting automakers]

-

Economic Slowdown Concerns: Concerns about a potential global economic slowdown could impact consumer spending on luxury goods like electric vehicles, potentially reducing demand for NIO's products.

What to Expect from the Q1 Earnings Report:

The upcoming Q1 earnings report will be crucial in determining NIO's future trajectory. Investors will be closely scrutinizing several key metrics, including:

-

Vehicle Deliveries: The number of vehicles delivered in Q1 will be a key indicator of NIO's sales performance and market share. A significant increase in deliveries could signal a positive trend, while a decline could exacerbate investor concerns.

-

Revenue Growth: Sustained revenue growth is vital for NIO's long-term sustainability. Investors will be looking for evidence of strong revenue growth, reflecting healthy demand for NIO's vehicles.

-

Profitability: NIO is still striving for profitability. While not expected to be highly profitable in Q1, any progress towards profitability will be a positive sign for investors.

-

Guidance: NIO's guidance for the remainder of 2024 will provide valuable insights into the company's future outlook and expectations. Strong guidance could reassure investors and boost the stock price.

Buy, Sell, or Hold? A Cautious Approach:

The recent dip in NIO's stock price presents a complex scenario for investors. While the challenges are real, NIO also possesses significant strengths, including a strong brand image, innovative technology, and a growing global presence.

Before making any investment decisions, consider these points:

-

Risk Tolerance: Investing in NIO carries inherent risks, given the competitive and volatile nature of the EV market. Only invest what you can afford to lose.

-

Long-Term Perspective: NIO is a long-term play. Short-term fluctuations should not dictate your investment strategy.

-

Diversification: Diversifying your portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

Conclusion:

The upcoming Q1 earnings report will be a pivotal moment for NIO. While the recent stock dip may present a buying opportunity for some long-term investors with a high-risk tolerance, it's crucial to thoroughly analyze the earnings report and consider the broader market context before making any investment decisions. Conduct your own thorough research and consult with a financial advisor before investing in NIO or any other stock.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Looming: Stock Dip – Buy Or Sell?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

This Week In Entertainment John Wicks Ballerina And Nintendo Switch 2 Debut

Jun 04, 2025

This Week In Entertainment John Wicks Ballerina And Nintendo Switch 2 Debut

Jun 04, 2025 -

Close Call In Cardiff England Beats West Indies Thanks To Roots Unbeaten 166

Jun 04, 2025

Close Call In Cardiff England Beats West Indies Thanks To Roots Unbeaten 166

Jun 04, 2025 -

Mountainheads Genesis How Real Life Tech Execs Influenced Jesse Armstrong

Jun 04, 2025

Mountainheads Genesis How Real Life Tech Execs Influenced Jesse Armstrong

Jun 04, 2025 -

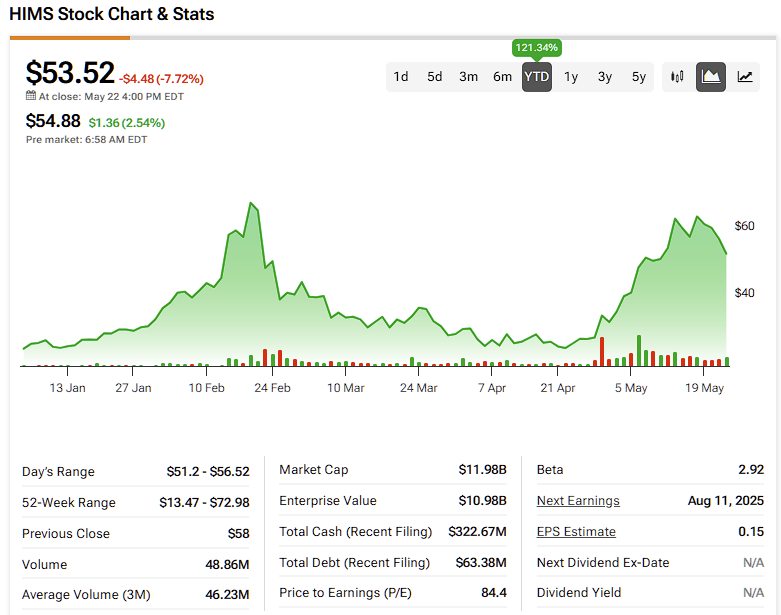

Hims And Hers Hims Stock Understanding The Volatility

Jun 04, 2025

Hims And Hers Hims Stock Understanding The Volatility

Jun 04, 2025 -

The 30 Year Old Tech Billionaires Productivity System

Jun 04, 2025

The 30 Year Old Tech Billionaires Productivity System

Jun 04, 2025