NIO Q1 2024 Earnings: Delivery Growth And Tariff Impacts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 2024 Earnings: Delivery Growth Outweighs Tariff Headwinds

NIO, a leading Chinese electric vehicle (EV) manufacturer, reported its first-quarter 2024 earnings, revealing a mixed bag of results. While vehicle deliveries surged, exceeding expectations, the impact of increased import tariffs presented a significant challenge, impacting overall profitability. This report delves into the key takeaways from NIO's Q1 2024 earnings call, analyzing the factors driving both the positive delivery growth and the negative tariff implications.

Record Vehicle Deliveries Despite Global Challenges:

NIO announced a significant increase in vehicle deliveries for Q1 2024, exceeding analysts' forecasts. This impressive growth can be attributed to several factors:

- Strong Demand for NIO's Models: The company's range of EVs, known for their advanced technology and stylish design, continue to resonate with consumers in the competitive Chinese EV market and beyond. The recent launch of the [mention specific new model if applicable and link to relevant news article] further fueled this demand.

- Expanded Charging Infrastructure: NIO's extensive and rapidly expanding battery swap network remains a significant competitive advantage, addressing range anxiety – a major concern for potential EV buyers. The company’s continued investment in this infrastructure is clearly paying dividends.

- Effective Marketing and Sales Strategies: NIO's targeted marketing campaigns and strategic partnerships have played a crucial role in driving sales growth. Their focus on building a strong brand image and customer loyalty is evident in their sustained performance.

Tariff Impacts Dampen Profitability:

Despite the impressive delivery numbers, NIO's Q1 2024 earnings also highlighted the negative impact of increased import tariffs, particularly in key export markets. This led to reduced profit margins and impacted the overall financial performance.

- Increased Production Costs: The tariffs directly increased the cost of importing components and exporting finished vehicles, squeezing NIO's profit margins. This is a significant concern for the company's long-term profitability and global expansion plans.

- Pricing Strategies: NIO has had to carefully navigate pricing strategies to mitigate the impact of tariffs, balancing affordability with maintaining profitability. This delicate balancing act will likely continue to be a focus for the company in the coming quarters.

- Potential for Future Tariff Adjustments: The ongoing global trade environment remains uncertain, and any further adjustments to import tariffs could significantly impact NIO's future performance. The company is likely monitoring these developments closely.

Looking Ahead: Navigating the Challenges:

NIO faces a complex landscape, balancing strong consumer demand with the headwinds of increased tariffs. The company's success in the coming quarters will depend on several factors:

- Managing Tariff Impacts: Developing effective strategies to mitigate the effects of import tariffs is crucial for NIO’s sustained growth and profitability. This might involve exploring alternative sourcing strategies or lobbying for tariff reductions.

- Maintaining Innovation: Continuing to innovate and develop new, competitive EV models is key to maintaining its market share in the increasingly competitive EV industry.

- Expanding Global Reach: Careful planning and strategic execution are vital for expanding into new international markets while managing the complexities of global trade and varying regulatory environments.

Conclusion:

NIO's Q1 2024 earnings showcased a compelling narrative of robust delivery growth juxtaposed with the challenges posed by increased import tariffs. While the delivery numbers are certainly positive, the impact of tariffs on profitability cannot be overlooked. The company’s ability to navigate these challenges will be crucial in determining its future success in the dynamic global EV market. Investors will be closely watching NIO's strategies to address these issues in the coming quarters. For more detailed financial information, visit the official NIO investor relations website. [Insert Link to NIO Investor Relations]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 2024 Earnings: Delivery Growth And Tariff Impacts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Selling Used Bathwater A Legitimate Business The Sydney Sweeney Case

Jun 03, 2025

Is Selling Used Bathwater A Legitimate Business The Sydney Sweeney Case

Jun 03, 2025 -

Sydney Sweeneys Used Bathwater A Deep Dive Into The Controversy

Jun 03, 2025

Sydney Sweeneys Used Bathwater A Deep Dive Into The Controversy

Jun 03, 2025 -

Iconic Wtf Podcast Hosted By Marc Maron To Conclude Its 16 Year Journey

Jun 03, 2025

Iconic Wtf Podcast Hosted By Marc Maron To Conclude Its 16 Year Journey

Jun 03, 2025 -

June 2nd 2025 Public Holiday Impacts Chinese And New Zealand Stock Exchanges

Jun 03, 2025

June 2nd 2025 Public Holiday Impacts Chinese And New Zealand Stock Exchanges

Jun 03, 2025 -

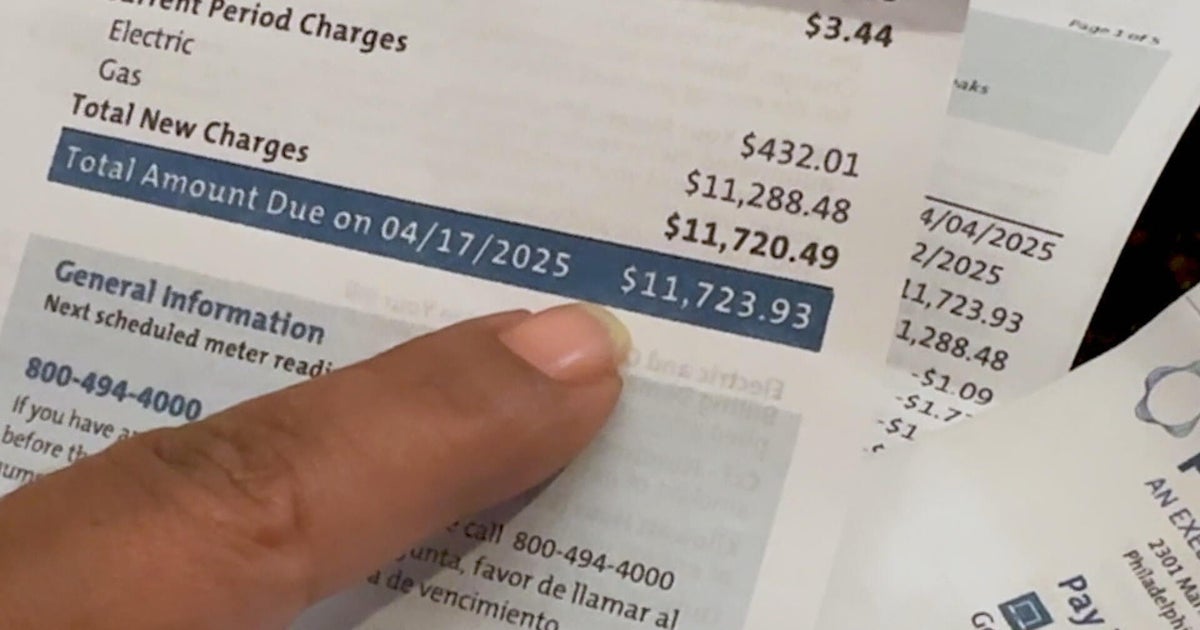

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025

Peco Customers Face 12 000 Bills Months Of Missing Statements Spark Outrage

Jun 03, 2025