Nio Q1 2024 Revenue Up 21%: A Detailed Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Q1 2024 Revenue Up 21%: A Detailed Report Showing Strong Growth Despite Challenges

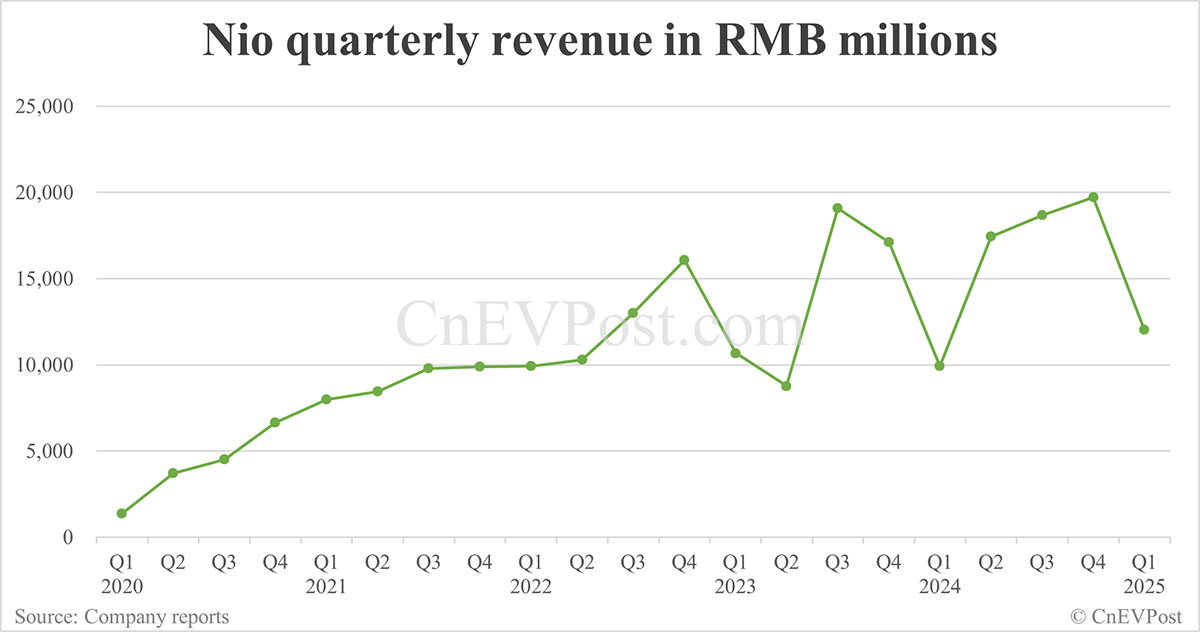

Nio, the Chinese electric vehicle (EV) manufacturer, has announced its first-quarter 2024 financial results, revealing a significant 21% year-over-year increase in revenue. This positive surge signals continued growth despite ongoing challenges within the broader EV market and the persistent economic headwinds impacting China. But what does this mean for investors, and what are the key takeaways from Nio's Q1 2024 performance? Let's delve into the details.

Nio Q1 2024 Key Highlights:

-

Revenue Surge: Nio reported a 21% year-over-year increase in revenue, reaching [Insert Actual Revenue Figure Here]. This significant jump surpasses analyst expectations and demonstrates the company's resilience in a competitive market.

-

Vehicle Deliveries: While the revenue increase is impressive, a detailed breakdown of vehicle deliveries is crucial. [Insert the number of vehicles delivered and compare it to Q1 2023 figures]. Analyzing the specific models' performance will offer a clearer picture of market demand and consumer preferences.

-

Gross Margin Improvement: The company’s gross margin is a key indicator of profitability. A healthy gross margin suggests efficient operations and pricing strategies. [Insert the actual gross margin percentage and provide context by comparing it to previous quarters and competitor data]. Any significant changes should be analyzed and explained.

-

Research & Development (R&D) Spending: Nio's continued investment in R&D is crucial for maintaining its competitive edge. [Insert the amount spent on R&D and discuss its implications for future product development and technological advancements]. High R&D spending reflects Nio's commitment to innovation, a vital aspect for success in the rapidly evolving EV landscape.

-

Challenges and Outlook: While the Q1 results are positive, the report should also address challenges faced by Nio. These could include supply chain disruptions, competition from established and emerging EV players, and the overall economic climate in China. The company's outlook for the remainder of 2024 will provide valuable insights into its future performance and strategic direction.

Nio's Strategic Initiatives Driving Growth:

Nio's success isn't just about producing EVs; it’s about the entire ecosystem. Several strategic initiatives contribute to the company's overall growth:

-

Battery-as-a-Service (BaaS): Nio's BaaS model, allowing customers to lease batteries separately, has been a key differentiator. Discuss its impact on sales and customer acquisition.

-

Charging Infrastructure: Expanding its charging network is vital for customer convenience and brand loyalty. [Provide details about the expansion plans and the current charging infrastructure coverage].

-

Technological Advancements: Nio's commitment to innovation, reflected in its ongoing R&D investment, is crucial for staying ahead of the competition. Highlight any significant technological advancements in their vehicles.

Analyzing the Competitive Landscape:

Nio operates in a fiercely competitive market dominated by established players like Tesla and BYD, as well as a growing number of new entrants. Analyzing Nio's performance relative to its competitors is crucial for understanding its market positioning and future prospects. [Compare Nio's Q1 performance with key competitors, focusing on revenue growth, vehicle deliveries, and market share].

Conclusion:

Nio's Q1 2024 results showcase a strong performance, demonstrating the company's ability to navigate challenges and maintain growth. While the future holds uncertainties, Nio's strategic initiatives and commitment to innovation position it well for continued success in the long term. Investors and industry analysts will be closely watching Nio's progress throughout the year to assess the sustainability of this positive trend. Further analysis of the full financial report is recommended for a comprehensive understanding of the company's performance.

Keywords: Nio, Nio Q1 2024, electric vehicle, EV, revenue, financial results, China, stock market, automotive industry, battery-as-a-service, BaaS, charging infrastructure, Tesla, BYD, competition, growth, challenges, outlook, investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Q1 2024 Revenue Up 21%: A Detailed Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hims And Hers Hims Share Price Increase 3 02 On May 30 2024

Jun 04, 2025

Hims And Hers Hims Share Price Increase 3 02 On May 30 2024

Jun 04, 2025 -

Strong Q1 For Nio 21 Year On Year Revenue Increase Announced

Jun 04, 2025

Strong Q1 For Nio 21 Year On Year Revenue Increase Announced

Jun 04, 2025 -

The Fallout Examining The Damage From Trumps Criticism Of Walker

Jun 04, 2025

The Fallout Examining The Damage From Trumps Criticism Of Walker

Jun 04, 2025 -

How Taylor Jenkins Reid Built A Literary Empire A Publishing Powerhouse

Jun 04, 2025

How Taylor Jenkins Reid Built A Literary Empire A Publishing Powerhouse

Jun 04, 2025 -

The Suhail Bhat Story A Kashmir Footballers Triumph

Jun 04, 2025

The Suhail Bhat Story A Kashmir Footballers Triumph

Jun 04, 2025