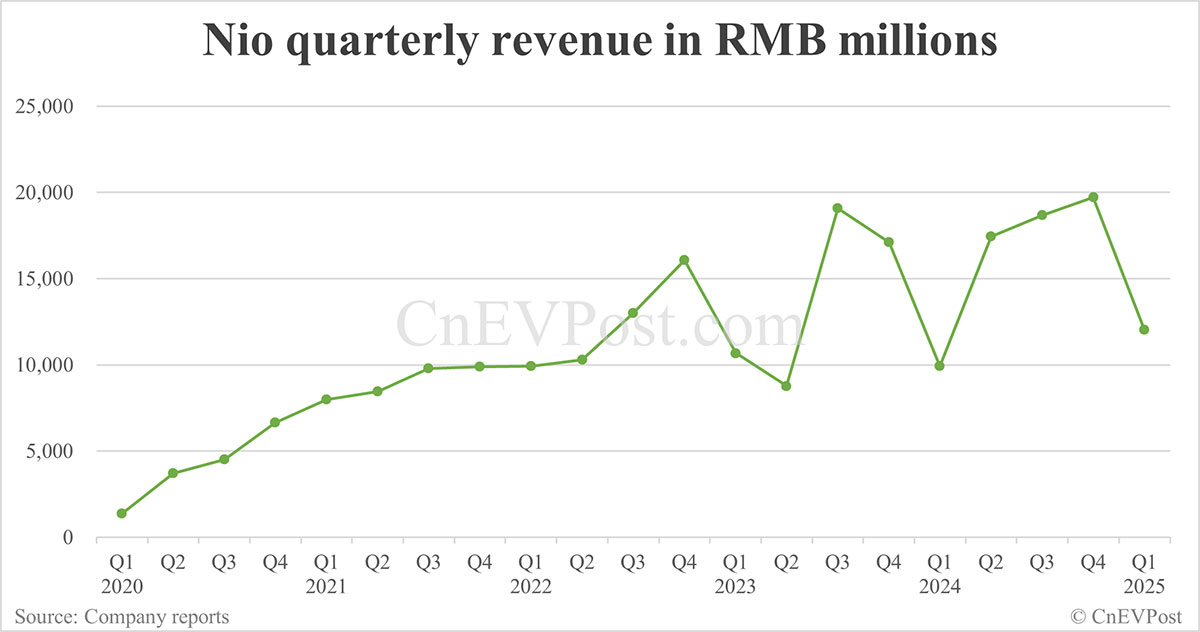

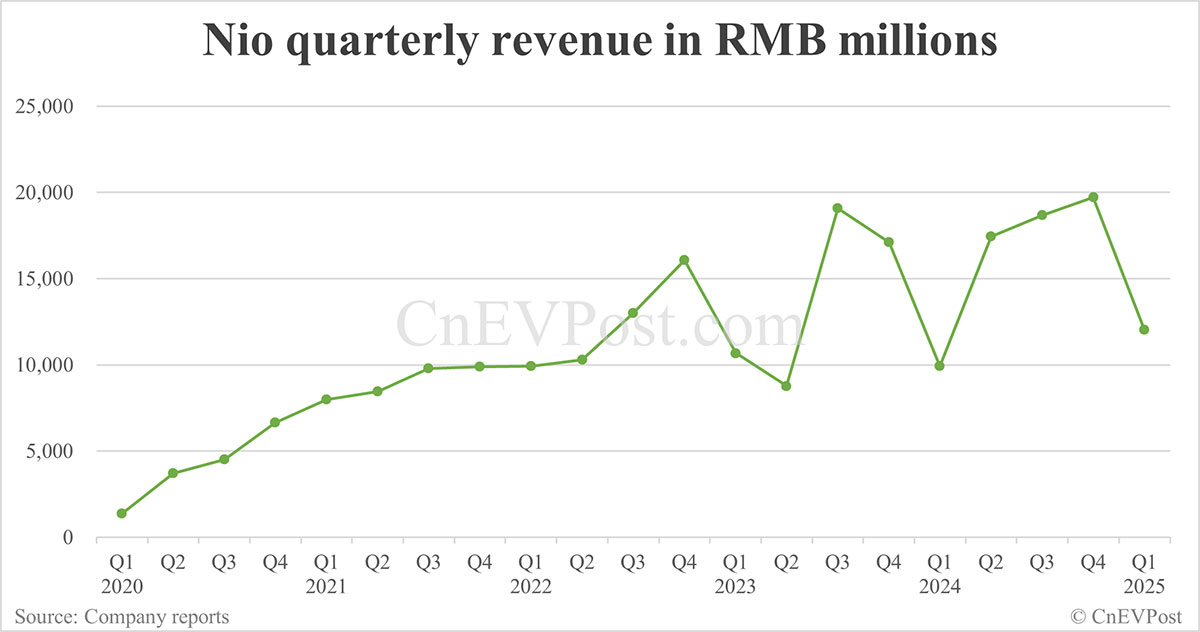

Nio Q1 2024 Earnings: 21% Revenue Growth Year-on-Year

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Q1 2024 Earnings: 21% Revenue Growth Year-on-Year Signals Strong Market Position

Nio, the leading Chinese electric vehicle (EV) manufacturer, announced its first-quarter 2024 earnings, revealing a robust 21% year-on-year revenue growth. This impressive performance underscores Nio's resilience in a competitive EV market and its strategic success in navigating economic headwinds. The results exceeded analyst expectations and sent positive ripples through the investment community. This news article delves deeper into the key highlights and implications of Nio's Q1 2024 financial report.

Key Highlights of Nio's Q1 2024 Earnings:

- Revenue Growth: The headline figure—a 21% year-on-year increase in revenue—demonstrates strong demand for Nio's vehicles, despite challenges in the broader global economy. This growth showcases the effectiveness of Nio's product strategy and marketing efforts.

- Vehicle Deliveries: While specific delivery numbers weren't immediately available in the initial press release, the revenue growth strongly suggests a significant increase in vehicle sales compared to the same period last year. Further details are expected in the full earnings report.

- Gross Profit Margin: Investors will be keenly interested in the gross profit margin figures, which will provide insights into Nio's pricing strategies and manufacturing efficiency. A healthy margin indicates sustainable profitability and long-term growth potential.

- Future Outlook: Nio's guidance for the upcoming quarters will be crucial in assessing its future performance. Any insights into planned product launches, expansion plans, or anticipated market conditions will significantly impact investor sentiment.

Factors Contributing to Nio's Success:

Nio's success can be attributed to several factors:

- Innovative Product Lineup: Nio consistently introduces technologically advanced EVs with compelling features and competitive pricing, attracting a wide range of customers. Their Battery-as-a-Service (BaaS) model also continues to be a differentiator in the market.

- Expanding Infrastructure: The company's investment in charging infrastructure and battery swapping stations is crucial for enhancing customer experience and expanding market reach. This network advantage is a key competitive moat.

- Effective Marketing and Brand Building: Nio has effectively cultivated a strong brand image, associating itself with innovation, luxury, and sustainability. This strong brand recognition helps drive sales and customer loyalty.

- Government Support: The Chinese government's continued support for the domestic EV industry, including subsidies and favorable policies, has played a vital role in Nio's growth.

Challenges and Future Considerations:

Despite the positive Q1 results, Nio faces ongoing challenges:

- Intense Competition: The Chinese EV market is extremely competitive, with established players and numerous new entrants vying for market share. Maintaining its competitive edge requires continuous innovation and adaptation.

- Global Economic Uncertainty: Global economic slowdowns and potential supply chain disruptions could impact Nio's future performance. Effective risk management is crucial.

- Supply Chain Management: Securing a reliable and efficient supply chain will continue to be paramount to meeting growing demand and ensuring timely vehicle deliveries.

Conclusion:

Nio's Q1 2024 earnings report signals a positive trajectory for the company. The strong revenue growth demonstrates its resilience and market leadership in the competitive Chinese EV market. While challenges remain, Nio's focus on innovation, infrastructure development, and brand building positions it favorably for continued success in the long term. Further analysis of the full earnings report will provide a more comprehensive picture of Nio's financial health and future prospects. Stay tuned for updates as more information becomes available. Investors should consult with their financial advisors before making any investment decisions.

Keywords: Nio, Nio Q1 2024 Earnings, Electric Vehicle, EV, China, Revenue Growth, Stock Market, Investment, Automotive Industry, Battery-as-a-Service, BaaS, EV Market, Chinese EV Market, Nio Stock, EV Sales.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Q1 2024 Earnings: 21% Revenue Growth Year-on-Year. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adp Report Weak Private Sector Job Growth Raises Recession Concerns

Jun 04, 2025

Adp Report Weak Private Sector Job Growth Raises Recession Concerns

Jun 04, 2025 -

West Indies Women Tour England 2nd Odi Live Stream And Scorecard

Jun 04, 2025

West Indies Women Tour England 2nd Odi Live Stream And Scorecard

Jun 04, 2025 -

The Real Tech Titans Who Inspired Jesse Armstrongs Mountainhead In Succession

Jun 04, 2025

The Real Tech Titans Who Inspired Jesse Armstrongs Mountainhead In Succession

Jun 04, 2025 -

England Womens Cricket Triumph Centuries Fuel 108 Run Win Against West Indies

Jun 04, 2025

England Womens Cricket Triumph Centuries Fuel 108 Run Win Against West Indies

Jun 04, 2025 -

Slowdown In Job Creation Adps May Employment Report Shows 37 000 Private Sector Hires

Jun 04, 2025

Slowdown In Job Creation Adps May Employment Report Shows 37 000 Private Sector Hires

Jun 04, 2025