Moody's Downgrade Fails To Dent Market: S&P 500 Leads Six-Day Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Fails to Dent Market: S&P 500 Leads Six-Day Rally

The U.S. credit rating downgrade by Moody's Investors Service failed to trigger the anticipated market turmoil, with the S&P 500 leading a remarkable six-day rally. This unexpected resilience highlights the complex interplay of factors influencing investor sentiment and the ongoing debate surrounding the U.S. economy's strength. While some analysts predicted widespread selling, the market reacted with surprising calm, prompting questions about the effectiveness of credit rating agencies in predicting market movements.

The downgrade, announced on August 1, lowered the U.S. government's credit rating from Aaa to Aa1, citing concerns about fiscal strength and the increasing national debt. Historically, such downgrades have often sent shockwaves through global markets. However, this time, the reaction was markedly different. The S&P 500 surged over 2% during the six-day period following the downgrade, demonstrating a level of investor confidence that defied expectations.

<h3>Why the muted reaction?</h3>

Several factors may account for the market's unexpected resilience:

- Already-priced-in concerns: Many analysts argue that the concerns reflected in Moody's downgrade were already largely factored into market valuations. The escalating national debt and political gridlock in Washington D.C. have been ongoing issues, and investors may have already adjusted their portfolios accordingly.

- Strong economic data: Recent economic data, including better-than-expected job growth and resilient consumer spending, may have offset the negative impact of the downgrade. This positive economic outlook continues to bolster investor confidence despite the lowered credit rating.

- Focus on interest rate trajectory: Instead of focusing solely on the downgrade, many investors appear to be prioritizing the Federal Reserve's anticipated interest rate decisions. The expectation of a pause or even rate cuts in the near future seems to be outweighing concerns about the U.S. credit rating.

- Global economic dynamics: The current global economic landscape, with various countries experiencing different levels of economic growth and stability, might have also played a role in minimizing the market's response to the downgrade.

<h3>What does this mean for investors?</h3>

The muted reaction to Moody's downgrade presents a complex situation for investors. While the S&P 500's rally is encouraging, it doesn't necessarily signal the end of economic uncertainty. The long-term implications of the downgrade, particularly concerning borrowing costs and investor confidence, remain to be seen.

It's crucial for investors to maintain a diversified portfolio and carefully consider their risk tolerance. Staying informed about economic indicators, interest rate decisions, and geopolitical events is crucial for navigating the current market landscape. Consider consulting with a financial advisor to develop a strategy that aligns with your individual financial goals.

<h3>Looking Ahead: Uncertainty Remains</h3>

While the market's initial response to the downgrade was surprisingly positive, the long-term effects remain uncertain. The ongoing debate surrounding fiscal policy, coupled with potential future economic headwinds, suggests that investors should remain vigilant and adapt their strategies accordingly. The interplay between economic data, interest rate expectations, and geopolitical events will continue to shape market dynamics in the coming months. This situation underscores the importance of continuous monitoring and informed decision-making in the ever-evolving world of finance.

Keywords: Moody's, credit rating downgrade, S&P 500, stock market rally, US economy, fiscal strength, national debt, interest rates, investor sentiment, economic indicators, financial markets, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Fails To Dent Market: S&P 500 Leads Six-Day Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Market Update Six Day Winning Streak For S And P 500 Positive Day For Dow And Nasdaq

May 21, 2025

Market Update Six Day Winning Streak For S And P 500 Positive Day For Dow And Nasdaq

May 21, 2025 -

Claim Your Helldivers 2 Warbonds Masters Of Ceremony On May 15th

May 21, 2025

Claim Your Helldivers 2 Warbonds Masters Of Ceremony On May 15th

May 21, 2025 -

Analysis Putins Actions Underscore Trumps Waning International Clout

May 21, 2025

Analysis Putins Actions Underscore Trumps Waning International Clout

May 21, 2025 -

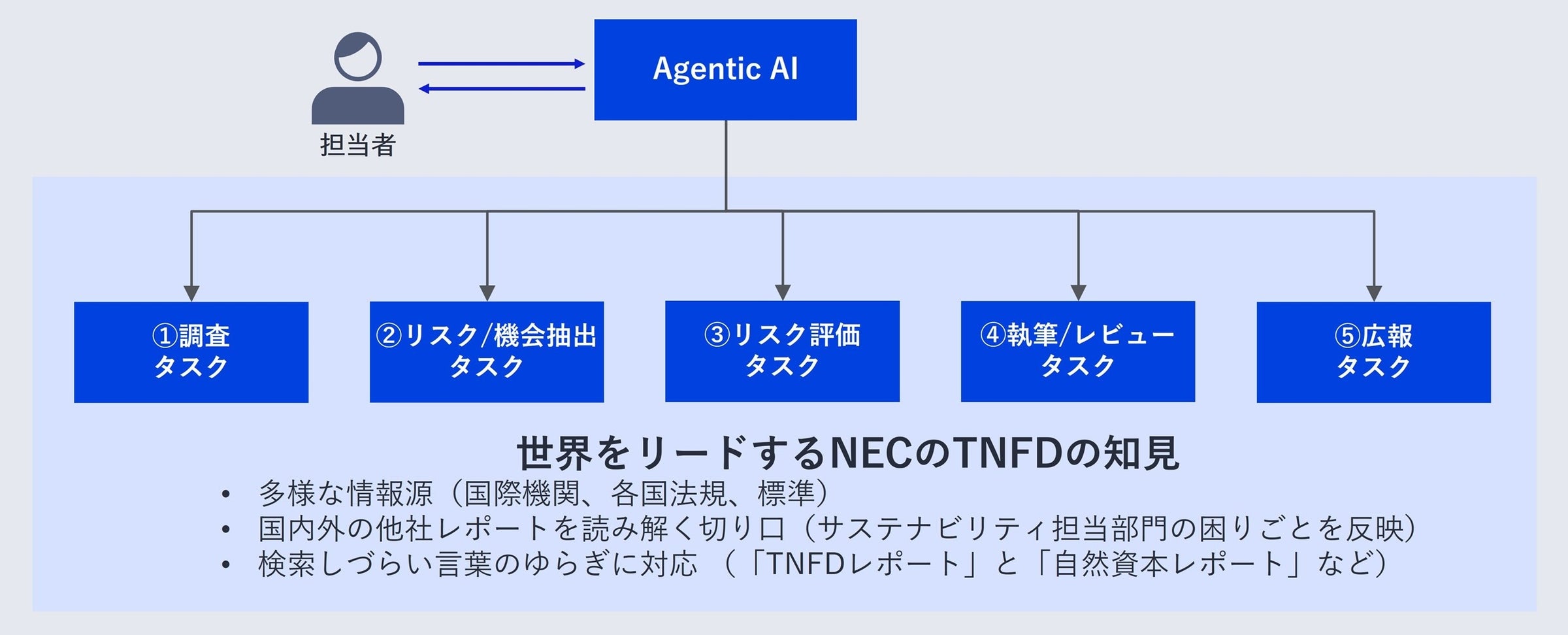

Tnfd Nec

May 21, 2025

Tnfd Nec

May 21, 2025 -

The Power Of Research Examining The Contributions Of Us Medical And Scientific Advancements

May 21, 2025

The Power Of Research Examining The Contributions Of Us Medical And Scientific Advancements

May 21, 2025