Navigating US-China Talks: Jim Cramer's 10 Stock Recommendations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating US-China Talks: Jim Cramer's 10 Stock Recommendations

The ongoing tension between the US and China continues to send shockwaves through the global economy, leaving investors scrambling for guidance. With trade wars, technological disputes, and geopolitical uncertainties dominating headlines, navigating the market requires a keen eye and expert insight. Financial guru Jim Cramer, known for his outspoken opinions and market analysis on CNBC's "Mad Money," recently offered his take on the situation, providing ten stock recommendations for investors looking to weather the storm. This analysis delves into Cramer's picks, examining the rationale behind them and considering the potential risks and rewards.

Cramer's Strategic Picks: A Deep Dive

While Cramer hasn't explicitly linked all his recommendations directly to the US-China trade war, his choices suggest a strategy focused on companies with strong domestic presence, diversified international portfolios, or those poised to benefit from specific technological trends independent of the bilateral relationship. It's crucial to remember that these are recommendations, not guarantees, and thorough individual research is essential before making any investment decisions.

Here's a closer look at the ten stocks (note: Specific stock tickers are omitted to avoid the appearance of endorsement; consult recent "Mad Money" episodes or reputable financial news sources for the exact list):

Sector 1: Domestic Focus & Resilience

-

Consumer Staples Giant: Cramer's inclusion of a major consumer staples company highlights the defensive nature of this sector. These companies typically see consistent demand regardless of economic fluctuations, making them relatively stable investments during periods of uncertainty. Think essential goods – food, household products, etc. – which are less susceptible to trade disruptions.

-

Healthcare Innovator: The healthcare sector often performs well even during times of geopolitical stress. This recommendation likely points to a company involved in innovation and growth, potentially less reliant on global supply chains.

-

Infrastructure Play: With increased focus on domestic infrastructure development, this pick likely represents a company positioned to benefit from government spending in this area. This could range from construction materials to engineering firms.

Sector 2: Global Reach & Diversification

-

Tech Diversification: This recommendation likely focuses on a tech company with a robust global presence and diverse product lines. Such companies can mitigate risks associated with dependence on any single market.

-

Pharmaceutical Powerhouse: The pharmaceutical industry boasts global reach and consistent demand. This pick likely represents a large-cap company with a diverse portfolio of products and a strong international presence.

-

Energy Independence: Given the energy sector's strategic importance, this selection might focus on a company contributing to domestic energy production or renewable energy sources, lessening reliance on foreign suppliers.

Sector 3: Technology & Innovation

-

Semiconductor Strength: This recommendation likely points to a semiconductor company benefiting from long-term trends in technology, regardless of geopolitical shifts. These are crucial components in many devices, indicating resilience across multiple sectors.

-

Cybersecurity Leader: With increasing cyber threats, this choice highlights the importance of cybersecurity solutions, a sector less impacted by international trade disputes.

-

Cloud Computing Champion: The cloud computing sector continues to grow rapidly, offering a company with a strong competitive position in a technology less dependent on specific geographical locations.

-

Industrial Automation: This pick potentially highlights companies benefiting from increasing automation trends across various industries, offering a strong long-term growth potential.

Disclaimer and Further Research: Investing in the stock market always involves risk. Before making any investment decisions, conduct thorough research, consult with a qualified financial advisor, and consider your personal risk tolerance. The information provided here is for informational purposes only and does not constitute financial advice.

Call to Action: Stay informed about global economic trends and carefully consider your investment strategy. Regularly review your portfolio and adapt your approach as needed. What are your thoughts on Cramer's picks? Share your insights in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating US-China Talks: Jim Cramer's 10 Stock Recommendations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Boost Microsoft Msft Stronger Than Amazon Says Analyst

May 10, 2025

Ai Boost Microsoft Msft Stronger Than Amazon Says Analyst

May 10, 2025 -

Victory Day 2024 Mutual Accusations Mark Moscow And Kyiv Relations

May 10, 2025

Victory Day 2024 Mutual Accusations Mark Moscow And Kyiv Relations

May 10, 2025 -

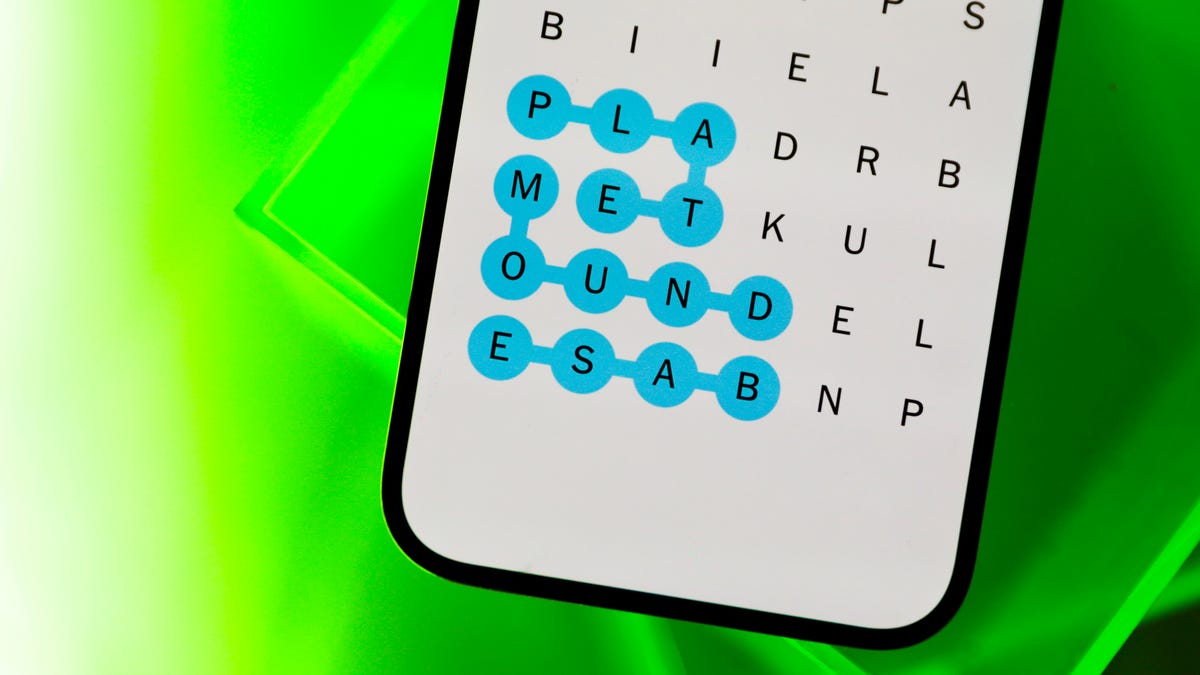

Stuck On Nyt Spelling Bee Hints And Answers For May 8th Puzzle 431

May 10, 2025

Stuck On Nyt Spelling Bee Hints And Answers For May 8th Puzzle 431

May 10, 2025 -

Karen Read Case Day One Of Trial Focuses On State Troopers Account

May 10, 2025

Karen Read Case Day One Of Trial Focuses On State Troopers Account

May 10, 2025 -

Solve Nyt Spelling Bee Hints And Answers For May 9th

May 10, 2025

Solve Nyt Spelling Bee Hints And Answers For May 9th

May 10, 2025