Negative Outlook For CoreWeave (CRWV) Stock: Analysis Of Wall Street Zen's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Negative Outlook for CoreWeave (CRWV) Stock: Wall Street Zen's Downgrade Sparks Concerns

CoreWeave (CRWV), a prominent player in the burgeoning cloud computing market, recently faced a setback with Wall Street Zen downgrading its outlook for the company's stock. This move has sent ripples through the investment community, prompting investors to reassess their positions and analyze the implications of this negative assessment. This article delves into the reasons behind Wall Street Zen's downgrade, examining the potential impact on CRWV's future performance and offering insights for investors navigating this uncertainty.

Wall Street Zen's Rationale: A Deep Dive

Wall Street Zen, a well-respected financial analysis firm, cited several key factors in its decision to downgrade CoreWeave. While the specifics may vary depending on the exact report, common concerns often include:

-

Valuation Concerns: A significant factor often cited in downgrades is overvaluation. Rapid growth in the tech sector can sometimes lead to inflated stock prices, making a correction likely. Wall Street Zen may have determined that CRWV's current market capitalization doesn't accurately reflect its long-term potential, especially considering the competitive landscape.

-

Increased Competition: The cloud computing market is incredibly competitive. Giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominate the space. New entrants constantly emerge, creating a challenging environment for smaller players like CoreWeave to maintain market share and profitability. Wall Street Zen's analysis likely incorporates this intense competitive pressure into its assessment.

-

Financial Performance: Analysis of CRWV's recent financial reports, including revenue growth, profitability margins, and cash flow, likely played a crucial role in the downgrade. Any signs of slowing growth or widening losses could be significant contributing factors. Accessing and analyzing these financial statements is crucial for informed investment decisions. [Link to CoreWeave Investor Relations page]

-

Macroeconomic Factors: The overall economic climate significantly impacts technology stocks. Rising interest rates, inflation, and potential recessionary pressures can all influence investor sentiment and affect the valuation of growth-oriented companies like CRWV. Wall Street Zen's analysis might have incorporated these broader macroeconomic trends.

What This Means for Investors

The downgrade from Wall Street Zen presents a significant challenge for CRWV investors. It signals a potential shift in market sentiment, suggesting that the stock might be overvalued or facing headwinds in the near term. However, it's crucial to remember that this is just one analyst's opinion, and other firms may hold different perspectives.

Strategies for Navigating the Uncertainty

Investors facing this news should consider the following strategies:

-

Conduct Thorough Due Diligence: Don't solely rely on one analyst's report. Consult multiple sources, including financial news outlets, research reports from other firms, and CoreWeave's own financial disclosures.

-

Diversify Your Portfolio: Holding a diversified portfolio can help mitigate risk. Don't put all your eggs in one basket, especially in a volatile market segment.

-

Re-evaluate Your Investment Thesis: Review the reasons you initially invested in CRWV. Have the underlying fundamentals changed? Does the current market outlook align with your investment goals and risk tolerance?

-

Consider Your Time Horizon: If you're a long-term investor with a high-risk tolerance, a temporary dip might not significantly impact your overall strategy. However, short-term investors might need to reassess their positions.

Conclusion: A Cautious Approach

The Wall Street Zen downgrade serves as a reminder that even promising companies can face challenges. Investors should approach CRWV stock with caution, conducting thorough research and considering their individual risk tolerance before making any investment decisions. The cloud computing market remains dynamic and competitive, requiring careful monitoring and analysis. Staying informed about CRWV's financial performance and industry developments is crucial for navigating this evolving landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Negative Outlook For CoreWeave (CRWV) Stock: Analysis Of Wall Street Zen's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Joe Burrows Primetime Frustration Mike Norths Take On The Controversy

May 27, 2025

Joe Burrows Primetime Frustration Mike Norths Take On The Controversy

May 27, 2025 -

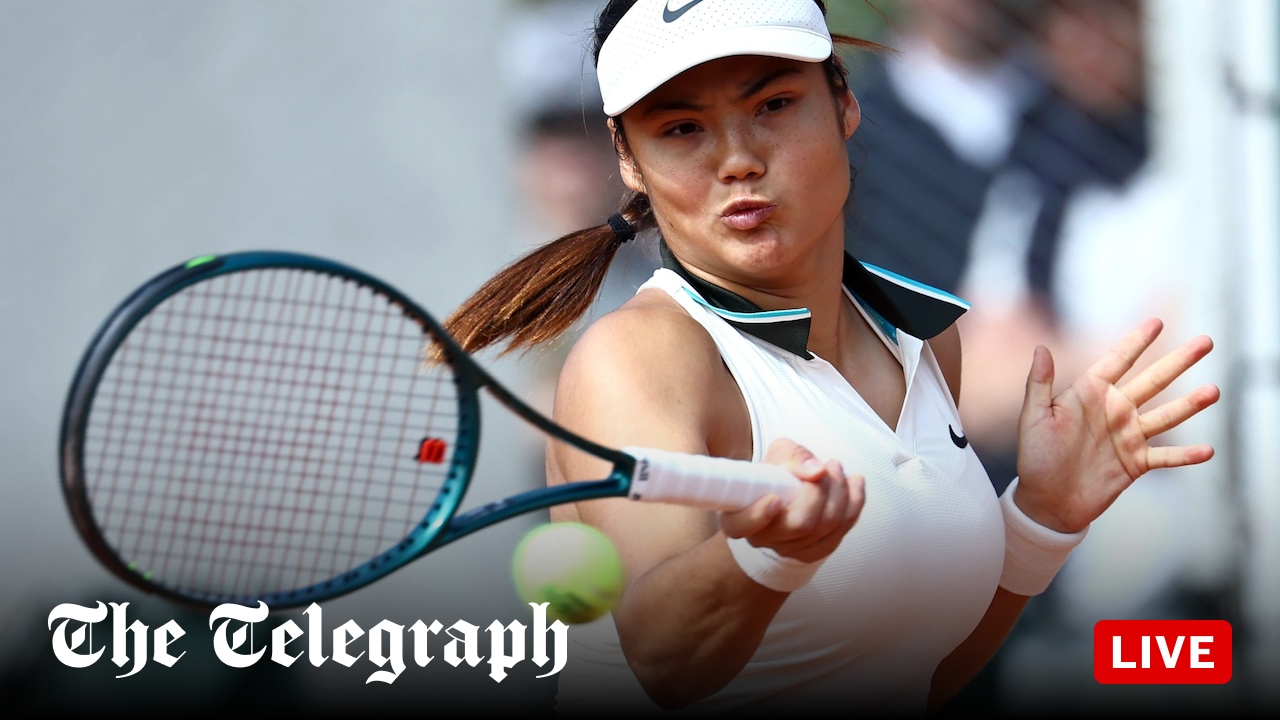

French Open Raducanu Wang Xinyu Match Live Score News And Analysis

May 27, 2025

French Open Raducanu Wang Xinyu Match Live Score News And Analysis

May 27, 2025 -

Nfl To Re Evaluate Scheduling After Burrows Criticism

May 27, 2025

Nfl To Re Evaluate Scheduling After Burrows Criticism

May 27, 2025 -

Roland Garros 2025 Who Will Win Haddad Maia 23 Vs Baptiste 70 Match Prediction

May 27, 2025

Roland Garros 2025 Who Will Win Haddad Maia 23 Vs Baptiste 70 Match Prediction

May 27, 2025 -

Nfl Acknowledges Scheduling Flaws Following Burrows Concerns

May 27, 2025

Nfl Acknowledges Scheduling Flaws Following Burrows Concerns

May 27, 2025