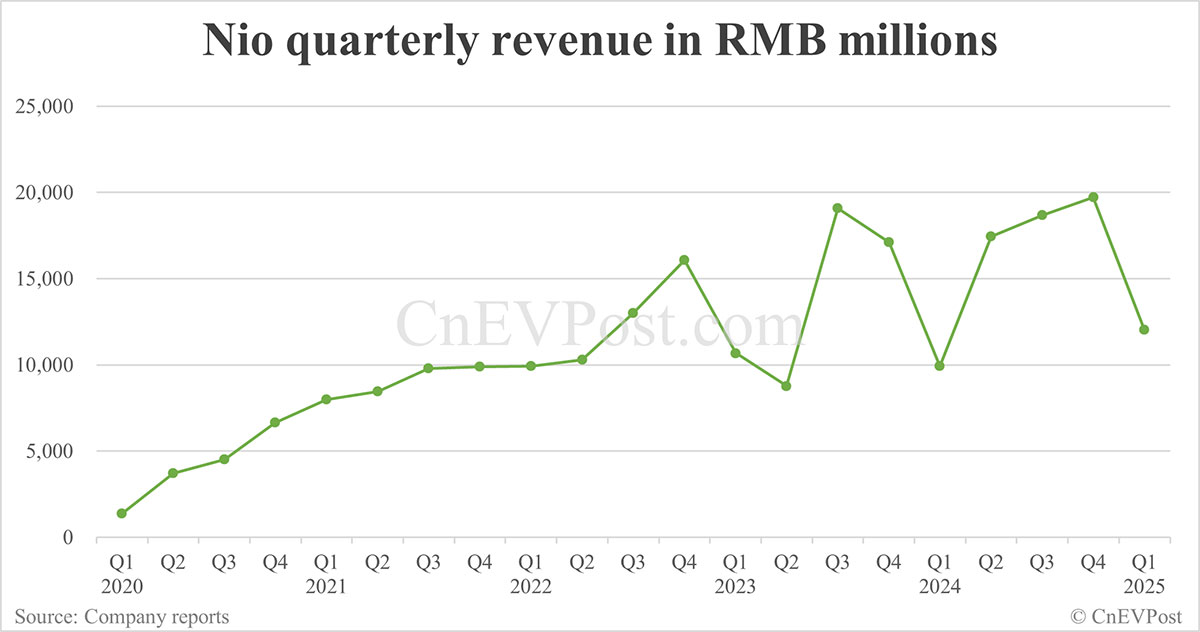

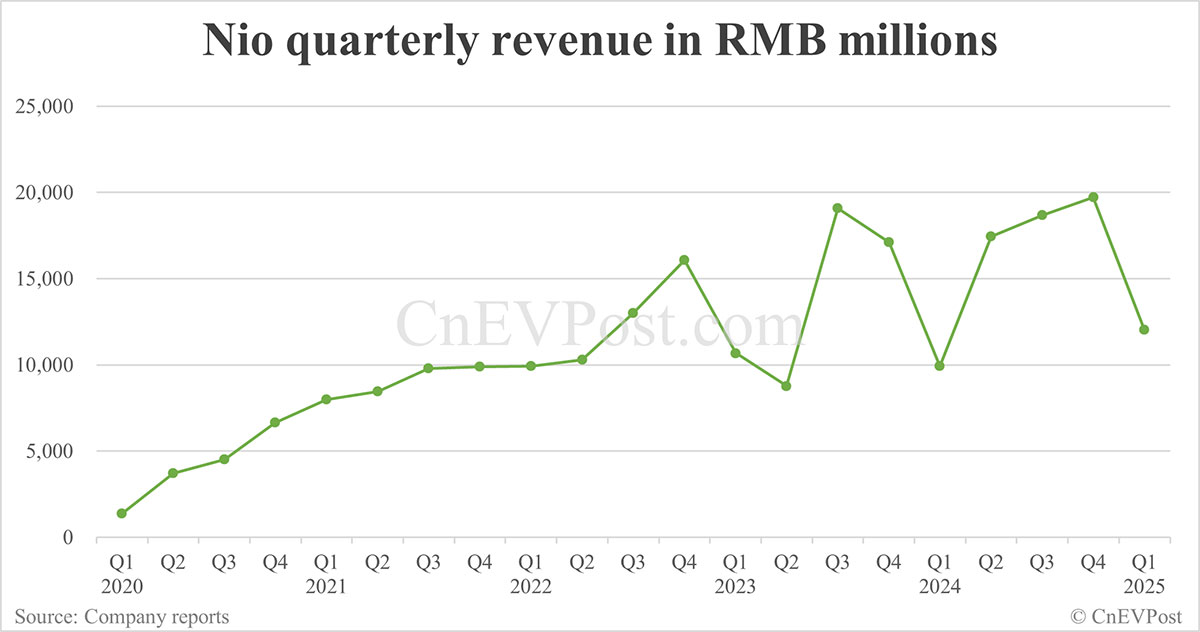

Nio Q1 2024 Revenue Up 21%: Strong Growth Despite Challenges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Q1 2024 Revenue Up 21%: Strong Growth Despite Headwinds

Chinese electric vehicle (EV) maker Nio reported a robust 21% year-over-year surge in revenue for the first quarter of 2024, defying challenging market conditions. The impressive figures signal continued resilience in the face of intensifying competition and ongoing economic uncertainty within the global automotive sector. However, analysts warn that sustaining this growth trajectory will require continued innovation and strategic adaptation.

The announcement, released [Insert Date of Release], exceeded some analysts' expectations, bolstering investor confidence in Nio's long-term prospects. The company delivered [Insert Number] vehicles in Q1 2024, representing a [Insert Percentage] increase compared to the same period last year. This strong delivery performance directly contributed to the significant revenue increase.

Key Factors Contributing to Nio's Q1 Success

Several factors contributed to Nio's impressive Q1 2024 performance:

- Strong Demand for New Models: The launch of the [Mention new models released, e.g., ET7, ES7] and continued popularity of existing models drove sales growth. Nio's focus on premium EVs and innovative features like battery swap technology continues to resonate with consumers.

- Effective Supply Chain Management: Despite ongoing global supply chain disruptions, Nio demonstrated effective management of its supply chain, ensuring sufficient component availability to meet growing demand. This proactive approach minimized production delays and maintained momentum.

- Expansion of Charging Infrastructure: Nio's continued investment in its battery swap network and charging infrastructure played a crucial role. This expanding infrastructure addresses a key concern for EV buyers – range anxiety – and enhances the overall customer experience. The company is aggressively expanding its network both domestically in China and internationally.

- Targeted Marketing Campaigns: Nio's targeted marketing campaigns effectively reached its key demographics, building brand awareness and driving sales. This focus on digital marketing and engaging customer experiences is a significant factor in their success.

Challenges and Future Outlook for Nio

Despite the positive Q1 results, Nio faces several challenges moving forward:

- Intense Competition: The Chinese EV market is incredibly competitive, with established players and numerous new entrants vying for market share. Nio must continue to innovate and differentiate its products to maintain its competitive edge.

- Global Economic Uncertainty: Global economic uncertainty and potential downturns could impact consumer spending on luxury goods, including premium EVs. Nio will need to navigate these uncertainties effectively.

- Maintaining Profitability: While revenue is up, Nio still needs to focus on improving profitability. Balancing growth with cost management will be crucial for long-term sustainability.

Nio's Q1 2024 results demonstrate the company's resilience and strategic acumen. However, navigating the challenges ahead will require continued innovation, strategic planning, and effective execution. The company's commitment to technological advancement, particularly in battery technology and autonomous driving, positions it well for future growth. Investors will be keenly watching Nio's performance in the coming quarters to see if this strong start can be sustained.

Keywords: Nio, NIO Stock, Electric Vehicles, EV, China, Revenue, Q1 2024, Earnings, Automotive Industry, Battery Swap, Electric Car, Chinese EV Market, Supply Chain, Competition

(Optional CTA): Learn more about Nio's latest innovations and financial reports by visiting their official website: [Insert Link to Nio Website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Q1 2024 Revenue Up 21%: Strong Growth Despite Challenges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

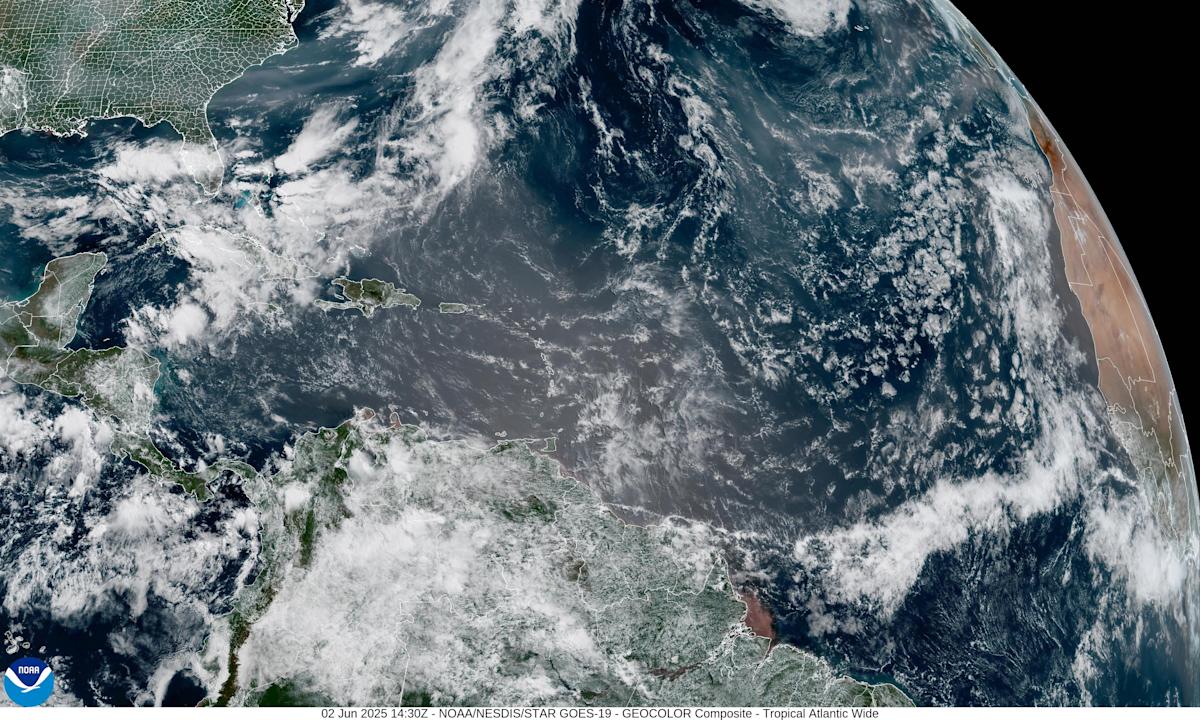

Floridas Air Quality Crisis The Impact Of Saharan Dust And Canadian Wildfires

Jun 04, 2025

Floridas Air Quality Crisis The Impact Of Saharan Dust And Canadian Wildfires

Jun 04, 2025 -

Chicago Fire Fc Stadium Project A Boost For South Loop Development

Jun 04, 2025

Chicago Fire Fc Stadium Project A Boost For South Loop Development

Jun 04, 2025 -

The Future Of Federal Unions Protecting Collective Bargaining In The Workplace

Jun 04, 2025

The Future Of Federal Unions Protecting Collective Bargaining In The Workplace

Jun 04, 2025 -

Self Made Billionaire Lucy Guo A Profile Of The Worlds Youngest

Jun 04, 2025

Self Made Billionaire Lucy Guo A Profile Of The Worlds Youngest

Jun 04, 2025 -

Trumps Big Beautiful Bill A Gop Defense Strategy Under Fire

Jun 04, 2025

Trumps Big Beautiful Bill A Gop Defense Strategy Under Fire

Jun 04, 2025