Mortgage Rate Increase: Economic Growth Fuels Higher Borrowing Costs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rate Increase: Economic Growth Fuels Higher Borrowing Costs

The dream of homeownership is becoming pricier. Recent economic indicators point to a significant increase in mortgage rates, a direct consequence of robust economic growth. This shift impacts potential homebuyers and the broader housing market, creating a complex scenario for both consumers and the financial sector.

The Rising Tide of Interest Rates

The Federal Reserve's efforts to combat inflation, coupled with a surprisingly resilient economy, have led to a steady climb in interest rates. This isn't just affecting mortgages; it's impacting all borrowing costs, from auto loans to credit cards. However, the impact on the housing market is particularly pronounced, given the significant financial commitment involved in purchasing a home. The average 30-year fixed mortgage rate has climbed noticeably in the past quarter, making it more expensive for individuals to secure a home loan.

Why the Increase? Understanding the Economic Drivers

Several factors contribute to this upward trend:

- Strong Economic Growth: A robust economy often translates to higher interest rates. As businesses thrive and consumer spending increases, demand for credit rises, pushing up borrowing costs. This increased demand puts upward pressure on interest rates across the board, including mortgages.

- Inflationary Pressures: The Federal Reserve's primary mandate is to control inflation. To curb rising prices, the Fed raises interest rates, making borrowing more expensive and slowing down economic activity. This strategy, while effective in combating inflation, inevitably increases mortgage rates.

- Investor Confidence: Strong economic performance often boosts investor confidence, leading to higher demand for higher-yielding investments. This increased demand further contributes to the rise in interest rates.

Impact on the Housing Market

The increase in mortgage rates has several immediate consequences for the housing market:

- Reduced Buyer Demand: Higher borrowing costs naturally reduce the number of potential homebuyers. Affordability shrinks as monthly payments increase, cooling down market activity.

- Potential Price Adjustments: As demand softens, there might be a downward pressure on home prices in some markets, although this effect varies greatly depending on location and market conditions. Areas with already high housing inventory might experience a more significant price correction.

- Shift in Buyer Behavior: Buyers might adjust their search criteria, looking for smaller homes or properties in less competitive areas to remain within their budget.

What Does This Mean for Homebuyers?

For those hoping to buy a home, the increased mortgage rates mean careful planning and potentially adjusting expectations. This includes:

- Increased Savings: Saving a larger down payment can help mitigate the impact of higher interest rates.

- Exploring Different Loan Options: Consulting with a mortgage broker to explore various loan options, including adjustable-rate mortgages (ARMs), can help find a more affordable solution. However, ARMs carry inherent risks, so careful consideration is crucial. [Link to article about ARMs]

- Re-evaluating Budget: Realistically assessing affordability and adjusting expectations is vital in navigating this challenging market.

Looking Ahead

Predicting future mortgage rates remains challenging. Economic forecasts vary, and unforeseen events can significantly impact interest rates. However, keeping abreast of economic indicators and consulting financial advisors can help individuals make informed decisions in this dynamic market. Staying informed about changes in interest rates and market trends is key to successfully navigating the home buying process.

Call to Action: Consult a financial advisor to discuss your options and strategize your home buying plan in this evolving economic climate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rate Increase: Economic Growth Fuels Higher Borrowing Costs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

May 16 2025 Check Your Numbers Maryland Lottery Mega Millions And Pick 3 Results

May 19, 2025

May 16 2025 Check Your Numbers Maryland Lottery Mega Millions And Pick 3 Results

May 19, 2025 -

Orioles O Neill Returns To Injured List Cowsers Comeback Update

May 19, 2025

Orioles O Neill Returns To Injured List Cowsers Comeback Update

May 19, 2025 -

Economic Uptick Pushes Mortgage Rates Higher For Homebuyers

May 19, 2025

Economic Uptick Pushes Mortgage Rates Higher For Homebuyers

May 19, 2025 -

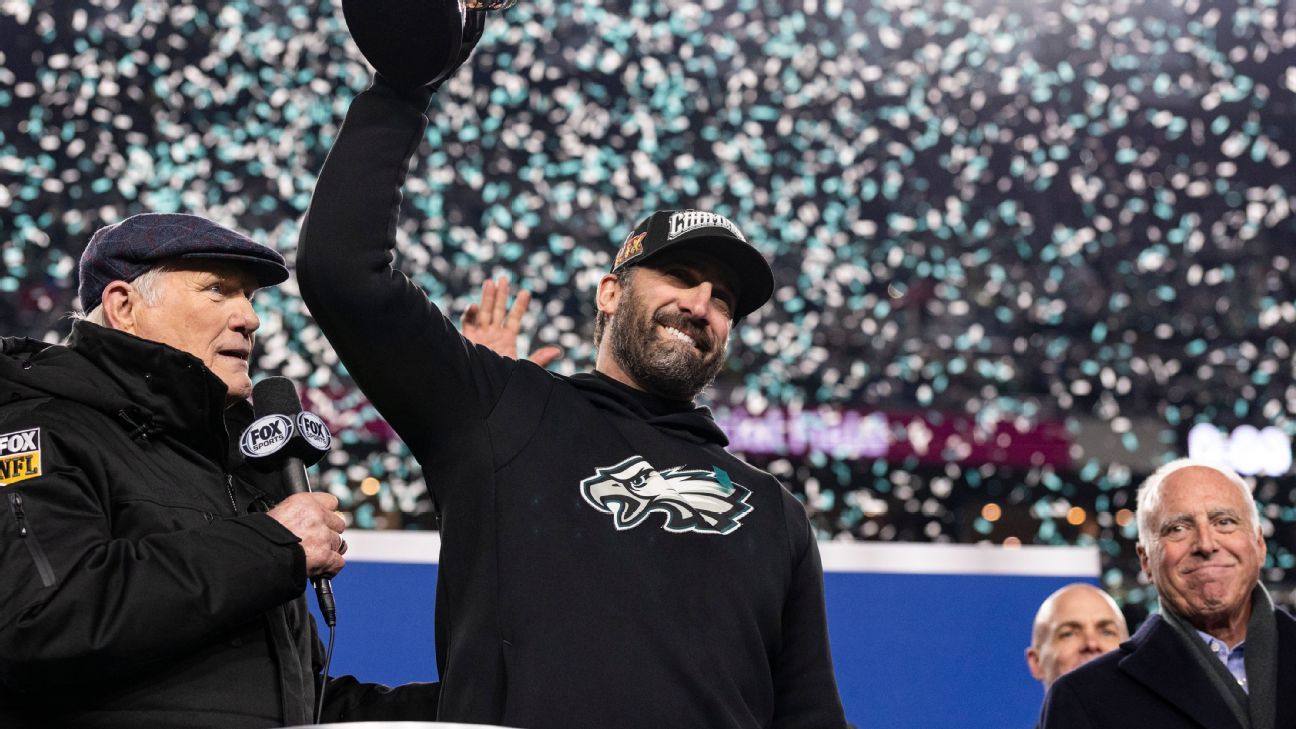

Eagles Reward Sirianni With Deserved Contract Extension

May 19, 2025

Eagles Reward Sirianni With Deserved Contract Extension

May 19, 2025 -

Ipl 2025 Lsg Vs Srh Live Score Player Confrontation And Match Report

May 19, 2025

Ipl 2025 Lsg Vs Srh Live Score Player Confrontation And Match Report

May 19, 2025