NIO Q1 Earnings Loom: Is The Stock Dip A Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings Loom: Is the Stock Dip a Buying Opportunity?

NIO, a leading Chinese electric vehicle (EV) maker, is poised to release its Q1 2024 earnings report, and investors are on edge. The stock has experienced a recent dip, leaving many wondering if this presents a strategic buying opportunity or a sign of further trouble ahead. This article delves into the factors influencing NIO's current market position and explores whether this dip signals a chance to capitalize on a potentially undervalued asset.

NIO's Recent Challenges:

NIO, like many other EV companies, has faced headwinds in recent months. The highly competitive Chinese EV market, characterized by aggressive pricing strategies from established players and new entrants, has put pressure on profit margins. Furthermore, the overall global economic slowdown and concerns about consumer spending have impacted demand across the automotive sector. These challenges have contributed to the recent decline in NIO's stock price.

Analyzing the Stock Dip:

The recent dip in NIO's stock price is multifaceted. While the broader economic climate plays a role, specific concerns about NIO's Q1 performance are also contributing factors. Analysts are keenly watching for updates on delivery numbers, gross margins, and the company's overall financial health. Any significant deviation from expectations could trigger further volatility. However, some analysts believe that the current price reflects a degree of pessimism that may not fully account for NIO's long-term growth potential.

Factors Suggesting a Buying Opportunity:

Despite the challenges, several factors suggest that the current dip could be a buying opportunity for long-term investors:

-

Strong Brand Recognition and Innovation: NIO has established a strong brand identity and reputation for innovation in the Chinese EV market. Their commitment to technological advancements, including battery swap technology and advanced driver-assistance systems (ADAS), positions them well for future growth.

-

Expanding Market Presence: NIO continues to expand its market presence both domestically and internationally. Further inroads into key markets could significantly boost revenue and profitability in the coming years.

-

Government Support for EVs: The Chinese government's continued support for the electric vehicle industry offers a supportive regulatory environment for NIO and its competitors. This support could help mitigate some of the challenges faced by the company.

-

Potential for Price Rebound: Many investors believe that NIO's current stock price undervalues its long-term potential. A strong Q1 earnings report could trigger a significant price rebound.

Risks to Consider:

While the potential upside is significant, investors should also be aware of the risks involved:

-

Intense Competition: The Chinese EV market is fiercely competitive. NIO faces stiff competition from established players like BYD and newer entrants vying for market share.

-

Economic Uncertainty: Global economic uncertainty remains a significant risk factor that could continue to impact consumer demand for EVs.

-

Supply Chain Disruptions: Potential disruptions to the global supply chain could affect NIO's production and delivery timelines.

Conclusion: Proceed with Caution and Due Diligence

The question of whether the current NIO stock dip represents a buying opportunity is complex and depends on individual investor risk tolerance and long-term outlook. While the potential for growth is undeniable, the risks associated with investing in NIO should not be underestimated. Thorough due diligence, including careful review of the Q1 earnings report and analysis of market trends, is crucial before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

Keywords: NIO, NIO Stock, Electric Vehicle, EV, Chinese EV Market, Q1 Earnings, Stock Dip, Buying Opportunity, Investment, Stock Market, Automotive Industry, NIO Stock Price, Battery Swap Technology, ADAS

Call to Action (subtle): Stay informed about NIO's Q1 earnings release and market developments to make informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings Loom: Is The Stock Dip A Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Meet Lucy Guo How She Overtook Taylor Swifts Net Worth

Jun 04, 2025

Meet Lucy Guo How She Overtook Taylor Swifts Net Worth

Jun 04, 2025 -

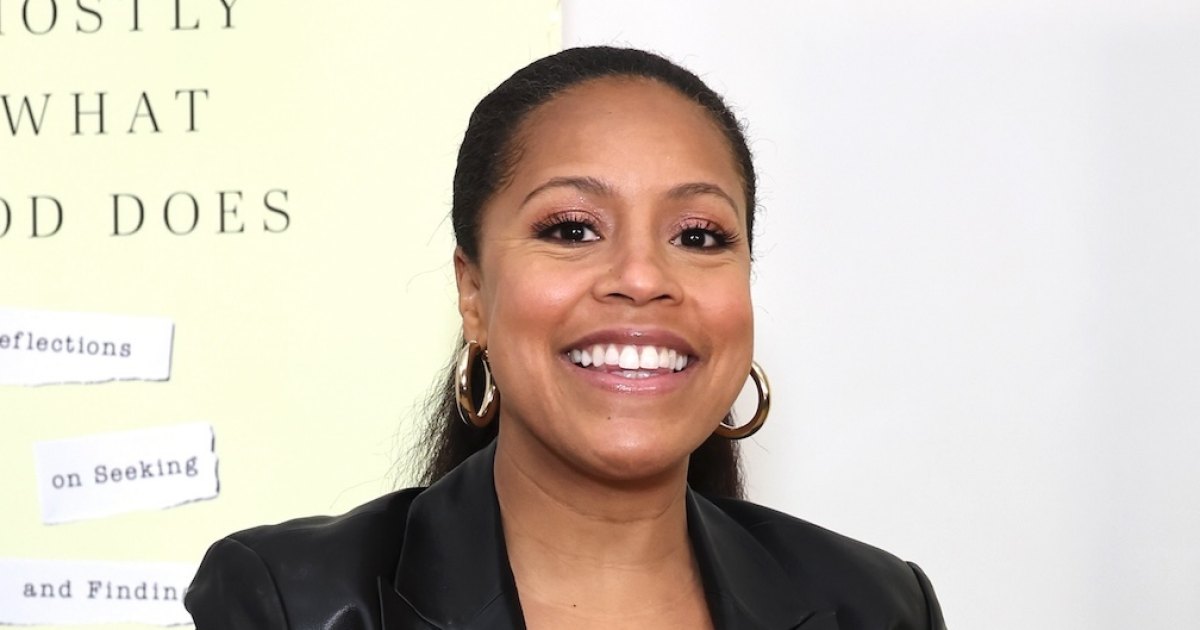

Sheinelle Jones Family Focus After Husbands Death Exclusive Update

Jun 04, 2025

Sheinelle Jones Family Focus After Husbands Death Exclusive Update

Jun 04, 2025 -

1 Billion Acquisition Private Equity Buys Popular Fried Chicken Brand

Jun 04, 2025

1 Billion Acquisition Private Equity Buys Popular Fried Chicken Brand

Jun 04, 2025 -

West Indies Women Tour Of England Live Cricket Streaming For 2nd Odi

Jun 04, 2025

West Indies Women Tour Of England Live Cricket Streaming For 2nd Odi

Jun 04, 2025 -

Both Teams Transformed Marquezs Preview Of India Thailand Exhibition Match

Jun 04, 2025

Both Teams Transformed Marquezs Preview Of India Thailand Exhibition Match

Jun 04, 2025