NIO Q1 2024 Earnings: Delivery Growth And Tariff Challenges

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

NIO Q1 2024 Earnings: Delivery Growth Tempers Tariff Headwinds

NIO, a leading Chinese electric vehicle (EV) manufacturer, reported its Q1 2024 earnings this week, revealing a mixed bag of results. While the company showcased impressive delivery growth, highlighting the continued demand for its premium EVs, challenges stemming from increased import tariffs cast a shadow on overall profitability. Let's delve into the details.

Headline-Grabbing Delivery Figures:

NIO announced a significant year-over-year increase in vehicle deliveries for Q1 2024, exceeding analysts' expectations. This surge underscores the persistent consumer appetite for NIO's range of electric SUVs and sedans, particularly its flagship models like the ET7 and ES7. The strong delivery numbers suggest a robust market position and growing brand recognition, even amidst a competitive EV landscape. This success is largely attributed to NIO's innovative battery-as-a-service (BaaS) program, which lowers the upfront cost of vehicle ownership and appeals to a broader range of consumers. Further details regarding specific delivery numbers and regional breakdowns can be found in NIO's official press release. [Link to NIO Press Release]

Tariff Troubles Cast a Long Shadow:

Despite the positive delivery figures, NIO's Q1 earnings were impacted by recently implemented import tariffs. These increased costs have directly affected the company's margins, squeezing profitability and necessitating a price adjustment strategy in some key markets. The company acknowledged the challenges posed by these tariffs and outlined its proactive approach to mitigate their impact. This includes exploring various avenues to optimize its supply chain and potentially negotiate more favorable trade agreements. The long-term impact of these tariffs remains uncertain, presenting a significant challenge for NIO's continued growth trajectory.

NIO's Strategic Response & Future Outlook:

NIO's response to the tariff challenges demonstrates a proactive and adaptable approach. The company is actively investing in research and development, aiming to further enhance its technological edge and introduce even more competitive EV models. This focus on innovation is crucial for maintaining its position in the fiercely competitive global EV market. Furthermore, NIO's continued expansion into new international markets, while facing tariff hurdles, signals its unwavering commitment to global growth.

Key Takeaways:

- Strong Delivery Growth: NIO exceeded delivery expectations, showcasing robust demand for its EVs.

- Tariff Challenges: Increased import tariffs significantly impacted profitability.

- Strategic Response: NIO is proactively addressing tariff challenges through supply chain optimization and R&D investment.

- Future Outlook: The long-term impact of tariffs remains a key uncertainty, but NIO's commitment to innovation and expansion remains strong.

What This Means for Investors:

NIO's Q1 2024 earnings represent a complex picture. While delivery numbers are encouraging, investors need to carefully consider the impact of tariffs on long-term profitability. The company's strategic response demonstrates resilience, but the effectiveness of these mitigation strategies will be crucial in determining future financial performance. Investors should closely monitor NIO's upcoming announcements and financial reports for further updates. [Link to NIO Investor Relations]

Looking Ahead:

The EV market continues to evolve rapidly, presenting both opportunities and challenges for manufacturers like NIO. The company's ability to navigate geopolitical factors, such as fluctuating tariffs, will be key to its future success. Its commitment to innovation and expansion, however, positions it favorably for continued growth in the long term. We will continue to monitor NIO's progress and provide further updates as they become available.

This article aims to provide a comprehensive overview of NIO's Q1 2024 earnings. Remember to conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on NIO Q1 2024 Earnings: Delivery Growth And Tariff Challenges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The Damage Trumps Public Rebuke Of Scott Walker

Jun 03, 2025

Analyzing The Damage Trumps Public Rebuke Of Scott Walker

Jun 03, 2025 -

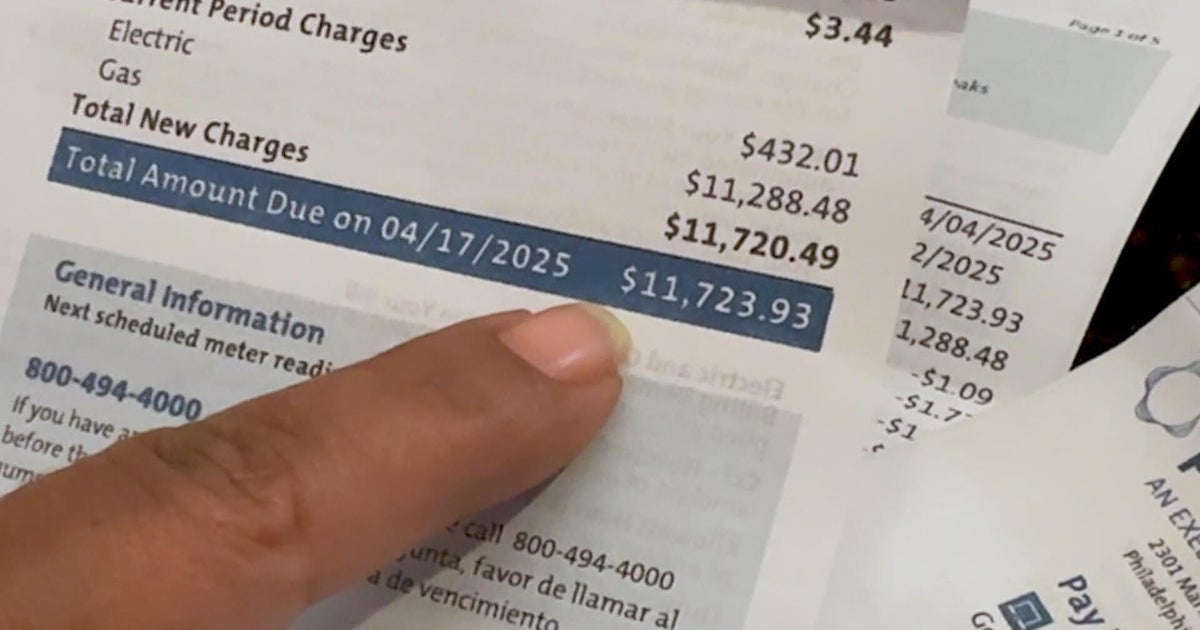

Pecos Billing System Under Fire After Customer Hit With 12 000 Bill

Jun 03, 2025

Pecos Billing System Under Fire After Customer Hit With 12 000 Bill

Jun 03, 2025 -

Harry Brook Joe Roots Form Improving With Age

Jun 03, 2025

Harry Brook Joe Roots Form Improving With Age

Jun 03, 2025 -

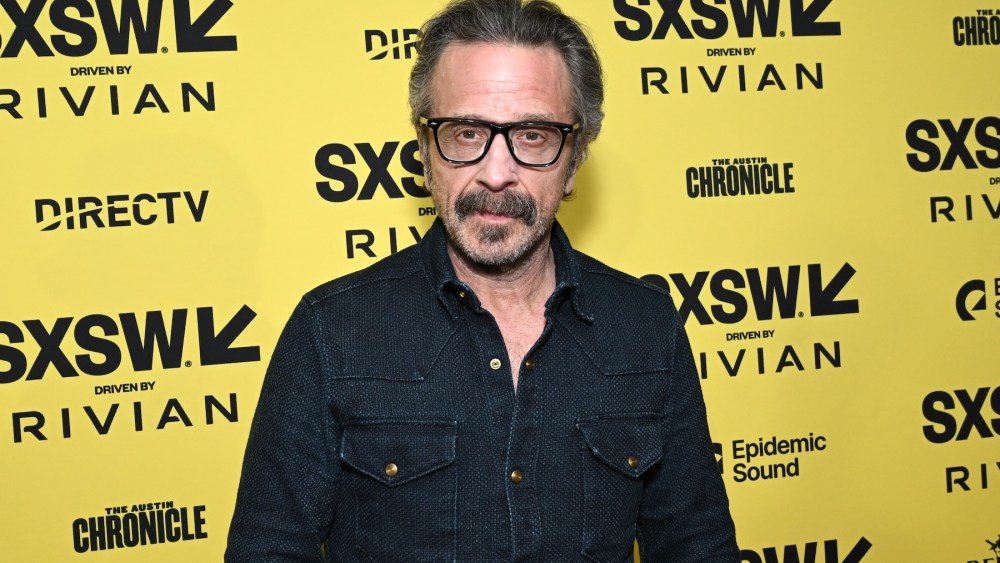

Longtime Podcast Wtf With Marc Maron To Cease Production

Jun 03, 2025

Longtime Podcast Wtf With Marc Maron To Cease Production

Jun 03, 2025 -

Twenty Years One Hundred Pounds Lighter Al Rokers Lasting Weight Loss

Jun 03, 2025

Twenty Years One Hundred Pounds Lighter Al Rokers Lasting Weight Loss

Jun 03, 2025