Market Volatility: Trump's Iran Comments Exacerbate S&P 500, Nasdaq Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: Trump's Iran Comments Exacerbate S&P 500, Nasdaq Losses

Tensions in the Middle East sent shockwaves through global markets on Tuesday, with comments from former President Donald Trump further fueling uncertainty and deepening losses for the S&P 500 and Nasdaq. The already jittery market, grappling with rising interest rates and inflation concerns, experienced a fresh wave of selling pressure following Trump's remarks on Iran. This article delves into the specifics of the market downturn and analyzes the impact of Trump's statements on investor sentiment.

Trump's Inflammatory Remarks Ignite Market Fears

Trump's comments, which [insert a link to a reputable news source reporting on Trump's exact comments here], rekindled fears of escalating tensions in the Middle East. His statements [briefly and neutrally summarize the content of the comments and their perceived implications for Iran]. This, coupled with already existing concerns about geopolitical instability in the region, triggered a sell-off across major indices.

The Impact on Key Indices: S&P 500 and Nasdaq

The S&P 500, a broad measure of the US stock market, experienced a significant decline, falling by [insert percentage] on Tuesday. The tech-heavy Nasdaq Composite fared even worse, plummeting by [insert percentage]. These losses represent a continuation of a downward trend that has been observed in recent weeks, exacerbated by Trump's intervention.

-

Energy Sector Volatility: The energy sector, often sensitive to geopolitical events, saw particularly sharp fluctuations. Oil prices [insert information on oil price changes and their correlation to Trump's comments]. This volatility underscores the interconnectedness of global markets and the significant impact of political uncertainty on investment decisions.

-

Investor Sentiment Plunges: The sudden downturn reflects a sharp deterioration in investor sentiment. The uncertainty surrounding the situation in Iran has made investors hesitant to take on risk, leading to a widespread sell-off. This is further compounded by ongoing anxieties about inflation and the Federal Reserve's monetary policy.

Beyond Trump's Comments: Contributing Factors to Market Volatility

While Trump's statements undoubtedly played a significant role in Tuesday's market decline, it's crucial to acknowledge other contributing factors:

-

Inflationary Pressures: Persistent inflationary pressures continue to weigh on investor confidence, forcing central banks to maintain tighter monetary policies. This leads to higher interest rates, making borrowing more expensive for businesses and potentially slowing economic growth. Learn more about the current inflation situation by reading [insert link to a reputable economic news source].

-

Geopolitical Uncertainty: Beyond Iran, broader geopolitical uncertainties, including the ongoing war in Ukraine, contribute to overall market volatility. The ripple effects of these conflicts are felt globally, impacting supply chains and investor sentiment.

What's Next for the Market?

Predicting the market's future trajectory is inherently challenging. However, several factors will likely influence the market's performance in the coming days and weeks:

-

Further Developments in Iran: Any escalation or de-escalation in the situation in Iran will directly impact market sentiment. Close monitoring of geopolitical developments is crucial.

-

Federal Reserve Policy: The Federal Reserve's upcoming policy decisions will also significantly impact market behavior. Any shift in monetary policy could trigger further volatility.

-

Corporate Earnings: Upcoming corporate earnings reports will also influence investor confidence. Strong earnings could help offset some of the negative sentiment.

Conclusion:

Trump's comments regarding Iran significantly exacerbated existing market anxieties, leading to a sharp decline in the S&P 500 and Nasdaq. While his remarks were a key trigger, the downturn reflects a confluence of factors, including persistent inflation, geopolitical instability, and ongoing uncertainty about the future economic landscape. Investors should remain vigilant and carefully consider the risks associated with the current market environment. Staying informed about global events and economic indicators is crucial for navigating this period of volatility.

(Disclaimer: This article is for informational purposes only and should not be considered financial advice.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: Trump's Iran Comments Exacerbate S&P 500, Nasdaq Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

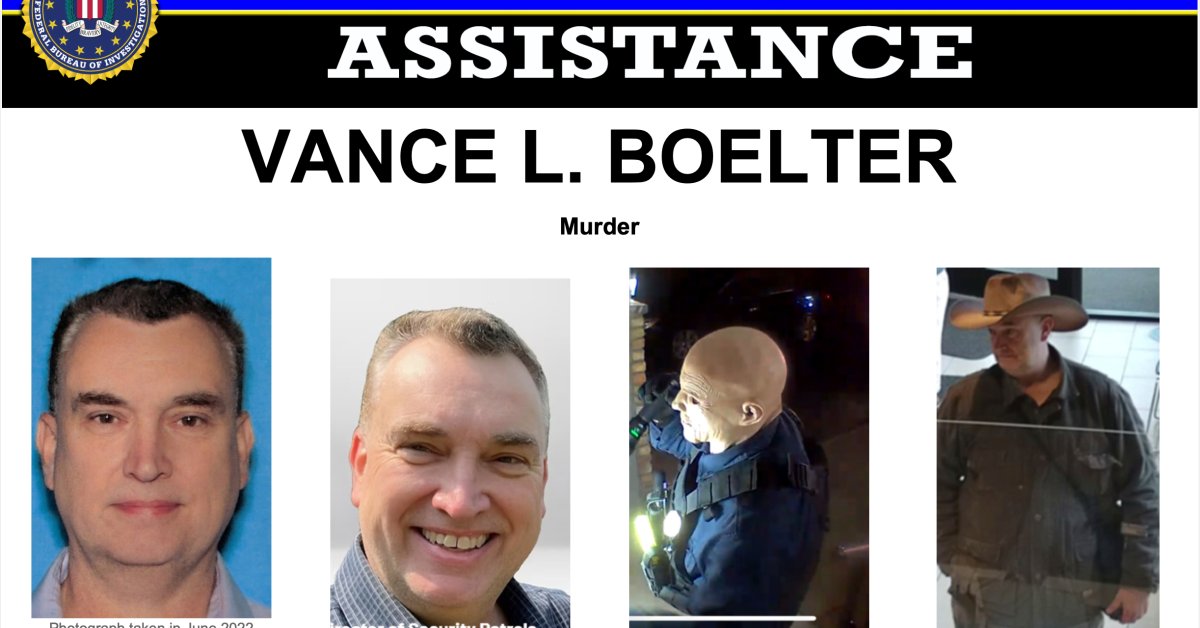

Shooting At Minnesota Capitol Suspect Vance Boelter In Custody Investigation Underway

Jun 21, 2025

Shooting At Minnesota Capitol Suspect Vance Boelter In Custody Investigation Underway

Jun 21, 2025 -

19 Mexican Mafia Gang Members Charged In Conspiracy To Kill La Rapper

Jun 21, 2025

19 Mexican Mafia Gang Members Charged In Conspiracy To Kill La Rapper

Jun 21, 2025 -

Club World Cup Harry Kanes Anticipation For Boca Juniors Match

Jun 21, 2025

Club World Cup Harry Kanes Anticipation For Boca Juniors Match

Jun 21, 2025 -

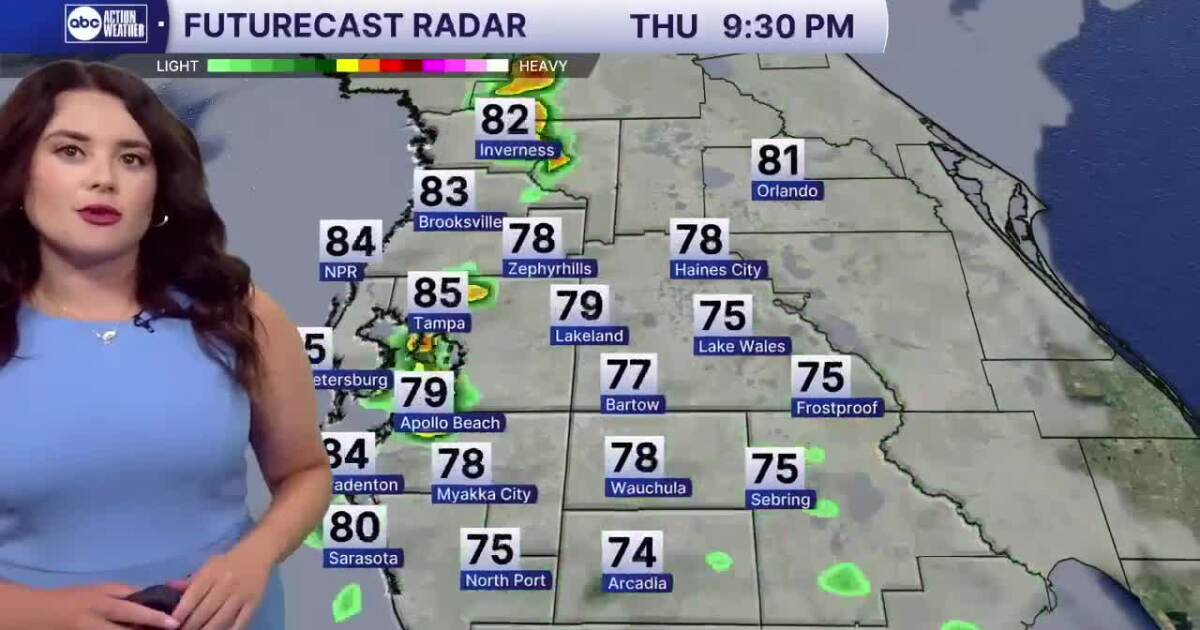

Todays Forecast Muggy Air And A Chance Of Late Day Showers

Jun 21, 2025

Todays Forecast Muggy Air And A Chance Of Late Day Showers

Jun 21, 2025 -

Club World Cup 2024 Bayern Munich Vs Boca Juniors Key Players And Predicted Starting Xi

Jun 21, 2025

Club World Cup 2024 Bayern Munich Vs Boca Juniors Key Players And Predicted Starting Xi

Jun 21, 2025