Michele Bullock, RBA: Cash Rate Pause – A Strategic Move For Australia?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Michele Bullock, RBA: Cash Rate Pause – A Strategic Move for Australia?

The Reserve Bank of Australia (RBA) Governor, Michele Bullock, recently announced a pause in the cash rate, leaving it unchanged at 4.1%. This decision, while seemingly a break from the aggressive rate hikes of the past year, has sparked considerable debate amongst economists and the public alike. Is this a strategic pause designed to assess the impact of previous increases, or a sign that the RBA’s tightening cycle is finally coming to an end? Let's delve into the complexities of this crucial monetary policy decision.

Understanding the RBA's Rationale

The RBA's primary mandate is to maintain price stability and full employment. Inflation, which soared to a 30-year high in 2022, has been the central focus of the bank's recent policy decisions. The aggressive rate hikes were implemented to cool down the overheating economy and curb inflation. However, the recent pause suggests a shift in strategy.

Governor Bullock cited several factors contributing to the decision. These include:

- Lagging effects of previous rate hikes: The full impact of the previous interest rate increases is yet to be felt, with a significant time lag often existing between policy changes and their effect on the economy. This makes accurate prediction challenging.

- Weakening economic growth: While inflation remains a concern, signs of slowing economic growth are becoming increasingly apparent. This necessitates a more cautious approach to further rate increases.

- Global economic uncertainty: The global economic landscape remains uncertain, with various challenges including the war in Ukraine and ongoing supply chain disruptions. This uncertainty further complicates the RBA's decision-making process.

Is it a Pause or a Pivot?

The crucial question on everyone's mind is whether this pause signifies a temporary breather or a complete pivot in monetary policy. While the RBA has refrained from declaring a definitive end to the tightening cycle, the language used in the announcement suggests a more data-dependent approach moving forward.

The RBA will closely monitor key economic indicators, including inflation data, employment figures, and consumer spending, before making any further decisions. This data-driven approach underscores the complexity of the situation and the challenges faced by the central bank in navigating a delicate balancing act between inflation control and economic growth.

The Impact on Australian Households and Businesses

The pause will offer some relief to Australian households and businesses grappling with higher borrowing costs. However, the uncertainty surrounding future rate movements continues to present challenges for long-term planning. The impact will vary depending on individual circumstances, particularly for those with significant variable-rate mortgages.

Looking Ahead: What to Expect

The coming months will be crucial in determining the RBA's next move. Market analysts and economists are closely watching inflation figures and other economic data. Any significant deviation from the RBA's forecasts could trigger another rate hike or, conversely, potentially signal the end of the tightening cycle. The situation remains fluid, and continued monitoring of the economic landscape is essential.

Further Reading:

For more in-depth analysis of the RBA's monetary policy, you can refer to the official RBA website: [Link to RBA website]

Conclusion:

Michele Bullock's decision to pause the cash rate represents a significant moment in Australia's economic story. While offering temporary respite, the decision highlights the delicate balancing act the RBA faces in managing inflation and fostering sustainable economic growth. The coming months will be critical in revealing whether this pause marks a strategic recalibration or a turning point in the RBA's monetary policy trajectory. Only time will tell if this strategic pause proves to be the right move for Australia's economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Michele Bullock, RBA: Cash Rate Pause – A Strategic Move For Australia?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Upcoming Rocket Launches Your Guide To Space X Nasa And Ula Missions From Cape Canaveral

Jul 09, 2025

Upcoming Rocket Launches Your Guide To Space X Nasa And Ula Missions From Cape Canaveral

Jul 09, 2025 -

Did You Spot This Batman Star In A Young Sheldon Episode

Jul 09, 2025

Did You Spot This Batman Star In A Young Sheldon Episode

Jul 09, 2025 -

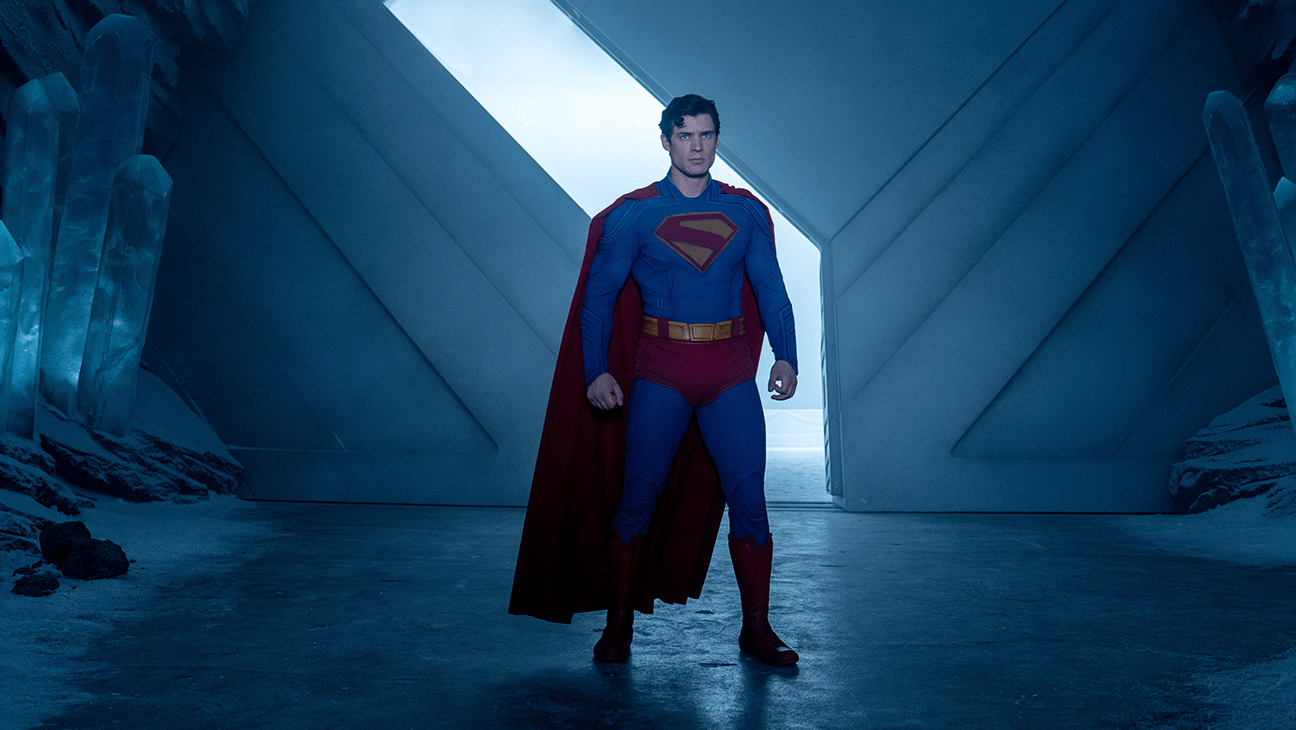

Early Reviews Praise James Gunns Superman A Promising New Beginning

Jul 09, 2025

Early Reviews Praise James Gunns Superman A Promising New Beginning

Jul 09, 2025 -

Update Neillsville Womans Plea In Lottery Ticket Alteration Case

Jul 09, 2025

Update Neillsville Womans Plea In Lottery Ticket Alteration Case

Jul 09, 2025 -

Sri Lanka To Bat First Key Odi Match Against Bangladesh Begins

Jul 09, 2025

Sri Lanka To Bat First Key Odi Match Against Bangladesh Begins

Jul 09, 2025

Latest Posts

-

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025

Quentin Tarantinos Inglourious Basterds 2009 Cast Characters And Legacy

Jul 09, 2025 -

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025

R25 Lakh For Freedom Assamese Influencer Archita Phukans Struggle With Prostitution

Jul 09, 2025 -

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025

Sarah Fergusons Refusal Of Kings Invitation A Royal Family Mystery

Jul 09, 2025 -

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025

Cape Canaveral Launch Follow Space Xs Falcon 9 Starlink Deployment Live

Jul 09, 2025 -

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025

Superman First Reactions Hail New Film As Thrilling Dcu Launch

Jul 09, 2025