NIO Q1 Earnings: Analyzing Delivery Growth Amidst Rising Tariff Pressures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 Earnings: Navigating Delivery Growth Amidst Rising Tariff Pressures

NIO, a leading Chinese electric vehicle (EV) manufacturer, recently released its Q1 2024 earnings report, revealing a mixed bag of results. While the company showcased impressive delivery growth, the looming shadow of rising import tariffs casts a cloud over its future prospects. This article delves into the key takeaways from NIO's Q1 earnings, analyzing the delivery figures and the challenges posed by escalating trade tensions.

Strong Delivery Growth, But at What Cost?

NIO reported a significant increase in vehicle deliveries during the first quarter, exceeding analysts' expectations. This positive trend underscores the continued demand for NIO's premium EVs in the competitive Chinese market. The success can be attributed to several factors, including:

- Successful new model launches: The introduction of new models and innovative features has attracted a wider customer base.

- Expanding charging infrastructure: NIO's commitment to building a robust charging network continues to provide a competitive edge.

- Enhanced brand recognition: Consistent marketing efforts and positive customer reviews have boosted brand awareness.

However, the celebratory tone is tempered by the escalating threat of rising import tariffs. These tariffs, primarily impacting raw materials and components sourced internationally, directly impact NIO's production costs and profitability. The company acknowledged this pressure in its earnings call, hinting at potential price adjustments or sourcing strategies to mitigate the impact.

Analyzing the Financial Performance:

While delivery numbers were positive, NIO's overall financial performance presented a more nuanced picture. The increase in production costs, driven partly by rising tariffs, impacted profit margins. Further analysis is needed to understand the long-term implications of these cost pressures on the company's financial health. Investors will be closely monitoring NIO's strategies to manage these challenges, including:

- Negotiating with suppliers: Securing favorable pricing agreements with key suppliers is crucial.

- Exploring alternative sourcing: Diversifying its supply chain to reduce reliance on tariff-affected regions.

- Optimizing production efficiency: Improving internal processes to minimize waste and enhance productivity.

The Future Outlook: Challenges and Opportunities

The Q1 earnings report highlights both the opportunities and challenges facing NIO. The strong delivery growth demonstrates sustained market demand, but the rising tariff pressures present a significant hurdle. NIO's ability to navigate this complex landscape will be a key determinant of its future success. The company's strategic responses to these challenges – including innovative product development, cost management strategies, and expansion into new markets – will be closely watched by investors and industry analysts alike.

Looking Ahead:

NIO's future performance hinges on its ability to manage rising costs while maintaining its growth trajectory. The company's commitment to innovation and its expanding global presence offer reasons for optimism. However, the impact of ongoing trade tensions remains a key uncertainty. Further updates from NIO will be critical in understanding the long-term implications of these factors.

Keywords: NIO, Q1 earnings, electric vehicle, EV, delivery growth, import tariffs, China, stock market, financial performance, supply chain, production costs, profitability, competition, new models, charging infrastructure, brand recognition, investment, analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 Earnings: Analyzing Delivery Growth Amidst Rising Tariff Pressures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Governor Walz Urges Democrats To Adopt Tougher Stance Criticizes Trumps Approach

Jun 03, 2025

Governor Walz Urges Democrats To Adopt Tougher Stance Criticizes Trumps Approach

Jun 03, 2025 -

Hims And Hers Hims Stock Market Activity 3 02 Gain Reported May 30

Jun 03, 2025

Hims And Hers Hims Stock Market Activity 3 02 Gain Reported May 30

Jun 03, 2025 -

Hims And Hers Health Hims Stock A Comprehensive Investment Overview

Jun 03, 2025

Hims And Hers Health Hims Stock A Comprehensive Investment Overview

Jun 03, 2025 -

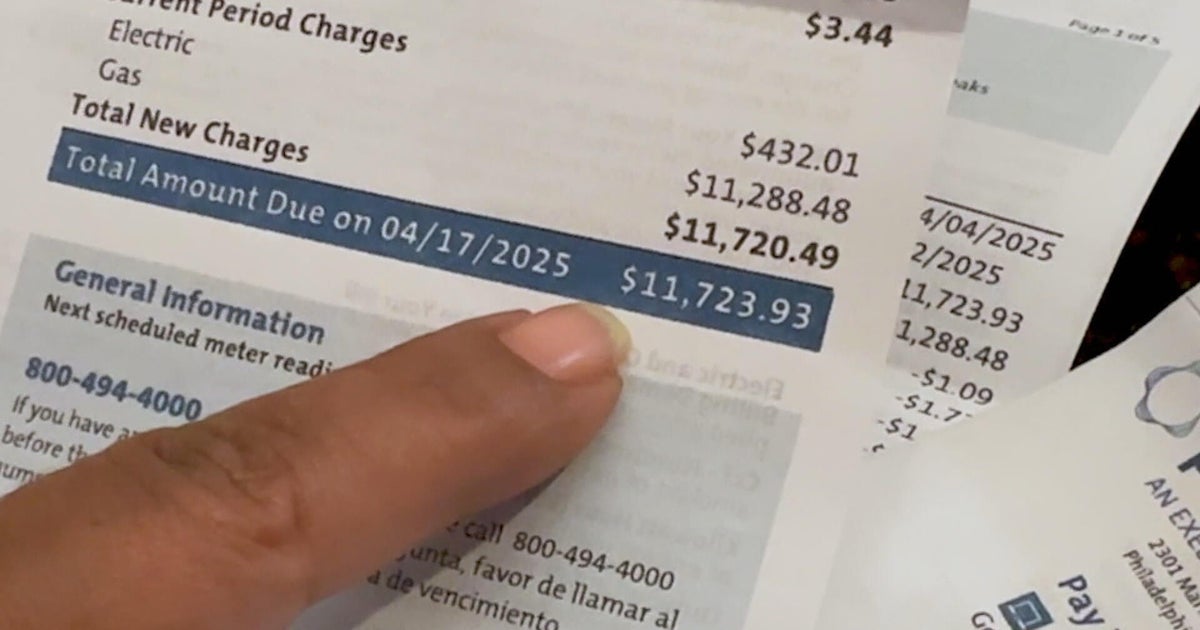

Investigation Launched Into Peco Billing After 12 000 Bill Controversy

Jun 03, 2025

Investigation Launched Into Peco Billing After 12 000 Bill Controversy

Jun 03, 2025 -

Wtf With Marc Maron Podcast An End Of An Era

Jun 03, 2025

Wtf With Marc Maron Podcast An End Of An Era

Jun 03, 2025