Mortgage Refinance Rates For May 19, 2025: A Detailed Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Refinance Rates for May 19, 2025: A Detailed Look

Introduction:

The mortgage market is constantly shifting, making it crucial to stay informed about current refinance rates. Are you considering refinancing your mortgage to lower your monthly payments or access your home equity? Understanding the refinance landscape is key. This article provides a detailed look at mortgage refinance rates as of May 19, 2025, offering insights into the factors influencing these rates and what you can expect. While we cannot provide exact, real-time rates (as those fluctuate constantly), we'll analyze the market trends and provide you with the tools to make informed decisions.

Current Mortgage Refinance Rate Landscape (May 19, 2025 Projection):

Predicting exact rates for a future date is impossible, but based on current market trends and expert analysis, we can project a likely range for May 19, 2025. Several factors influence mortgage rates, including the Federal Reserve's monetary policy, inflation rates, and overall economic conditions. Assuming a relatively stable economic environment, we project the following ranges for various mortgage types:

-

30-Year Fixed-Rate Refinance: Projected range: 5.5% - 7.5%. This range accounts for variations based on credit score, loan-to-value ratio (LTV), and other borrower-specific factors. A higher credit score and lower LTV will generally result in a lower rate.

-

15-Year Fixed-Rate Refinance: Projected range: 4.5% - 6.5%. Shorter-term mortgages typically come with lower interest rates but require higher monthly payments.

-

ARM (Adjustable-Rate Mortgage) Refinance: Projected range: 4.0% - 6.0% (initial rate). ARMs offer potentially lower initial rates, but the rate can adjust periodically, leading to uncertainty in long-term payments. Proceed with caution and fully understand the terms before opting for an ARM.

Factors Affecting Refinance Rates:

Several key elements significantly impact your refinance rate:

-

Credit Score: A higher credit score often translates to better interest rates. Work on improving your credit score before applying for a refinance. Learn more about (link to a reputable source).

-

Loan-to-Value Ratio (LTV): Your LTV is the ratio of your mortgage loan amount to your home's value. A lower LTV generally results in more favorable rates.

-

Down Payment: A larger down payment can lead to a lower LTV and consequently, a lower interest rate.

-

Debt-to-Income Ratio (DTI): Lenders assess your DTI to evaluate your ability to manage additional debt. A lower DTI improves your chances of securing a better rate.

-

Mortgage Type: The type of mortgage you choose (fixed-rate, adjustable-rate, etc.) directly influences the interest rate.

-

Economic Conditions: Broad economic factors like inflation and interest rate hikes set by the Federal Reserve significantly impact mortgage rates.

Should You Refinance?

The decision to refinance hinges on several factors. Consider these questions:

-

Can you significantly lower your interest rate? A substantial reduction in your interest rate can result in significant savings over the life of the loan.

-

What are the closing costs? Weigh the potential savings against the closing costs associated with refinancing.

-

What is your financial situation? Ensure you can comfortably afford the monthly payments under the new loan terms.

-

How long do you plan to stay in your home? Refinancing makes more sense if you plan to stay in your home long enough to recoup the closing costs.

Conclusion:

Navigating mortgage refinance rates requires careful planning and consideration of multiple factors. While these projected rates for May 19, 2025, offer a glimpse into the potential market, it's vital to consult with a mortgage professional for personalized advice tailored to your unique financial situation. Remember to shop around and compare offers from multiple lenders to secure the best possible rate. Staying informed about market trends and understanding your financial profile are crucial steps in making a well-informed decision about refinancing your mortgage.

Disclaimer: This article provides general information and projections only. It is not financial advice. Consult with a qualified financial advisor and mortgage lender for personalized guidance. Rates are subject to change based on market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Refinance Rates For May 19, 2025: A Detailed Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is A Reality Tv Show For Us Citizenship On The Horizon

May 19, 2025

Is A Reality Tv Show For Us Citizenship On The Horizon

May 19, 2025 -

Tyler O Neills Injury Orioles Place Outfielder On Injured List Again

May 19, 2025

Tyler O Neills Injury Orioles Place Outfielder On Injured List Again

May 19, 2025 -

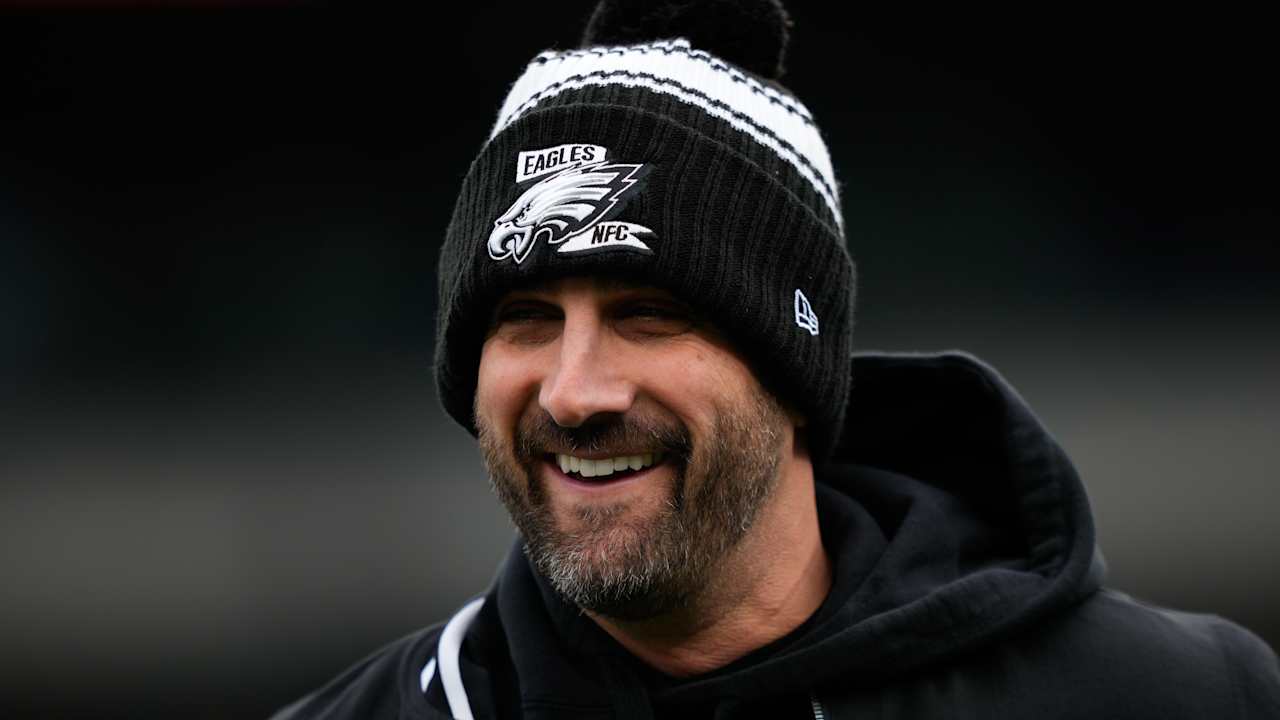

Nick Siriannis New Contract Eagles Coach Secures Long Term Future

May 19, 2025

Nick Siriannis New Contract Eagles Coach Secures Long Term Future

May 19, 2025 -

Ukraine Conflict Trumps Planned Discussion With Putin On Monday

May 19, 2025

Ukraine Conflict Trumps Planned Discussion With Putin On Monday

May 19, 2025 -

Find Out Now Maryland Lottery Mega Millions And Pick 3 Results May 16 2025

May 19, 2025

Find Out Now Maryland Lottery Mega Millions And Pick 3 Results May 16 2025

May 19, 2025