Massive Bitcoin ETF Investment: $5 Billion And Counting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Massive Bitcoin ETF Investment: $5 Billion and Counting – A New Era for Crypto?

The cryptocurrency world is buzzing with excitement as investments into Bitcoin exchange-traded funds (ETFs) surge past the incredible milestone of $5 billion. This monumental influx of capital signals a significant shift in the perception and acceptance of Bitcoin as a mainstream asset class, potentially ushering in a new era of crypto adoption. But what's driving this unprecedented growth, and what does it mean for the future of Bitcoin and the broader cryptocurrency market?

The Surge in Bitcoin ETF Investment: A Closer Look

The recent approval of the first spot Bitcoin ETF in the United States acted as a catalyst, igniting a wave of investment that continues to gain momentum. This regulatory breakthrough, long awaited by industry players, has legitimized Bitcoin in the eyes of many institutional investors who were previously hesitant due to regulatory uncertainty. The $5 billion figure represents a significant commitment from both large and small investors, showcasing a growing confidence in Bitcoin's long-term potential.

Several factors contribute to this surge:

- Regulatory Clarity: The approval of a spot Bitcoin ETF provided much-needed regulatory clarity, reducing the perceived risk associated with investing in Bitcoin.

- Institutional Adoption: Major financial institutions are increasingly incorporating Bitcoin into their portfolios, viewing it as a potential hedge against inflation and diversification strategy.

- Growing Mainstream Acceptance: Bitcoin is gradually gaining wider acceptance among the general public, driven by increasing media coverage and the growing understanding of its underlying technology.

- Limited Supply: Bitcoin's inherent scarcity, with a fixed supply of 21 million coins, is another factor driving its value and attracting investors seeking a store of value.

What Does This Mean for the Future?

This massive investment in Bitcoin ETFs signifies a potential turning point for the cryptocurrency market. The increased liquidity and accessibility offered by ETFs are likely to attract even more investors, further driving up Bitcoin's price. However, it's crucial to remember that the cryptocurrency market is inherently volatile, and price fluctuations are to be expected.

Potential Challenges and Considerations:

While the current trend is overwhelmingly positive, it's important to acknowledge potential challenges:

- Market Volatility: The cryptocurrency market remains volatile, and sharp price corrections are possible. Investors should be prepared for potential risks.

- Regulatory Uncertainty (Globally): While the US has made significant strides, regulatory landscapes in other countries remain uncertain, potentially impacting global adoption.

- Environmental Concerns: The energy consumption associated with Bitcoin mining remains a subject of ongoing debate and scrutiny.

Looking Ahead: The Potential of Bitcoin ETFs

The $5 billion invested in Bitcoin ETFs is just the beginning. As more ETFs are approved and the regulatory landscape becomes clearer, we can expect even greater investment flows into the Bitcoin market. This could significantly impact the price of Bitcoin and the broader cryptocurrency landscape, potentially leading to a period of sustained growth and mainstream adoption. The future remains bright, but investors should always conduct thorough research and understand the risks involved before investing in any cryptocurrency.

Further Reading:

Call to Action: Stay informed about the latest developments in the cryptocurrency market and conduct thorough research before making any investment decisions. Consider consulting with a financial advisor before investing in cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Massive Bitcoin ETF Investment: $5 Billion And Counting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Russias Ukraine Assault Intensifies Trump Attempts To Broker Peace Talks Between Putin And Zelensky

May 21, 2025

Russias Ukraine Assault Intensifies Trump Attempts To Broker Peace Talks Between Putin And Zelensky

May 21, 2025 -

5 B Poured Into Bitcoin Etfs Directional Bets And Future Outlook

May 21, 2025

5 B Poured Into Bitcoin Etfs Directional Bets And Future Outlook

May 21, 2025 -

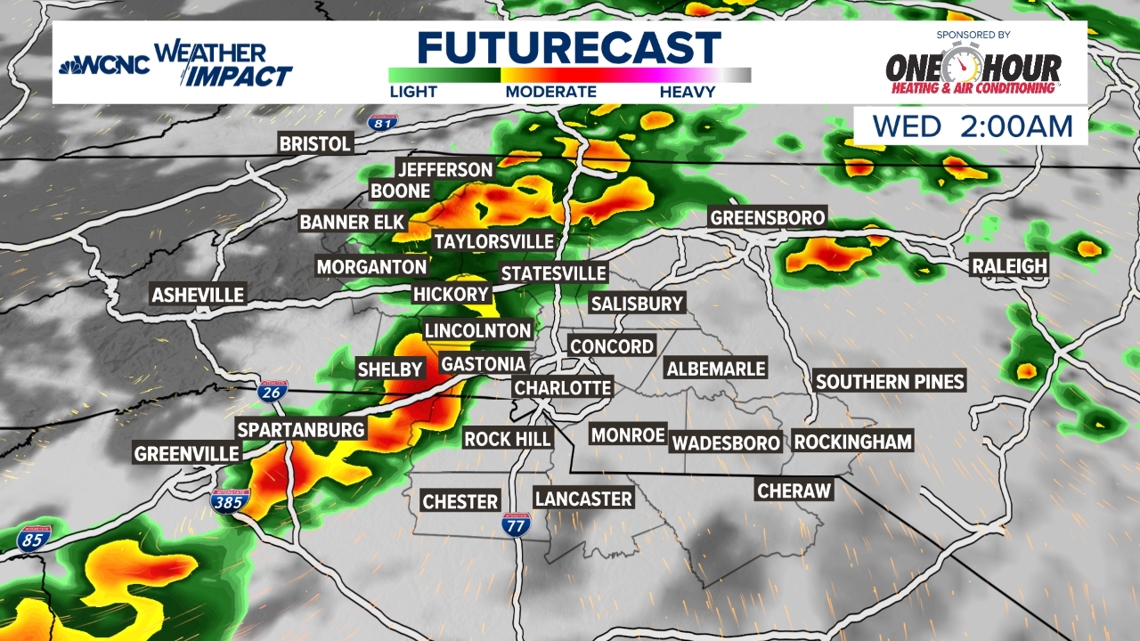

Few Strong Storms Expected Late Tuesday Very Isolated Threat

May 21, 2025

Few Strong Storms Expected Late Tuesday Very Isolated Threat

May 21, 2025 -

Overnight Severe Storm Watch Issued For Parts Of North Carolina Prepare For Heavy Rain

May 21, 2025

Overnight Severe Storm Watch Issued For Parts Of North Carolina Prepare For Heavy Rain

May 21, 2025 -

200 Million Inflows Ethereum Sees Investment Boom Following Pectra Upgrade

May 21, 2025

200 Million Inflows Ethereum Sees Investment Boom Following Pectra Upgrade

May 21, 2025