Navigating US-China Trade: 10 Stocks Jim Cramer Recommends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating US-China Trade: 10 Stocks Jim Cramer Recommends for a Volatile Market

The ongoing US-China trade relationship remains one of the most significant factors influencing global markets. Its volatility creates both significant risks and potentially lucrative opportunities for savvy investors. Navigating this complex landscape requires careful consideration, and understanding which companies are best positioned to weather – or even profit from – the shifting tides is crucial. That's where the insights of seasoned investors like Jim Cramer can prove invaluable. This article explores ten stocks Cramer recommends for navigating the unpredictable waters of US-China trade.

Understanding the US-China Trade Landscape:

The trade war between the US and China has significantly impacted global supply chains, leading to increased tariffs and uncertainty for businesses. While a complete resolution remains elusive, understanding the nuances of this relationship is key to making informed investment decisions. Some sectors, like technology and manufacturing, have been particularly affected. Others, however, have found ways to adapt and even thrive amidst the uncertainty.

Jim Cramer's Stock Picks: A Closer Look

Jim Cramer, the renowned host of CNBC's "Mad Money," is known for his outspoken opinions and market analysis. While his recommendations should always be considered alongside your own due diligence, his insights often offer a valuable perspective on market trends. Here are ten stocks he's recommended, categorized for easier understanding:

Technology Sector (Adaptability and Innovation):

-

NVIDIA (NVDA): A leader in AI and high-performance computing, NVIDIA benefits from the increasing demand for advanced technologies globally, even amidst trade tensions. Cramer highlights its strong position in various sectors, making it relatively resilient to trade uncertainties. Remember to always conduct your own research before investing.

-

Microsoft (MSFT): A tech giant with diversified revenue streams, Microsoft shows resilience in the face of global economic fluctuations. Its cloud computing services (Azure) are particularly strong and benefit from increasing global digital adoption.

-

Taiwan Semiconductor Manufacturing Company (TSM): A key player in semiconductor manufacturing, TSM's global reach and crucial role in the tech supply chain position it for continued growth, despite geopolitical challenges. However, its sensitivity to trade regulations should be carefully considered.

Consumer Goods Sector (Adapting to Shifting Demand):

-

Nike (NKE): A global brand with a strong presence in both the US and China, Nike demonstrates adaptability in navigating complex trade relations. Its direct-to-consumer strategy helps mitigate some of the supply chain challenges.

-

Coca-Cola (KO): A consumer staple with widespread global reach, Coca-Cola tends to weather economic storms relatively well. Its diversified product portfolio and established distribution networks provide significant resilience.

Industrial and Manufacturing Sector (Navigating Supply Chain Disruptions):

-

Caterpillar (CAT): A major player in construction and mining equipment, Caterpillar’s global presence and adaptation to changing market dynamics makes it a compelling choice for long-term investors.

-

Deere & Company (DE): Similar to Caterpillar, Deere is a key player in agricultural equipment and benefits from the sustained demand for food globally.

Financials Sector (Stability and Long-Term Growth):

-

JPMorgan Chase (JPM): A major player in the financial sector, JPMorgan Chase is known for its stability and strong performance. While sensitive to market downturns, its size and diversified business model often provide a buffer against economic shocks.

-

Berkshire Hathaway (BRK.B): Warren Buffett's Berkshire Hathaway offers diversification across various sectors, making it a relatively safe haven in times of market uncertainty. It’s a long-term investment strategy favored by many.

Healthcare Sector (Consistent Demand):

- Abbott Laboratories (ABT): The healthcare sector typically shows resilience even during economic downturns due to consistent demand for medical products and services. Abbott's diverse portfolio helps navigate market fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and past performance does not guarantee future results. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about the evolving US-China trade relations and continue to research these and other companies to make well-informed investment choices. Remember to diversify your portfolio and consider your individual risk tolerance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating US-China Trade: 10 Stocks Jim Cramer Recommends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Light Shed On Ferraris Underperformance Ocon And Hamiltons Perspectives

May 11, 2025

New Light Shed On Ferraris Underperformance Ocon And Hamiltons Perspectives

May 11, 2025 -

Microsoft Msft Stock Soars Analyst Highlights Ai Dominance Over Amazon

May 11, 2025

Microsoft Msft Stock Soars Analyst Highlights Ai Dominance Over Amazon

May 11, 2025 -

Barcelonas Lamine Yamal A Rising Star Undeterred By Setback

May 11, 2025

Barcelonas Lamine Yamal A Rising Star Undeterred By Setback

May 11, 2025 -

Grow A Garden Night Explore The Latest Additions To Their Seed Pack

May 11, 2025

Grow A Garden Night Explore The Latest Additions To Their Seed Pack

May 11, 2025 -

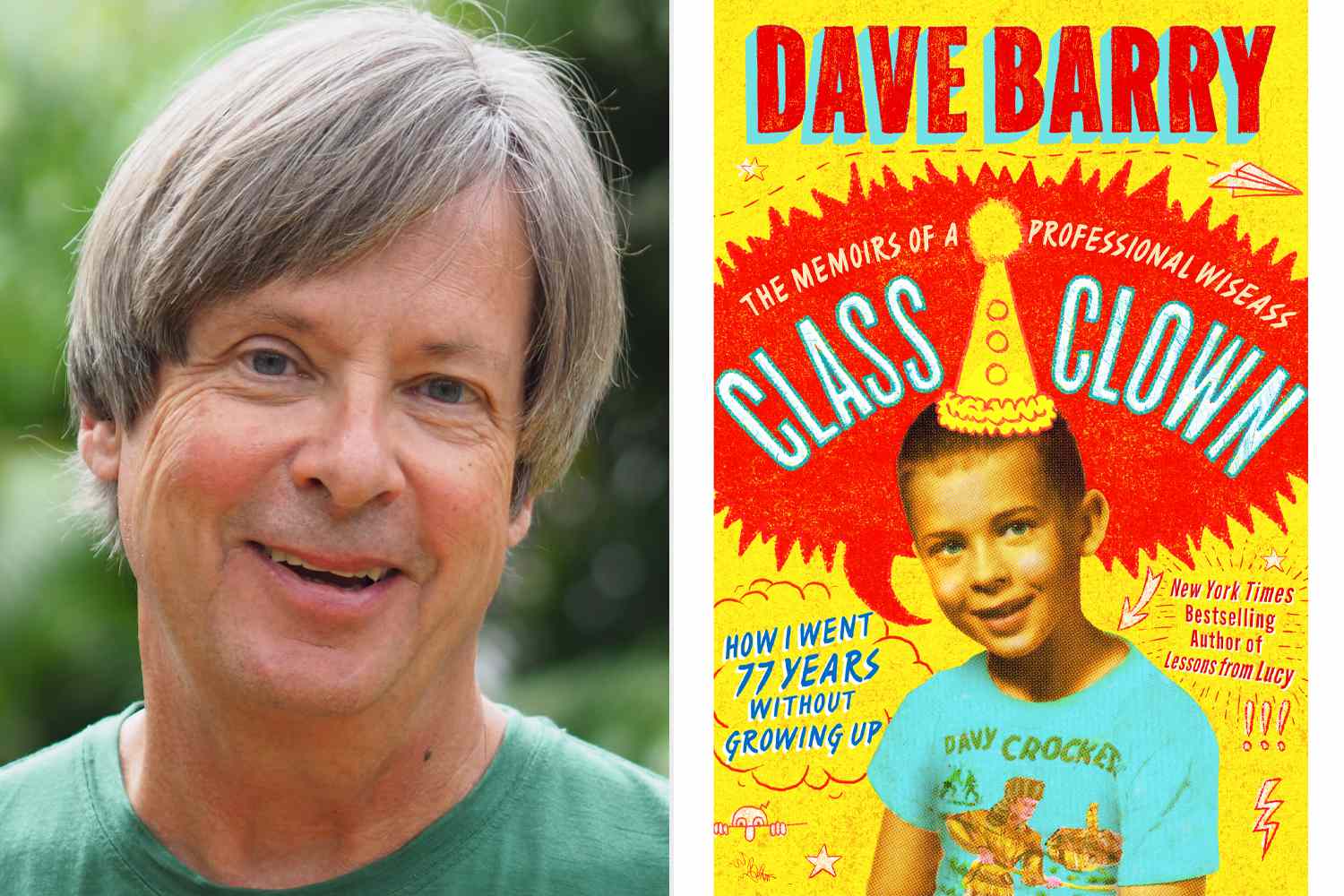

Learn From Dave Barry Essential Advice For Aspiring Writers

May 11, 2025

Learn From Dave Barry Essential Advice For Aspiring Writers

May 11, 2025