MicroStrategy's New Preferred Stock: A 9% Dividend Yield

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MicroStrategy's New Preferred Stock: A Tempting 9% Dividend Yield, But Is It Worth the Risk?

MicroStrategy Incorporated (MSTR), the business intelligence firm known for its significant Bitcoin holdings, has launched a new offering designed to attract yield-hungry investors: a preferred stock with a juicy 9% dividend yield. This announcement sent ripples through the financial markets, prompting investors to assess the potential rewards against the inherent risks. But is this high-yield preferred stock a smart investment, or a trap for the unwary?

Understanding the Offering:

MicroStrategy's Series A Mandatory Convertible Preferred Stock offers a compelling dividend yield of 9%, significantly higher than many other comparable investments currently available. This high yield is designed to attract investors seeking passive income in a time of rising interest rates. The stock also includes a mandatory conversion feature, meaning it will automatically convert into common stock under specific circumstances, offering potential for capital appreciation beyond the dividend payments.

The Allure of High Yield:

A 9% dividend yield is undeniably attractive in the current market environment. With inflation remaining a concern and interest rates fluctuating, income-oriented investors are actively searching for high-yield options. MicroStrategy's offering directly targets this demand, presenting a potentially lucrative opportunity for those seeking substantial passive income streams. This high yield could be particularly appealing to retirees or individuals with a longer-term investment horizon seeking stable returns.

However, Proceed with Caution:

While the high dividend yield is enticing, investors must carefully consider the risks associated with this investment. Preferred stock generally ranks below common stock in the capital structure, meaning preferred stockholders are paid dividends before common stockholders, but they may have lower upside potential. The mandatory conversion feature introduces another layer of complexity, creating uncertainty about the future value of the investment.

Key Risk Factors to Consider:

- Company Performance: The dividend payments are dependent on MicroStrategy's financial health. Any downturn in the company's performance could impact its ability to maintain or increase dividend payouts. The company's heavy reliance on Bitcoin further adds volatility to its financial outlook.

- Interest Rate Risk: Rising interest rates could make the preferred stock less attractive compared to other fixed-income investments.

- Conversion Risk: The mandatory conversion features introduce uncertainty regarding the future value of the investment, potentially limiting capital appreciation opportunities compared to traditional common stock investments.

Comparing to Other High-Yield Investments:

Before investing in MicroStrategy's preferred stock, investors should compare it to other high-yield alternatives, such as high-yield bonds or dividend-paying stocks. This comparative analysis should include a thorough assessment of risks, potential returns, and diversification strategies. Consider seeking advice from a qualified financial advisor to make an informed decision.

Conclusion:

MicroStrategy's new preferred stock offering presents a potentially attractive investment opportunity for those seeking high dividend yields. However, the significant risks associated with the investment should not be overlooked. A thorough understanding of the company's financial health, the implications of the mandatory conversion, and a comparison with other high-yield alternatives are crucial before making any investment decisions. Remember, high yield often comes with high risk. Proceed with caution and consult a financial professional to assess if this investment aligns with your individual risk tolerance and financial goals.

Keywords: MicroStrategy, preferred stock, dividend yield, high-yield investment, MSTR, investment risk, mandatory convertible preferred stock, Bitcoin, passive income, interest rates, financial analysis, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MicroStrategy's New Preferred Stock: A 9% Dividend Yield. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mario Kart World 1 2 0 3 Lap Courses Cpu Nerf And More

Jul 31, 2025

Mario Kart World 1 2 0 3 Lap Courses Cpu Nerf And More

Jul 31, 2025 -

Exclusive Luka Doncic Reveals Offseason Training Focus Following Lakers Series

Jul 31, 2025

Exclusive Luka Doncic Reveals Offseason Training Focus Following Lakers Series

Jul 31, 2025 -

Domestic Violence Funding Cuts A Deadly Consequence

Jul 31, 2025

Domestic Violence Funding Cuts A Deadly Consequence

Jul 31, 2025 -

Geleceginizi Sekillendirecek Ueniversite Ve Boeluem Secimi Stratejileri

Jul 31, 2025

Geleceginizi Sekillendirecek Ueniversite Ve Boeluem Secimi Stratejileri

Jul 31, 2025 -

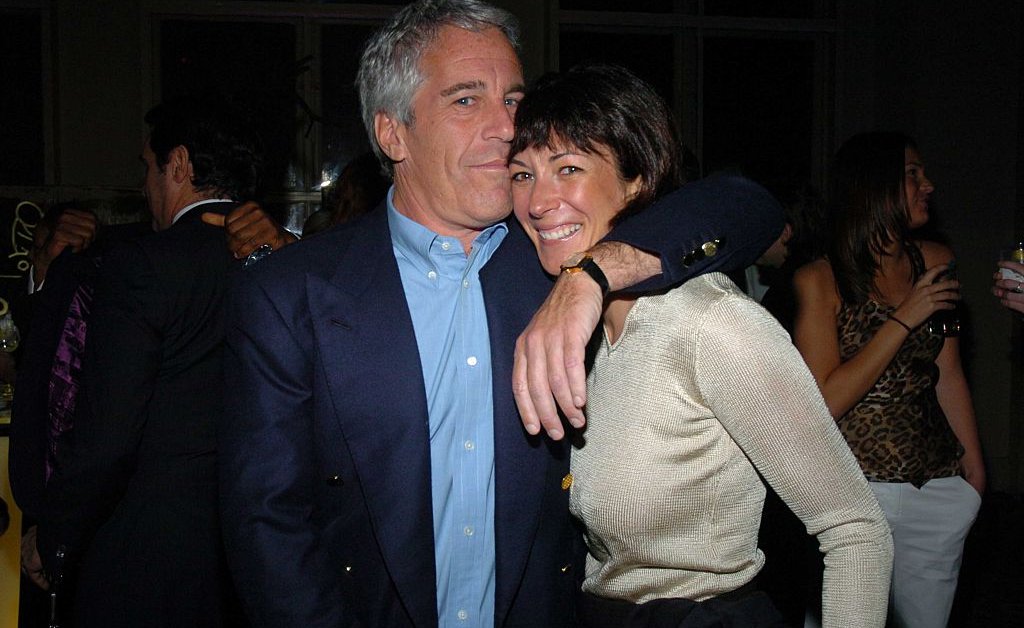

Who Is Ghislaine Maxwell Unraveling Her Connection To Jeffrey Epstein

Jul 31, 2025

Who Is Ghislaine Maxwell Unraveling Her Connection To Jeffrey Epstein

Jul 31, 2025