Mortgage Rate Increase Follows Positive Economic Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rate Increase Follows Positive Economic Data: What it Means for Homebuyers

The seemingly unstoppable rise of mortgage rates took another leap this week, following the release of surprisingly strong economic data. This news has sent ripples through the housing market, leaving many potential homebuyers wondering what the future holds. While positive economic indicators are generally good news, the impact on the mortgage market is proving to be a double-edged sword.

Strong Economic Data Fuels Rate Hike

Recent economic reports painted a picture of robust growth, exceeding many analysts' expectations. This positive economic performance, including strong job growth and increased consumer spending, has emboldened the Federal Reserve to continue its campaign of interest rate hikes. These increases aim to curb inflation, but they have a direct and significant impact on mortgage rates. As the cost of borrowing money increases, so does the cost of a mortgage.

The Impact on the Housing Market

This latest mortgage rate increase is likely to further cool the already slowing housing market. Higher rates mean higher monthly payments, making homeownership less affordable for many potential buyers. This could lead to:

- Reduced Buyer Demand: Fewer people will be able to afford to buy a home at current prices, leading to a decrease in demand.

- Price Adjustments: As demand softens, we might see a moderation in home price growth, or even potential price decreases in some markets.

- Increased Competition for Lower-Rate Mortgages: Borrowers will be fiercely competing for the best mortgage rates, potentially leading to more stringent lending requirements.

What Should Homebuyers Do?

This news presents challenges for those hoping to enter the housing market. However, there are still steps prospective homebuyers can take:

- Improve Your Credit Score: A higher credit score will qualify you for better interest rates, potentially mitigating some of the impact of the rate hike. Learn more about improving your credit score . (External link to a reputable source)

- Shop Around for Mortgages: Comparing rates and terms from multiple lenders is crucial to securing the best possible deal. Use online mortgage calculators and comparison tools to your advantage.

- Consider Adjustable-Rate Mortgages (ARMs): While riskier, ARMs often offer lower initial interest rates than fixed-rate mortgages. However, it's crucial to carefully weigh the potential for future rate increases.

- Save a Larger Down Payment: A larger down payment can reduce your loan amount and potentially lower your monthly payments.

Looking Ahead:

While the recent economic data is positive overall, the impact on the housing market through rising mortgage rates is undeniably significant. The coming months will likely see continued volatility in the mortgage market as the Federal Reserve navigates the delicate balance between controlling inflation and maintaining economic growth. Staying informed and consulting with financial professionals is crucial for anyone considering buying a home in this evolving landscape.

Keywords: Mortgage rates, interest rates, housing market, economic data, Federal Reserve, homebuyers, home prices, adjustable-rate mortgages, fixed-rate mortgages, credit score, buying a home, mortgage affordability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rate Increase Follows Positive Economic Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Check Your Tickets Maryland Lottery Mega Millions And Pick 3 May 16 2025

May 19, 2025

Check Your Tickets Maryland Lottery Mega Millions And Pick 3 May 16 2025

May 19, 2025 -

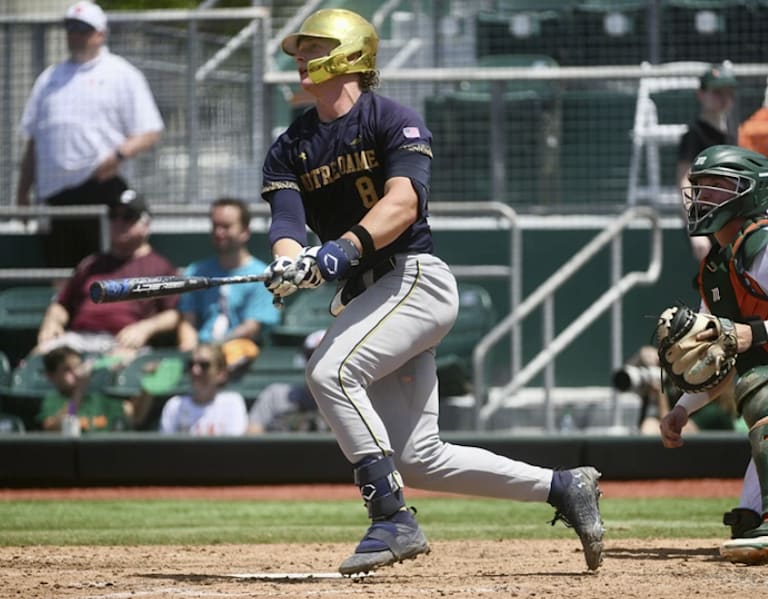

Notre Dame Baseballs Triumph Over Miami Tinneys Key Role In Series Win

May 19, 2025

Notre Dame Baseballs Triumph Over Miami Tinneys Key Role In Series Win

May 19, 2025 -

Pope Leos Inaugural Address Hope For Peace And Global Unity

May 19, 2025

Pope Leos Inaugural Address Hope For Peace And Global Unity

May 19, 2025 -

Department Of Homeland Security Explores Reality Tv For Citizenship Applications

May 19, 2025

Department Of Homeland Security Explores Reality Tv For Citizenship Applications

May 19, 2025 -

Latonya Pottain Featured On My 600 Lb Life Passes Away At Age 40

May 19, 2025

Latonya Pottain Featured On My 600 Lb Life Passes Away At Age 40

May 19, 2025