Market Volatility: S&P 500 And Nasdaq Losses Reflect Fed Rate Decisions And Iran Situation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: S&P 500 and Nasdaq Losses Reflect Fed Rate Decisions and Iran Situation

Wall Street experienced a turbulent week, with the S&P 500 and Nasdaq Composite suffering significant losses. This downturn reflects a confluence of factors, primarily the Federal Reserve's ongoing interest rate hikes and escalating tensions in Iran following the death of a prominent Iranian general. Investors are grappling with uncertainty across multiple sectors, leading to increased market volatility and prompting concerns about a potential recession.

The Fed's Impact on Market Sentiment: The Federal Reserve's commitment to combating inflation through aggressive interest rate increases continues to be a major driver of market volatility. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings. This week's market reaction underscores the sensitivity of investor sentiment to the Fed's monetary policy decisions. Analysts are closely watching upcoming economic data releases, such as inflation figures and employment reports, to gauge the Fed's future actions and their potential impact on the markets. [Link to a relevant article on Federal Reserve policy]

<h3>Geopolitical Uncertainty Adds to the Mix</h3>

The situation in Iran, following the recent events, has injected further uncertainty into the already volatile market. Oil prices, a key indicator of global economic health, have experienced fluctuations in response to the geopolitical developments. This instability adds another layer of complexity for investors already navigating the challenges posed by rising interest rates. The impact on global supply chains and energy markets remains a key concern for analysts. [Link to a reputable news source covering the Iran situation]

<h3>S&P 500 and Nasdaq Losses: A Deeper Dive</h3>

The S&P 500, a broad measure of the US stock market, experienced a decline of [Insert Percentage]% this week, while the tech-heavy Nasdaq Composite fell by [Insert Percentage]%. This downturn affected various sectors, with technology stocks, particularly vulnerable to rising interest rates, bearing the brunt of the losses. Several key companies within these indices saw significant drops in their share prices, reflecting broader investor anxiety.

Key sectors affected:

- Technology: High-growth tech companies are particularly susceptible to rising interest rates as they often rely on future earnings projections.

- Financials: The financial sector is sensitive to interest rate changes, and the current environment presents both opportunities and challenges.

- Energy: Geopolitical events in Iran directly impact the energy sector, creating price volatility.

<h3>What to Expect Next: Navigating Market Volatility</h3>

Predicting the market's trajectory with certainty is impossible, but several factors will likely continue to shape the near-term outlook:

- Further Fed Rate Hikes: The Fed's future actions will significantly influence market sentiment.

- Inflation Data: Upcoming inflation reports will provide crucial insights into the effectiveness of the Fed's monetary policy.

- Geopolitical Developments: The situation in Iran, and other global conflicts, will continue to impact investor confidence.

For investors, this period of volatility underscores the importance of diversification, risk management, and a long-term investment strategy. Consult with a financial advisor to discuss your individual circumstances and adjust your portfolio accordingly. [Link to a resource on investing strategies]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and past performance does not guarantee future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: S&P 500 And Nasdaq Losses Reflect Fed Rate Decisions And Iran Situation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Harry Kanes Focus Boca Juniors And The Club World Cup Challenge

Jun 21, 2025

Harry Kanes Focus Boca Juniors And The Club World Cup Challenge

Jun 21, 2025 -

Climate Change In The Crosshairs The Stakes This Summer

Jun 21, 2025

Climate Change In The Crosshairs The Stakes This Summer

Jun 21, 2025 -

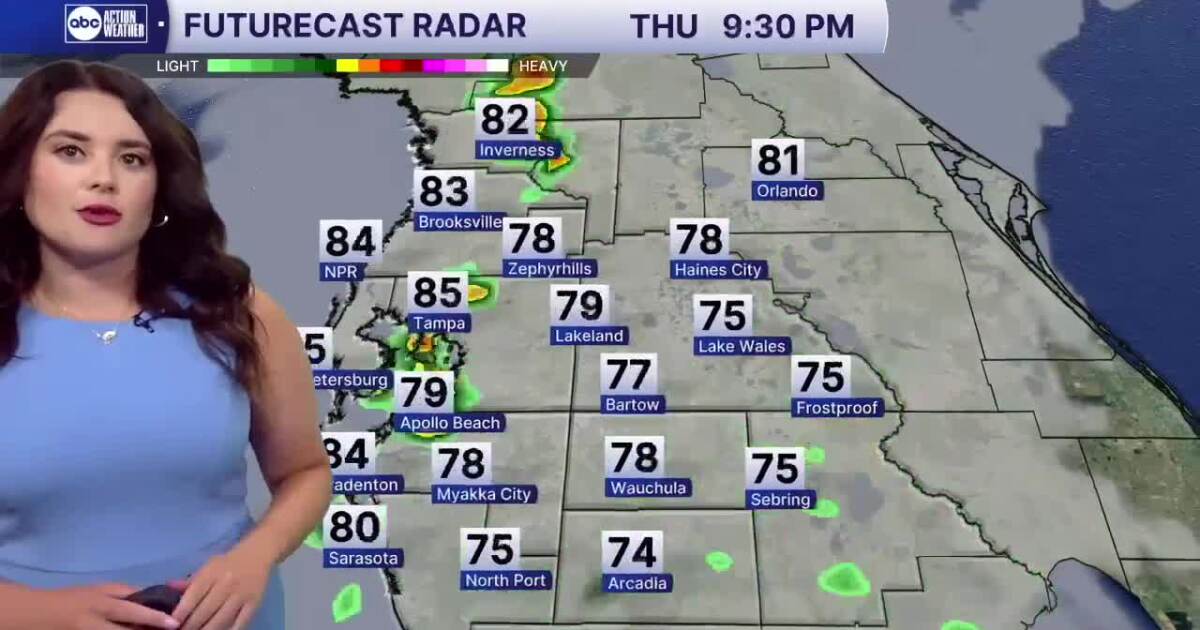

Muggy Conditions And Afternoon Showers Predicted Todays Weather Forecast

Jun 21, 2025

Muggy Conditions And Afternoon Showers Predicted Todays Weather Forecast

Jun 21, 2025 -

Federal Charges Filed Against 19 Mexican Mafia Members In Connection With Swifty Blues Attempted Murder

Jun 21, 2025

Federal Charges Filed Against 19 Mexican Mafia Members In Connection With Swifty Blues Attempted Murder

Jun 21, 2025 -

Suzanne Morphew Case Husband Barry Morphew Arrested A Second Time

Jun 21, 2025

Suzanne Morphew Case Husband Barry Morphew Arrested A Second Time

Jun 21, 2025