Market Volatility: S&P 500 And Nasdaq Slump Amidst Iran Situation And Fed Rate Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: S&P 500 and Nasdaq Slump Amidst Iran Situation and Fed Rate Expectations

Geopolitical tensions and interest rate anxieties send shockwaves through US stock markets.

The US stock market experienced a significant downturn this week, with the S&P 500 and Nasdaq Composite indices suffering notable declines. This volatility can be attributed to a confluence of factors, primarily the escalating situation in Iran and persistent uncertainty surrounding future Federal Reserve interest rate hikes. Investors, already grappling with high inflation and potential recessionary pressures, are reacting cautiously to these interconnected developments.

Iran Tensions Fuel Uncertainty:

The recent unrest in Iran, following the death of Mahsa Amini, has added a layer of geopolitical complexity to the already volatile global landscape. Increased tensions in the Middle East always carry the potential to disrupt oil supplies and impact global energy prices. This uncertainty is causing investors to seek safer havens, leading to a sell-off in riskier assets like stocks. The potential for further escalation and its cascading effects on the global economy are major concerns driving the current market slump. Analysts are closely monitoring developments in the region and their potential impact on inflation and economic growth. [Link to reputable news source on Iran situation]

Fed Rate Hikes and Inflationary Pressures:

Adding to the market's anxieties are ongoing concerns about the Federal Reserve's monetary policy. The Fed's aggressive approach to combatting inflation through interest rate hikes has raised fears of a potential recession. While higher interest rates aim to curb inflation, they also increase borrowing costs for businesses and consumers, potentially slowing economic activity. The market is nervously anticipating the Fed's next move, with investors closely scrutinizing economic data releases for clues about future rate decisions. [Link to Federal Reserve website]

S&P 500 and Nasdaq Take a Hit:

The impact of these factors is clearly visible in the performance of major market indices. The S&P 500, a broad measure of the US stock market, experienced a [percentage]% drop, while the tech-heavy Nasdaq Composite saw an even steeper decline of [percentage]%. This significant downturn reflects investor apprehension and a flight to safety. Sectors most sensitive to interest rate changes, such as technology and consumer discretionary, have been particularly hard hit.

What Does This Mean for Investors?

The current market volatility highlights the importance of a diversified investment strategy and a long-term perspective. While short-term fluctuations are inevitable, focusing on long-term goals and maintaining a balanced portfolio can help mitigate the impact of market downturns. Investors should consider consulting with a financial advisor to assess their risk tolerance and adjust their portfolios accordingly.

Looking Ahead:

The coming weeks will be crucial in determining the trajectory of the market. The evolution of the situation in Iran, upcoming economic data releases, and the Fed's subsequent policy decisions will all play significant roles in shaping investor sentiment. Market analysts are divided on the outlook, with some predicting further declines and others anticipating a potential rebound. It’s a time for careful monitoring and informed decision-making. Staying informed about global events and economic indicators is more important than ever for investors navigating this period of uncertainty.

Keywords: Market Volatility, S&P 500, Nasdaq, Iran, Federal Reserve, Interest Rates, Inflation, Recession, Geopolitical Risk, Stock Market, Investment Strategy, Economic Uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: S&P 500 And Nasdaq Slump Amidst Iran Situation And Fed Rate Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

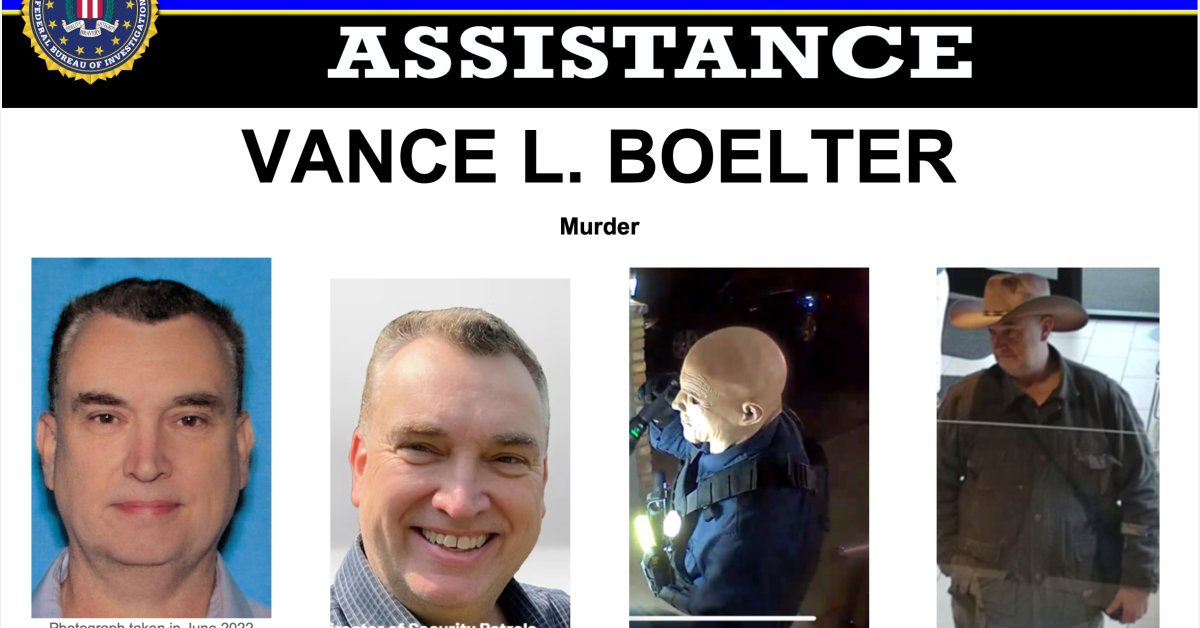

Minnesota Capitol Shooting Update On The Arrest Of Vance L Boelter

Jun 21, 2025

Minnesota Capitol Shooting Update On The Arrest Of Vance L Boelter

Jun 21, 2025 -

Bayern Munich Vs Boca Juniors Club World Cup Match Preview Starting Xi And Team News Updates

Jun 21, 2025

Bayern Munich Vs Boca Juniors Club World Cup Match Preview Starting Xi And Team News Updates

Jun 21, 2025 -

Increased Ice Activity Trumps New Deportation Strategy In Democratic Areas

Jun 21, 2025

Increased Ice Activity Trumps New Deportation Strategy In Democratic Areas

Jun 21, 2025 -

Tottenhams Kane Relishes Club World Cup Test Against Bocas Fearsome Fanbase

Jun 21, 2025

Tottenhams Kane Relishes Club World Cup Test Against Bocas Fearsome Fanbase

Jun 21, 2025 -

Kesha Slayyyter And Rose Gray Attention Tour Collaboration Details Revealed

Jun 21, 2025

Kesha Slayyyter And Rose Gray Attention Tour Collaboration Details Revealed

Jun 21, 2025