May 30th Market Update: Hims & Hers Health (HIMS) Shares Climb 3.02%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

May 30th Market Update: Hims & Hers Health (HIMS) Shares Climb 3.02% – A Bullish Sign?

The telehealth market saw a surge of positive sentiment today, with Hims & Hers Health (HIMS) shares experiencing a notable 3.02% climb. This upward trend has investors buzzing, prompting questions about the future trajectory of this prominent telehealth company. But what fueled this increase, and what does it mean for potential investors? Let's dive into the details.

Hims & Hers Health (HIMS): A Quick Overview

Before we analyze today's market movement, a brief recap of Hims & Hers Health is in order. Hims & Hers is a leading telehealth platform offering a wide range of healthcare services, including mental health support, sexual health products, and dermatological treatments. Their direct-to-consumer model and convenient online platform have made them a significant player in the rapidly expanding telehealth sector. The company has been aggressively expanding its offerings and targeting new demographic groups, making them a compelling investment for many.

Factors Contributing to Today's 3.02% Surge

While pinpointing the exact cause of any single day's stock movement is challenging, several factors likely contributed to today's positive performance for HIMS:

- Positive Market Sentiment: The broader market showed signs of recovery today, contributing to a generally positive investor sentiment. This overall optimism often lifts even individual stocks, particularly those with growth potential like HIMS.

- Strong Q1 Earnings (Potential): While official reports haven't been released yet, market speculation and analyst predictions might point to strong Q1 earnings. Positive whispers in the financial community can significantly influence stock prices.

- Increased User Base: The company’s continued growth in user acquisition could also be a driving factor. A larger and more engaged user base suggests increased revenue potential, attracting the attention of investors.

- Strategic Partnerships or Announcements: Although not confirmed at the time of writing, the possibility of strategic partnerships or new product announcements could have fueled the positive market response. Keep an eye out for official press releases from Hims & Hers Health.

What Does This Mean for Investors?

The 3.02% increase is certainly encouraging for current HIMS investors, but it's crucial not to overreact to short-term fluctuations. While this positive movement suggests a degree of market confidence, investors should conduct thorough due diligence before making any investment decisions. Analyzing the company's financials, future growth prospects, and competitive landscape is essential.

Looking Ahead: Potential Challenges and Opportunities

Despite today's positive news, Hims & Hers Health faces several challenges. Increased competition in the telehealth space, regulatory hurdles, and maintaining profitability are all important considerations. However, the company's innovative approach, expanding product line, and strong brand recognition present significant opportunities for future growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Further Research: For more detailed information, we recommend reviewing Hims & Hers Health's official investor relations website and consulting reputable financial news sources.

Keywords: Hims & Hers Health, HIMS, telehealth, stock market, market update, stock price, investment, Q1 earnings, healthcare, online healthcare, direct-to-consumer, market sentiment, stock market analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on May 30th Market Update: Hims & Hers Health (HIMS) Shares Climb 3.02%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Longtime Podcast Wtf With Marc Maron To Conclude After Successful 16 Year Run

Jun 03, 2025

Longtime Podcast Wtf With Marc Maron To Conclude After Successful 16 Year Run

Jun 03, 2025 -

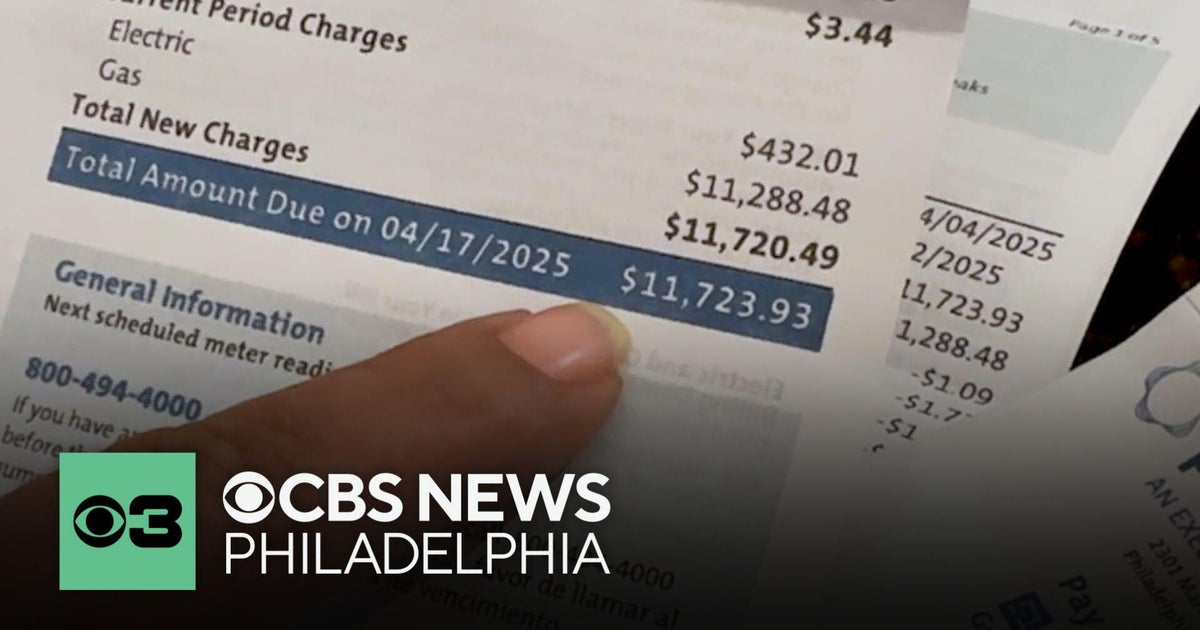

Pennsylvania Utility Customer Disputes Massive 12 000 Peco Energy Bill

Jun 03, 2025

Pennsylvania Utility Customer Disputes Massive 12 000 Peco Energy Bill

Jun 03, 2025 -

Rising Dte Energy Costs A Looming Financial Crisis For Michigan Families

Jun 03, 2025

Rising Dte Energy Costs A Looming Financial Crisis For Michigan Families

Jun 03, 2025 -

The 2 C Threshold Essential Actions For Corporate Climate Resilience

Jun 03, 2025

The 2 C Threshold Essential Actions For Corporate Climate Resilience

Jun 03, 2025 -

Collective Bargaining For Federal Employees Challenges And Opportunities Ahead

Jun 03, 2025

Collective Bargaining For Federal Employees Challenges And Opportunities Ahead

Jun 03, 2025