Nio Q1 2024: 21% Revenue Growth Year-on-Year

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nio Q1 2024: 21% Revenue Growth Year-on-Year Fuels EV Optimism

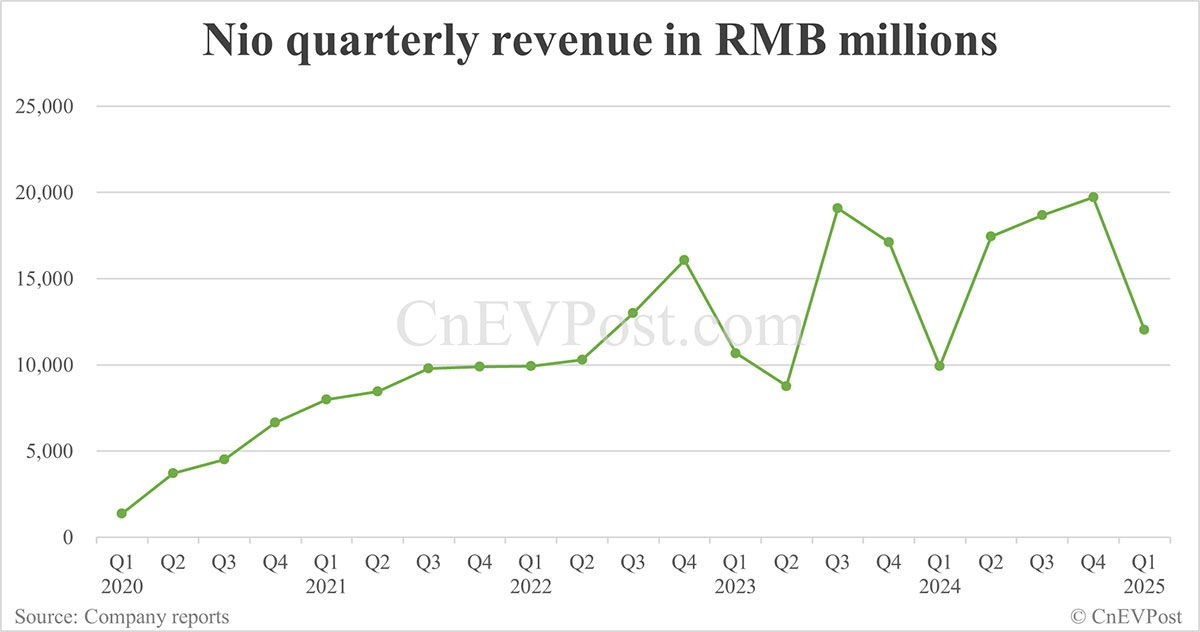

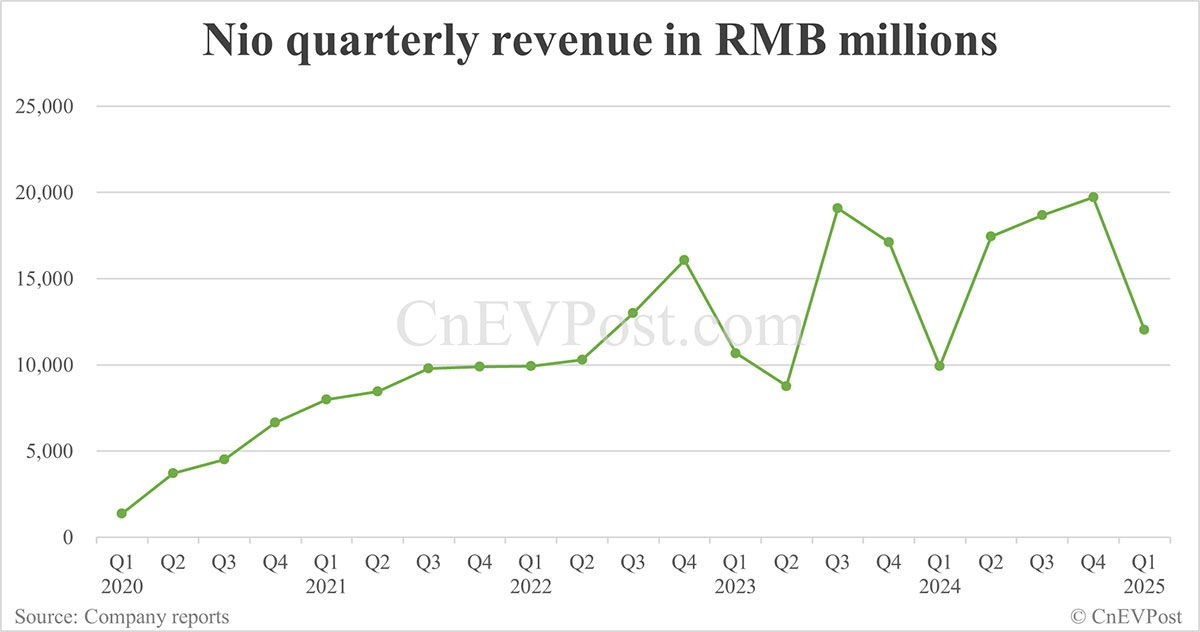

Nio, the prominent Chinese electric vehicle (EV) manufacturer, has announced strong first-quarter 2024 results, reporting a robust 21% year-on-year revenue growth. This impressive performance underscores the company's continued resilience in a competitive EV market and fuels optimism for future growth. The announcement sent ripples through the stock market, signaling a positive outlook for the burgeoning EV sector in China and beyond.

Key Highlights of Nio's Q1 2024 Earnings:

- Revenue Surge: Nio's revenue exceeded expectations, reaching [Insert Actual Revenue Figure Here], a 21% increase compared to Q1 2023. This significant jump demonstrates strong consumer demand for Nio's vehicles.

- Vehicle Deliveries: While specific numbers need to be inserted here, the company delivered a substantial number of vehicles, showcasing the effectiveness of its sales and marketing strategies. [Insert Actual Delivery Figures Here]. This figure represents [Insert Percentage Change Compared to Q1 2023] growth.

- Gross Margin Improvement: Nio reported an improved gross margin, indicating increased efficiency in its manufacturing and operational processes. [Insert Actual Gross Margin Percentage Here]. This positive trend suggests the company is effectively managing costs while maintaining high-quality products.

- Future Outlook: Nio remains optimistic about its future prospects, highlighting the growing demand for EVs in China and its ongoing efforts in research and development. The company is poised to benefit from government incentives and the expanding EV charging infrastructure.

Factors Contributing to Nio's Success:

Nio's Q1 success can be attributed to several key factors:

- Innovative Product Line: Nio's lineup of stylish and technologically advanced EVs continues to attract customers. Features like battery swapping technology and advanced driver-assistance systems (ADAS) provide a competitive edge.

- Expanding Infrastructure: The continued expansion of Nio's battery swapping network is crucial, addressing range anxiety – a major concern for potential EV buyers. This infrastructure investment is paying off in terms of increased sales and customer satisfaction.

- Strong Brand Reputation: Nio has cultivated a strong brand image, associating itself with luxury, innovation, and sustainability, attracting a loyal customer base.

- Government Support: Government policies supporting the EV industry in China have created a favorable environment for Nio's growth.

Challenges and Future Outlook:

Despite the impressive Q1 results, Nio faces ongoing challenges:

- Intense Competition: The EV market is fiercely competitive, with established players and new entrants vying for market share. Nio must continue to innovate and differentiate itself to maintain its competitive edge.

- Supply Chain Disruptions: Global supply chain issues remain a concern, potentially impacting production and delivery timelines. Nio's ability to navigate these complexities will be critical for sustained growth.

- Global Expansion: While focusing on the Chinese market is crucial, successful global expansion will be vital for long-term success. This requires navigating differing regulations and consumer preferences in various markets.

Conclusion:

Nio's Q1 2024 results demonstrate its strength and resilience in the dynamic EV landscape. The 21% year-on-year revenue growth is a significant achievement, fueled by strong product offerings, strategic infrastructure investments, and a positive market environment. While challenges remain, Nio's future prospects appear promising, positioning it as a key player in the global EV revolution. Investors and consumers alike will be closely watching Nio's progress in the coming quarters. For more detailed information, refer to Nio's official earnings report. [Link to Nio's official website]

Keywords: Nio, Nio Q1 2024, electric vehicle, EV, revenue growth, China EV market, battery swapping, EV sales, automotive industry, stock market, EV technology, ADAS, gross margin, supply chain

Related Articles: (These would link to other relevant articles on your site)

- [Link to article about the Chinese EV market]

- [Link to article about competing EV manufacturers]

- [Link to article about the future of EV technology]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nio Q1 2024: 21% Revenue Growth Year-on-Year. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Steeler Dbs Disrespectful Act Towards Pitt Logo Sparks Outrage

Jun 04, 2025

Steeler Dbs Disrespectful Act Towards Pitt Logo Sparks Outrage

Jun 04, 2025 -

Ukraine Confirms Crimea Bridge Strike With Underwater Explosives

Jun 04, 2025

Ukraine Confirms Crimea Bridge Strike With Underwater Explosives

Jun 04, 2025 -

Sudden Death Of Jonathan Joss Remembering The King Of The Hill And Parks And Recreation Star

Jun 04, 2025

Sudden Death Of Jonathan Joss Remembering The King Of The Hill And Parks And Recreation Star

Jun 04, 2025 -

Pitt Logo Defaced Former Wvu Defensive Back And Current Steeler Under Fire

Jun 04, 2025

Pitt Logo Defaced Former Wvu Defensive Back And Current Steeler Under Fire

Jun 04, 2025 -

Saharan Dust Caribbean Suffocated Us On Alert

Jun 04, 2025

Saharan Dust Caribbean Suffocated Us On Alert

Jun 04, 2025