Navigating US-China Trade: Jim Cramer's 10 Must-Watch Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating US-China Trade: Jim Cramer's 10 Must-Watch Stocks

The ongoing US-China trade relationship remains one of the most significant geopolitical and economic factors impacting global markets. For investors, understanding this dynamic is crucial, and knowing which companies are best positioned to weather – or even profit from – the fluctuating tides is paramount. That's where renowned financial commentator Jim Cramer comes in. His insights, while often controversial, are widely followed, and his recent recommendations on navigating the complexities of US-China trade are worth examining. This article explores ten stocks Cramer highlights as particularly important to watch in this volatile environment.

Understanding the US-China Trade Landscape

Before diving into Cramer's picks, it's vital to understand the current state of US-China trade. Years of escalating tariffs and trade disputes have created uncertainty for businesses operating in both markets. While some progress has been made, the relationship remains fragile, susceptible to sudden shifts in policy. This volatility presents both risks and opportunities for investors. Companies with diversified supply chains, strong domestic markets, and a robust international presence are generally better equipped to handle trade uncertainties. Conversely, companies heavily reliant on either the US or Chinese markets could face significant challenges.

Jim Cramer's Top 10 Stocks to Watch:

While Cramer doesn't explicitly label these stocks as a "US-China Trade Portfolio," his commentary suggests they're particularly relevant given the current climate. It's crucial to remember that these are suggestions, and conducting your own thorough research before making any investment decisions is paramount. This is not financial advice.

Note: Specific stock tickers are omitted here to avoid outdated information. Consult reputable financial news sources for the most up-to-date ticker symbols and Cramer's latest commentary.

Here's a generalized overview of the types of companies Cramer often highlights in this context:

-

Tech Giants with Global Reach: Companies with diverse product lines and a significant global presence are less susceptible to trade disruptions. Think major players in software, cloud computing, and semiconductors. Their scale and diversification often provide a buffer against trade-related headwinds.

-

Companies with Strong Domestic Demand: Businesses that primarily cater to the US market are less directly impacted by US-China trade tensions. This includes companies in consumer staples, healthcare, and certain industrial sectors.

-

Companies Adapting Supply Chains: Businesses proactively diversifying their supply chains away from China are generally viewed more favorably. This showcases strategic foresight and resilience in the face of geopolitical uncertainty.

-

Energy Companies: The energy sector is often influenced by global trade dynamics. Companies with diversified energy sources and strong international partnerships can be less vulnerable to trade disputes.

-

Financials with Global Exposure: Major financial institutions with international operations can navigate trade complexities more effectively due to their diversified revenue streams and global reach.

-

Industrial Conglomerates: Large industrial companies with diversified product offerings and global operations often have the resources to adapt to changing trade landscapes.

-

Consumer Discretionary Companies with Global Brands: Strong brands with global appeal often maintain resilience in the face of trade uncertainties.

-

Companies Benefiting from Reshoring: Companies that are bringing manufacturing back to the US or other locations are positioned to benefit from reduced reliance on China.

-

Agricultural Businesses: The agricultural sector is frequently impacted by trade policy. Companies with diverse product lines and global reach are often better positioned to manage these impacts.

-

Companies Leveraging Alternative Markets: Businesses actively expanding into other markets beyond the US and China demonstrate adaptability and reduce reliance on any single trade relationship.

Disclaimer: This article provides general information and commentary based on publicly available information. It is not intended as financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Further Research:

To stay updated on Jim Cramer's insights and the evolving US-China trade relationship, regularly consult reputable financial news sources such as CNBC, Bloomberg, and The Wall Street Journal. Remember to critically assess all information and diversify your investment portfolio to mitigate risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating US-China Trade: Jim Cramer's 10 Must-Watch Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

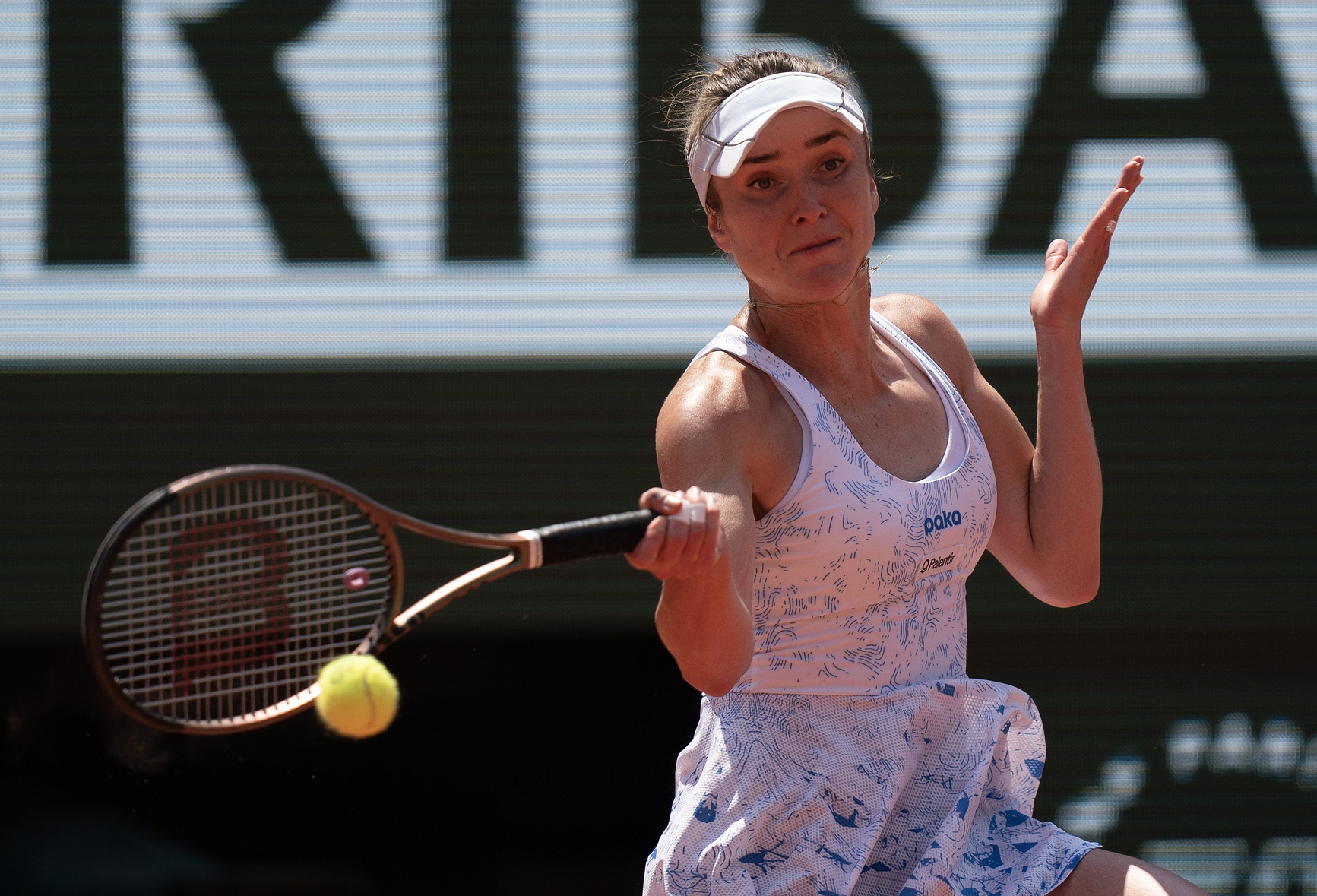

Svitolina Vs Baptiste Head To Head Record Betting Tips And 2025 Italian Open Prediction

May 11, 2025

Svitolina Vs Baptiste Head To Head Record Betting Tips And 2025 Italian Open Prediction

May 11, 2025 -

Analyst Highlights Microsofts Superior Ai Capabilities Compared To Amazon

May 11, 2025

Analyst Highlights Microsofts Superior Ai Capabilities Compared To Amazon

May 11, 2025 -

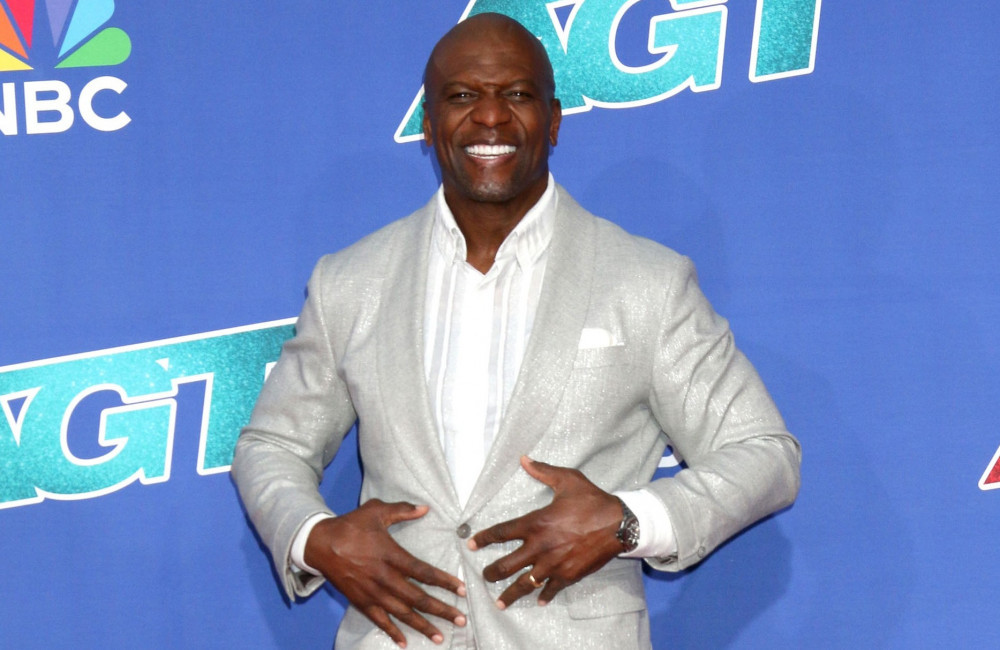

Terry Crews On Everybody Hates Chris Aiming For Simpsons And Family Guy Status

May 11, 2025

Terry Crews On Everybody Hates Chris Aiming For Simpsons And Family Guy Status

May 11, 2025 -

Planting Guide Sowing The New Grow A Garden Night Seeds

May 11, 2025

Planting Guide Sowing The New Grow A Garden Night Seeds

May 11, 2025 -

Barcos Varados En Maracaibo Un Reflejo De La Crisis Economica Y Petrolera Bajo Maduro

May 11, 2025

Barcos Varados En Maracaibo Un Reflejo De La Crisis Economica Y Petrolera Bajo Maduro

May 11, 2025