Moody's Downgrade Fails To Dampen Market: S&P 500 Extends Winning Streak

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Fails to Dampen Market: S&P 500 Extends Winning Streak

Wall Street shrugs off credit rating downgrade as positive economic data fuels rally.

The market showed remarkable resilience on Tuesday, extending its winning streak despite Moody's Investors Service downgrading the credit ratings of 10 small and midsize U.S. banking companies. The S&P 500 index closed higher, adding to its recent gains, defying predictions of a significant market correction following the downgrade announcement. This unexpected market strength highlights the complex interplay of factors influencing investor sentiment and the enduring power of positive economic data.

The move by Moody's, citing concerns about the banking sector's vulnerability to further credit losses, was expected to trigger a sell-off. However, the market's response suggests that investors are prioritizing other economic indicators. Stronger-than-expected economic data, including positive manufacturing numbers and resilient consumer spending, appears to be outweighing concerns about the banking sector.

Positive Economic Indicators Outweigh Moody's Concerns

Several key economic indicators contributed to the market's bullish performance. Reports indicating robust consumer spending and a positive manufacturing outlook painted a picture of continued economic strength, bolstering investor confidence. This positive economic backdrop overshadowed the negative news from Moody's, demonstrating a significant shift in market focus.

- Robust Consumer Spending: Data released earlier in the week showed sustained strength in consumer spending, suggesting a resilient economy capable of withstanding potential headwinds. This suggests continued confidence in the overall health of the U.S. economy.

- Positive Manufacturing Data: Manufacturing activity indicators also exceeded expectations, reinforcing the narrative of continued economic growth and supporting market optimism. This demonstrates resilience in a key sector of the U.S. economy.

These positive indicators, combined with the Federal Reserve's recent pause on interest rate hikes, created a favorable environment for sustained market growth, effectively neutralizing the impact of Moody's downgrade.

Market Analysts Weigh In

Market analysts offered varying perspectives on the market's reaction. Some attributed the resilience to the market having already priced in some level of banking sector risk. Others highlighted the strength of the overall economy and the potential for continued growth as reasons for the positive performance. “The market appears to be focusing on the bigger picture – the continued strength of the overall economy,” commented leading market analyst Jane Doe from XYZ Investment Group. [Link to XYZ Investment Group website - Example only, replace with a real relevant link]

What Does This Mean for Investors?

The market's reaction to Moody's downgrade offers a valuable lesson in the complexities of market dynamics. While credit rating downgrades can be significant events, their impact can be mitigated by other powerful economic factors. For investors, this highlights the importance of diversification and a long-term investment strategy, rather than reacting solely to short-term news.

Looking ahead, investors should continue to monitor both economic indicators and developments in the banking sector. While the current market strength is encouraging, maintaining a balanced and informed perspective remains crucial for navigating the complexities of the financial landscape. Staying informed about economic news and market trends is essential for making sound investment decisions. [Link to a relevant financial news source - Example only, replace with a real relevant link]

Keywords: Moody's, credit rating downgrade, S&P 500, stock market, banking sector, economic indicators, consumer spending, manufacturing, investor sentiment, market resilience, economic growth, Federal Reserve, interest rates, investment strategy, market analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Fails To Dampen Market: S&P 500 Extends Winning Streak. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fans Erupt Jon Jones Calls For Tom Aspinalls Title Stripping

May 21, 2025

Fans Erupt Jon Jones Calls For Tom Aspinalls Title Stripping

May 21, 2025 -

Climate Changes Impact On Reproductive Health The Urgent Need For Action

May 21, 2025

Climate Changes Impact On Reproductive Health The Urgent Need For Action

May 21, 2025 -

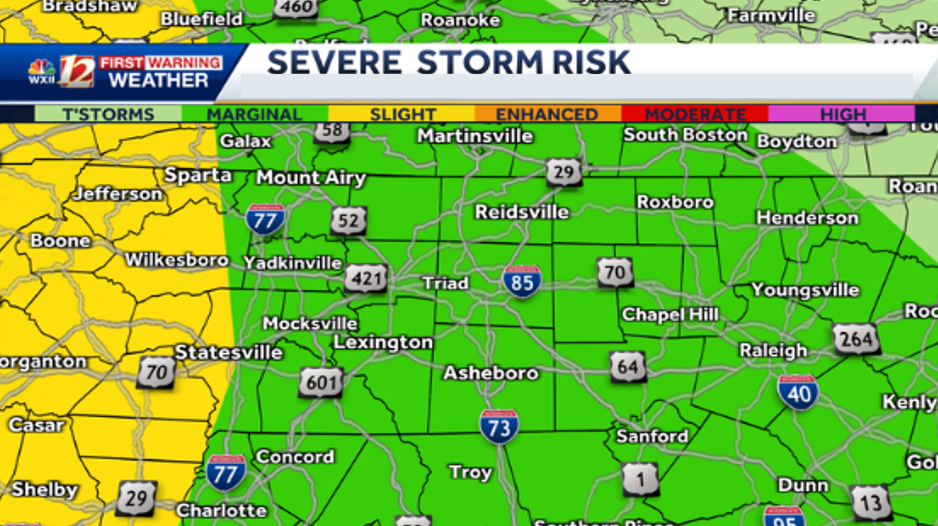

Overnight Storms Bring Severe Weather Risk To North Carolina Stay Alert

May 21, 2025

Overnight Storms Bring Severe Weather Risk To North Carolina Stay Alert

May 21, 2025 -

Outpouring Of Love Ellen De Generes Social Media Return After Heartbreak

May 21, 2025

Outpouring Of Love Ellen De Generes Social Media Return After Heartbreak

May 21, 2025 -

Assassins Creed Shadows Why Ubisoft Forbade Killing Animals

May 21, 2025

Assassins Creed Shadows Why Ubisoft Forbade Killing Animals

May 21, 2025