NIO Q1 2024 Earnings Preview: Examining Delivery Numbers And Tariff Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 2024 Earnings Preview: Examining Delivery Numbers and Tariff Impact

NIO's Q1 2024 earnings announcement is fast approaching, and investors are eagerly awaiting crucial data on vehicle deliveries and the impact of recent tariff adjustments. The Chinese electric vehicle (EV) maker has experienced a rollercoaster ride recently, navigating a complex market landscape marked by intense competition and global economic uncertainty. This preview delves into the key factors investors should watch closely as NIO unveils its financial performance for the first quarter of 2024.

Delivery Numbers: A Key Performance Indicator (KPI)

NIO's quarterly vehicle delivery figures are arguably the most significant metric investors will scrutinize. Strong delivery numbers demonstrate robust demand and market acceptance of NIO's vehicles, particularly its flagship models like the ET7 and ET5. Any significant deviation from analysts' expectations could trigger considerable market volatility. A substantial increase in deliveries would signal positive momentum, while a decline could raise concerns about the company's market share and overall competitiveness. We'll be closely examining the breakdown of deliveries across different models to gain a clearer picture of consumer preferences and product performance. [Link to NIO investor relations page]

The Impact of Tariffs: Navigating Global Trade Dynamics

Recent adjustments to tariffs, both domestically in China and internationally, will undoubtedly have influenced NIO's operational costs and profitability. The impact of these changes on the company's pricing strategies and overall margins is a critical element of the upcoming earnings report. Investors will be keen to understand how NIO has mitigated these tariff-related challenges and whether any price adjustments have been necessary to maintain competitiveness. Understanding NIO's strategy for navigating these global trade dynamics will be crucial in assessing its long-term prospects.

Beyond Deliveries and Tariffs: Other Crucial Factors

While delivery numbers and tariff impacts are central to the Q1 2024 earnings preview, several other factors warrant attention:

- Gross margin: A key indicator of profitability, gross margin will reveal NIO's efficiency in managing production costs and pricing strategies.

- Research and development (R&D) expenses: NIO's investments in innovation and future technologies will be reflected in its R&D spending. Sustained investment suggests a commitment to long-term growth.

- Guidance for Q2 2024: Forward-looking guidance will offer insights into NIO's expectations for the remainder of the year, providing crucial information for investors' future decision-making.

- Battery swap program performance: NIO's unique battery swap technology is a key differentiator. Its performance and adoption rates will be closely monitored.

NIO's Competitive Landscape: A Battle for Market Share

NIO operates in a fiercely competitive EV market, facing pressure from both established domestic players and international automakers. The Q1 2024 results will offer valuable insight into NIO's ability to maintain its market share and continue its growth trajectory against this backdrop. Analyzing the company's strategic response to competitors' actions and market trends will be a critical aspect of assessing the overall outlook.

Conclusion: What to Expect

The NIO Q1 2024 earnings report is poised to provide a comprehensive overview of the company's performance amidst a dynamic and challenging market. By closely examining delivery numbers, the impact of tariffs, and other key financial metrics, investors can gain a clearer understanding of NIO's current position and its future growth potential. Stay tuned for our in-depth analysis following the official release of the earnings report. [Link to a follow-up article or analysis page - placeholder]

Keywords: NIO, NIO Q1 2024, NIO earnings, electric vehicle, EV, Chinese EV, vehicle deliveries, tariffs, battery swap, stock market, investment, NIO stock, Q1 2024 earnings preview, NIO financial results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 2024 Earnings Preview: Examining Delivery Numbers And Tariff Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rising Dte Energy Costs A Financial Crisis Looms For Michigan Families

Jun 03, 2025

Rising Dte Energy Costs A Financial Crisis Looms For Michigan Families

Jun 03, 2025 -

Sheinelle Jones Receives Outpouring Of Support Following Husbands Passing

Jun 03, 2025

Sheinelle Jones Receives Outpouring Of Support Following Husbands Passing

Jun 03, 2025 -

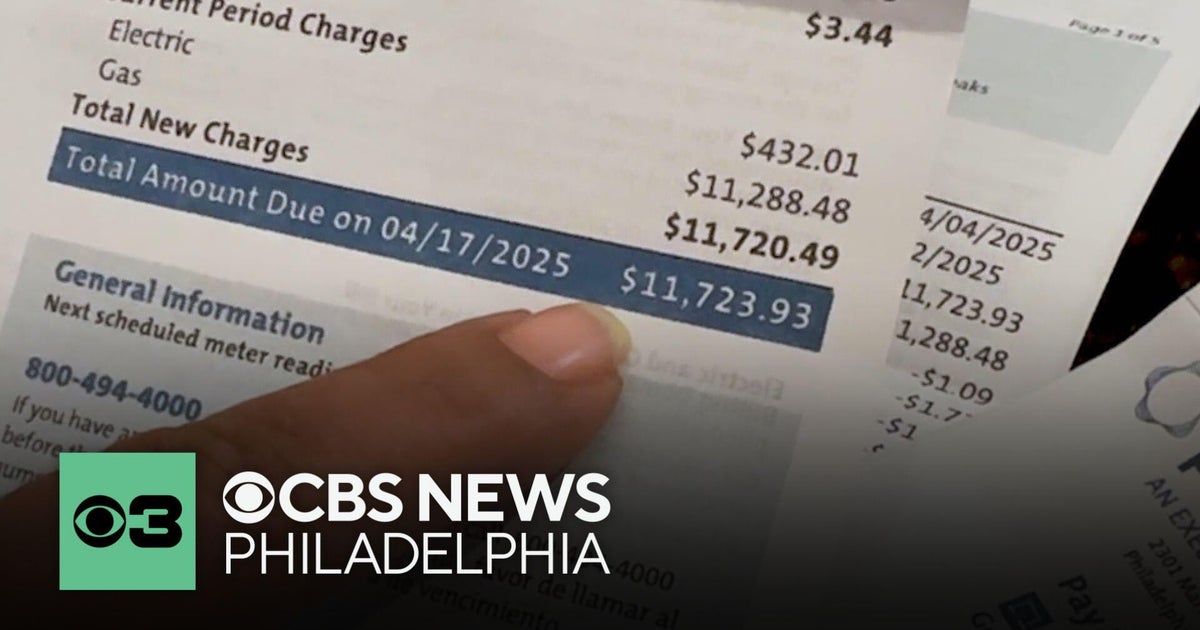

Massive Peco Bill Customer Receives 12 000 Charge After Months Of Missed Statements

Jun 03, 2025

Massive Peco Bill Customer Receives 12 000 Charge After Months Of Missed Statements

Jun 03, 2025 -

Successions Mountainhead Exploring The True Tech Titans Who Inspired It

Jun 03, 2025

Successions Mountainhead Exploring The True Tech Titans Who Inspired It

Jun 03, 2025 -

Economic Events In Asia Monday June 2nd 2025 Overview

Jun 03, 2025

Economic Events In Asia Monday June 2nd 2025 Overview

Jun 03, 2025