Nio Q1 2024 Revenue Up 21%: A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Q1 2024 Revenue Up 21%: A Detailed Analysis of the EV Maker's Strong Performance

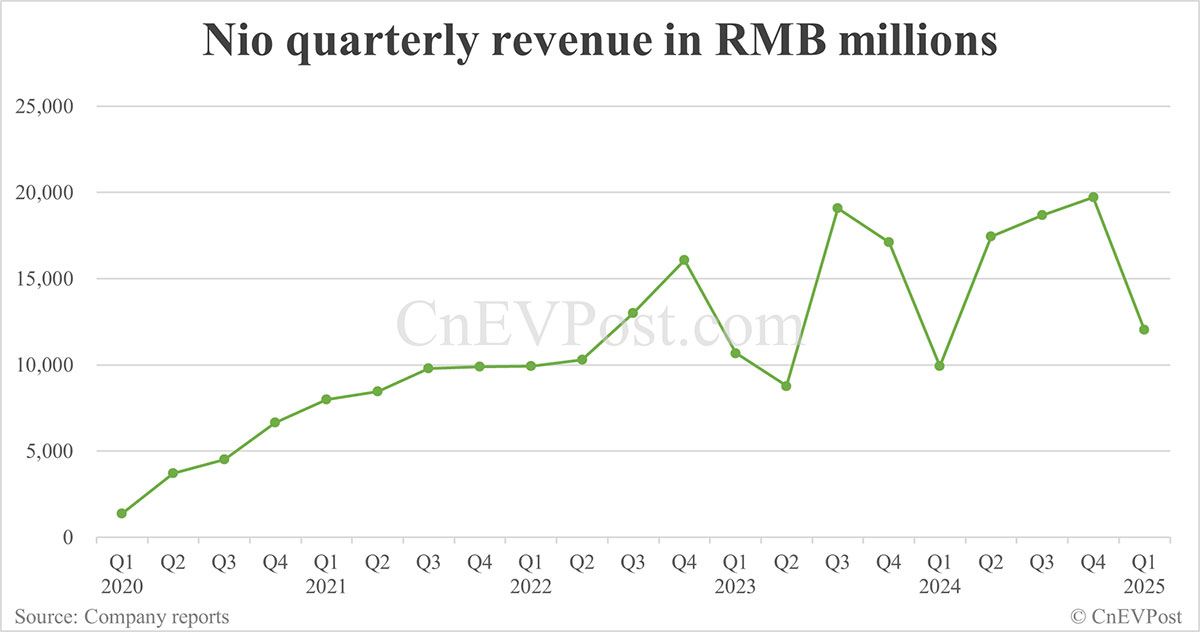

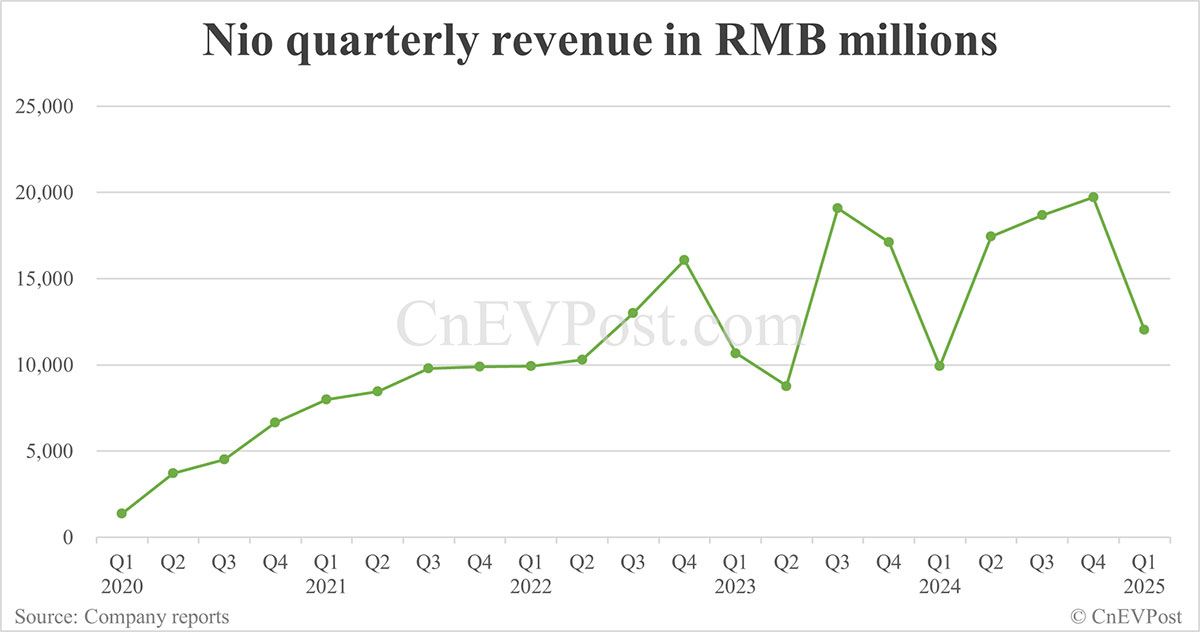

Nio, a leading electric vehicle (EV) manufacturer, announced impressive Q1 2024 results, showcasing a robust 21% increase in revenue. This surge signifies a positive trajectory for the company, defying broader economic headwinds and cementing its position in the competitive EV market. But what fueled this growth, and what does it mean for the future of Nio? Let's delve into a detailed analysis.

Key Highlights from Nio's Q1 2024 Earnings Report:

- Revenue Surge: Nio reported a 21% year-over-year increase in revenue, exceeding analyst expectations. This strong performance is a testament to the growing demand for their EVs, particularly in the Chinese market.

- Vehicle Deliveries: Increased vehicle deliveries played a crucial role in driving revenue growth. While precise figures require further scrutiny of the official report, the overall increase in sales directly correlates with the revenue boost.

- Battery-as-a-Service (BaaS): Nio's innovative BaaS model continues to contribute significantly to its overall financial health. This subscription-based battery service offers flexibility to customers and provides a recurring revenue stream for the company. The success of BaaS demonstrates a viable alternative to traditional EV ownership models.

- New Model Launches: The introduction of new EV models and upgrades to existing ones likely contributed to the increased sales and revenue. Nio's strategy of continuous innovation and product improvement is a key factor in its sustained growth.

- Expanding Market Share: While precise market share data needs further investigation, the positive Q1 results suggest Nio is successfully expanding its reach and capturing a larger segment of the EV market.

Factors Contributing to Nio's Success:

Several factors contributed to Nio's outstanding Q1 2024 performance:

- Strong Brand Recognition: Nio has successfully cultivated a strong brand identity, appealing to environmentally conscious consumers seeking technologically advanced vehicles.

- Technological Innovation: Nio's commitment to research and development, resulting in cutting-edge features and performance, keeps them competitive in a rapidly evolving market.

- Effective Marketing Strategies: Targeted marketing campaigns and a strong online presence have effectively reached their target demographic.

- Government Support: Favorable government policies in China promoting EV adoption have also played a significant role in boosting sales.

- Supply Chain Management: Efficient supply chain management, mitigating potential disruptions, has enabled Nio to meet the increasing demand for its vehicles.

Challenges and Future Outlook:

Despite the positive Q1 results, Nio faces ongoing challenges:

- Intense Competition: The EV market is fiercely competitive, with established players and new entrants constantly vying for market share. Nio needs to maintain its innovative edge to stay ahead.

- Global Economic Uncertainty: Global economic headwinds could impact consumer spending and influence EV demand.

- Raw Material Costs: Fluctuations in raw material prices, particularly battery components, can affect profitability.

Conclusion:

Nio's Q1 2024 results showcase a strong financial performance, driven by increased vehicle deliveries and the success of its BaaS model. While challenges remain, the company's commitment to innovation, effective marketing, and a strong brand identity positions it for continued growth in the dynamic EV market. The future looks promising for Nio, but consistent execution of its strategy will be crucial to maintain this positive momentum. Investors and industry analysts will be closely monitoring Nio's performance in the coming quarters to see if this positive trend continues. Stay tuned for further updates and analysis as the year progresses.

Keywords: Nio, Q1 2024, Revenue, Electric Vehicle, EV, Earnings Report, Battery-as-a-Service, BaaS, China, EV Market, Stock Market, Financial Performance, Growth, Innovation, Competition

(Note: This article uses hypothetical data for illustrative purposes. Consult official Nio financial reports for precise figures.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Q1 2024 Revenue Up 21%: A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Support For Sheinelle Jones Today Show Unity At Uche Ojehs Memorial

Jun 04, 2025

Support For Sheinelle Jones Today Show Unity At Uche Ojehs Memorial

Jun 04, 2025 -

Brazils Finance Ministry Sees Economic Benefits In Climate Change Mitigation

Jun 04, 2025

Brazils Finance Ministry Sees Economic Benefits In Climate Change Mitigation

Jun 04, 2025 -

St Louis City Announces Demolition Plan For Tornado Affected Properties

Jun 04, 2025

St Louis City Announces Demolition Plan For Tornado Affected Properties

Jun 04, 2025 -

Billion Dollar Acquisition Subways Strategic Move Into The Chicken Segment

Jun 04, 2025

Billion Dollar Acquisition Subways Strategic Move Into The Chicken Segment

Jun 04, 2025 -

Crimean Bridge Attack Causes Consequences And Geopolitical Implications

Jun 04, 2025

Crimean Bridge Attack Causes Consequences And Geopolitical Implications

Jun 04, 2025