Massive Bitcoin ETF Investment: A Deep Dive Into The Recent $5B+ Influx

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Massive Bitcoin ETF Investment: A Deep Dive into the Recent $5B+ Influx

The cryptocurrency world is buzzing after witnessing a staggering influx of over $5 billion into Bitcoin exchange-traded funds (ETFs) in just the last few weeks. This unprecedented surge marks a significant turning point, signaling a growing institutional confidence in Bitcoin and its potential as a mainstream asset. But what's driving this monumental investment, and what does it mean for the future of Bitcoin and the broader crypto market? Let's dive deep into this exciting development.

The $5 Billion Question: What Fueled This Massive Investment?

Several factors contribute to this remarkable investment boom in Bitcoin ETFs. One key driver is the recent approval of several Bitcoin ETFs by the US Securities and Exchange Commission (SEC). This regulatory green light has opened the floodgates for institutional investors, who were previously hesitant due to regulatory uncertainty. The availability of regulated and easily accessible Bitcoin investment vehicles through ETFs significantly reduces the perceived risk and operational complexities involved in directly holding Bitcoin.

Another contributing factor is the increasing macroeconomic uncertainty. With inflation remaining stubbornly high and traditional markets experiencing volatility, investors are seeking alternative assets that offer diversification and potential for higher returns. Bitcoin, with its decentralized nature and limited supply, is increasingly viewed as a hedge against inflation and geopolitical instability.

Furthermore, the growing institutional adoption of Bitcoin is playing a crucial role. Major financial institutions, including BlackRock, Fidelity, and Invesco, are now actively involved in the Bitcoin ETF space, lending credibility and further attracting investment. This signals a shift in the perception of Bitcoin, moving beyond its early days of being primarily associated with speculative trading to a more mature and established asset class.

A Closer Look at the Impact:

This massive investment is likely to have several significant impacts:

- Increased Bitcoin Price Volatility: The influx of capital can lead to short-term price fluctuations as investors buy and sell. However, the long-term impact is expected to be positive, leading to gradual price appreciation.

- Greater Market Liquidity: The increased trading volume in Bitcoin ETFs will improve market liquidity, making it easier for investors to buy and sell Bitcoin without significantly impacting the price.

- Increased Mainstream Adoption: The success of Bitcoin ETFs paves the way for broader mainstream adoption. More investors, particularly those who are unfamiliar with or hesitant about direct cryptocurrency trading, can now gain exposure to Bitcoin through regulated channels.

- Further Regulatory Scrutiny: The significant growth in Bitcoin ETF investment is likely to lead to increased regulatory scrutiny of the cryptocurrency market. This could potentially lead to stricter regulations but also greater clarity and stability.

What Does the Future Hold?

The recent $5 billion+ investment in Bitcoin ETFs marks a watershed moment for the cryptocurrency market. While short-term price volatility is expected, the long-term outlook remains overwhelmingly positive. The growing institutional adoption, increased regulatory clarity, and the inherent characteristics of Bitcoin as a decentralized, limited-supply asset all point towards a future where Bitcoin plays a significant role in the global financial landscape. This trend is likely to continue, potentially attracting even more investment in the years to come.

Call to Action: Stay informed about the latest developments in the crypto market by subscribing to our newsletter and following us on social media. Remember to conduct thorough research before making any investment decisions. This article is for informational purposes only and does not constitute financial advice.

Keywords: Bitcoin ETF, Bitcoin Exchange Traded Fund, Bitcoin Investment, Cryptocurrency Investment, Institutional Investment, SEC Approval, Bitcoin Price, Crypto Market, Macroeconomic Uncertainty, Inflation Hedge, Bitcoin Adoption, Regulatory Clarity.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Massive Bitcoin ETF Investment: A Deep Dive Into The Recent $5B+ Influx. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Immigrant Competition For U S Citizenship A Proposed Reality Tv Show

May 20, 2025

Immigrant Competition For U S Citizenship A Proposed Reality Tv Show

May 20, 2025 -

Helldivers 2 May 15th Update New Warbond Drops And Masters Of Ceremony

May 20, 2025

Helldivers 2 May 15th Update New Warbond Drops And Masters Of Ceremony

May 20, 2025 -

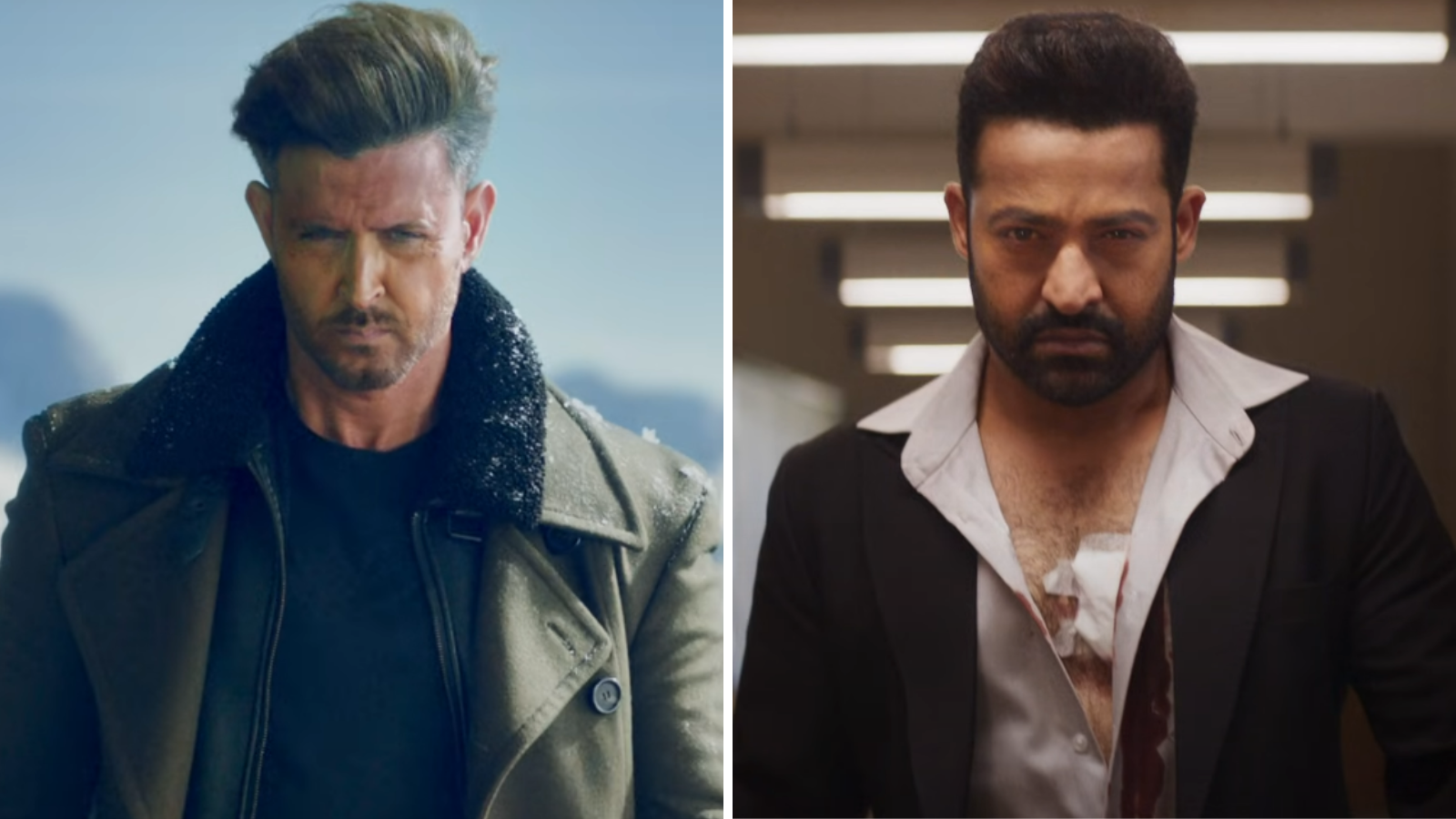

Fans React War 2 Teaser Promises A Bigger Spectacle Than Rrr And Pathaan

May 20, 2025

Fans React War 2 Teaser Promises A Bigger Spectacle Than Rrr And Pathaan

May 20, 2025 -

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025 -

Jenn Stergers Account The Untold Story Of The Brett Favre Sexting Scandals Impact

May 20, 2025

Jenn Stergers Account The Untold Story Of The Brett Favre Sexting Scandals Impact

May 20, 2025