Mortgage Rate Drop: Lowest Since October 2024

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rate Drop: Lowest Since October 2024 – A Sign of Relief for Homebuyers?

The housing market has received a much-needed shot in the arm with a significant drop in mortgage rates, reaching their lowest point since October 2024. This unexpected downturn offers a glimmer of hope for potential homebuyers who have been sidelined by persistently high interest rates. But is this a temporary dip or a sustained trend? Let's delve into the details.

What Caused the Drop?

Several factors are contributing to this encouraging decline in mortgage rates. Recent economic data showing a slight slowdown in inflation has led many experts to believe the Federal Reserve may ease its aggressive interest rate hiking cycle. This, in turn, has eased pressure on mortgage rates, which are often closely tied to the federal funds rate. Furthermore, a decrease in investor demand for Treasury bonds has also played a role, freeing up capital and potentially lowering borrowing costs for mortgages.

How Low Are We Talking?

While the exact figures fluctuate slightly depending on the lender and loan type, many are reporting 30-year fixed mortgage rates dipping below [Insert current average rate here]%, the lowest since October 2024. This represents a considerable decrease from the peak rates seen earlier this year, offering significant savings for borrowers over the life of their loan. For example, a [Insert example loan amount] loan at [Insert higher rate]% versus [Insert lower rate]% could mean a difference of [Insert dollar amount] in monthly payments – a substantial amount for many households.

Is This a Sustainable Trend?

While the current drop is welcome news, it's crucial to approach it with a degree of caution. Economic forecasts remain uncertain, and several factors could impact mortgage rates in the coming months. Inflationary pressures, geopolitical instability, and unexpected shifts in the housing market itself could all influence future rate movements. Experts advise against waiting for even lower rates before making a decision, as the market remains dynamic and unpredictable.

What Should Homebuyers Do?

For those considering purchasing a home, this drop in mortgage rates presents a valuable opportunity. However, it’s essential to:

- Shop around: Compare rates from multiple lenders to secure the best possible deal.

- Check your credit score: A higher credit score typically qualifies you for better interest rates.

- Get pre-approved: This demonstrates your seriousness to sellers and allows you to move quickly when you find the right property.

- Understand your budget: Don't overextend yourself financially; ensure your monthly mortgage payments fit comfortably within your overall financial plan.

Looking Ahead:

The future of mortgage rates remains uncertain. While this recent drop provides a much-needed boost to the housing market, continuous monitoring of economic indicators and expert analysis is crucial. Staying informed and making well-researched decisions will be vital for both buyers and sellers navigating the complexities of the current market. For further insights into current mortgage rates and market trends, we recommend checking reputable financial websites such as [Link to a reputable financial news site] and [Link to another reputable financial news site].

Call to Action: Are you ready to take advantage of these lower mortgage rates? Connect with a mortgage professional today to explore your options! (This CTA is subtle and encourages further research).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rate Drop: Lowest Since October 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

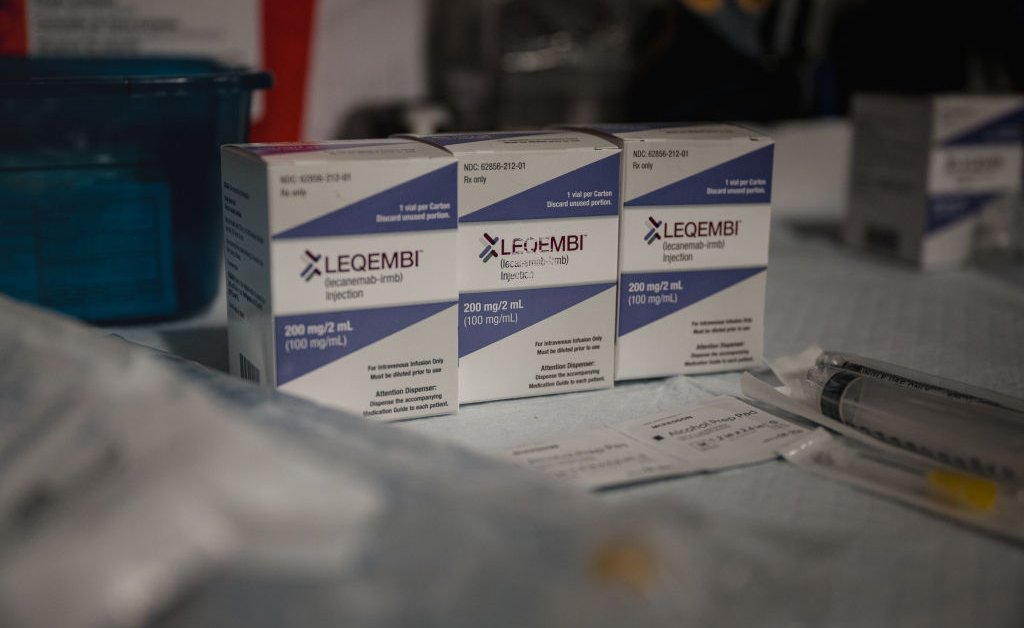

Injectable Alzheimers Drug A Convenient Home Treatment Option

Sep 09, 2025

Injectable Alzheimers Drug A Convenient Home Treatment Option

Sep 09, 2025 -

Stock Market Surge Inflation Data To Test Todays Gains In S And P 500 Nasdaq And Dow

Sep 09, 2025

Stock Market Surge Inflation Data To Test Todays Gains In S And P 500 Nasdaq And Dow

Sep 09, 2025 -

Analyzing The September Fed Meeting Implications For Your Mortgage Rate

Sep 09, 2025

Analyzing The September Fed Meeting Implications For Your Mortgage Rate

Sep 09, 2025 -

J J Watts Cbs Broadcasting Debut A Tony Romo Contract Re Do

Sep 09, 2025

J J Watts Cbs Broadcasting Debut A Tony Romo Contract Re Do

Sep 09, 2025 -

Heated Rivalry Sherrone Moore And The Oklahoma Fan Incident

Sep 09, 2025

Heated Rivalry Sherrone Moore And The Oklahoma Fan Incident

Sep 09, 2025

Latest Posts

-

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025 -

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025

The Evolution Of Armani Tracing The Iconic Looks That Shaped A Brand

Sep 09, 2025